[Asia Economy Reporter Joeslgina] Due to the ongoing impact of the novel coronavirus infection (COVID-19), the scale of smartphone shipments in the U.S. shrank by 5% year-on-year in the second quarter. With a flood of mid-to-low-priced smartphones entering the market, the average smartphone price also dropped by 10% compared to a year ago. By company, Samsung Electronics maintained its shipment volume at the previous year's level thanks to strong sales of mid-to-low-end devices, while LG Electronics experienced a double-digit decline.

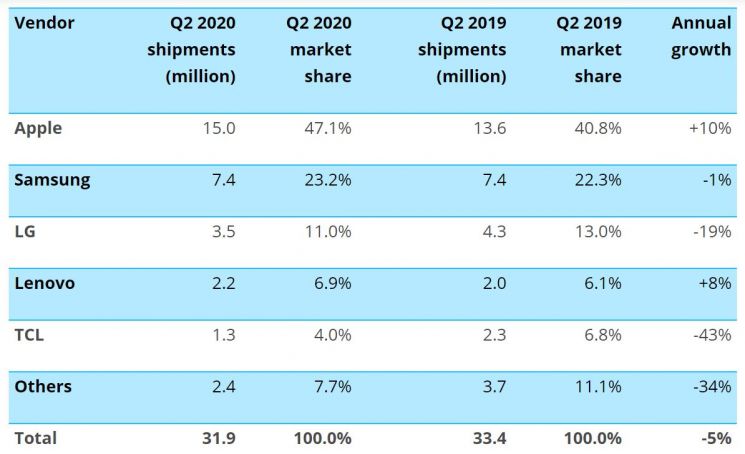

According to a report released on the 11th (local time) by market research firm Canalys, the scale of smartphone shipments in the U.S. in the second quarter was recorded at 31.9 million units. Although this was a 5% decrease compared to the same period last year, it was an 11% increase compared to the first quarter when COVID-19 began in earnest. The report stated, "The resumption of operations at Chinese production plants at the end of March and the reopening of stores in May and June led to a recovery compared to the first quarter," adding, "Apple and Samsung accounted for 7 out of 10 units."

Apple set a new record in the U.S. market in the second quarter. iPhone shipments reached 15 million units, a 10% increase year-on-year. The flagship product, iPhone 11, saw shipments increase by 15% compared to the previous year's bestseller, the SR. Additionally, with the launch of the competitively priced iPhone SE2, Apple's market share soared from 40.8% in the second quarter of last year to 47.1% in the second quarter of this year.

Samsung Electronics' second-quarter shipments were 7.4 million units, similar to the previous year. However, Canalys added that shipments of the ambitiously launched Galaxy S20 5G series decreased by 59% compared to the S10 series. Instead of flagship sluggishness, it is evaluated that sales of budget devices such as the Galaxy A series helped maintain the previous year's level. Market share slightly increased to 23.2% compared to a year ago.

In the case of LG Electronics, shipments sharply dropped from around 4.3 million units to about 3.5 million units. The decline reached 19%. Market share also fell from 13% to 11%. However, according to another market research firm, Strategy Analytics (SA), LG Electronics' market share in the second quarter was 13.9%, higher than the same period last year (13.6%) and the previous quarter (12.6%).

Following were Lenovo (2.2 million units, 6.9%) and TCL (1.3 million units, 4.0%).

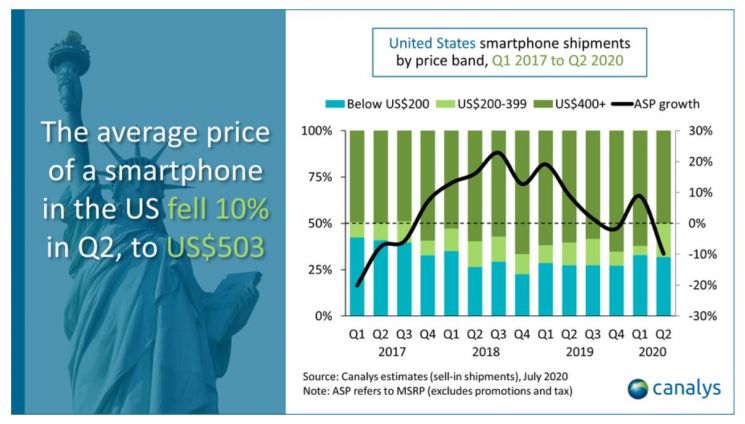

The spread of 5G smartphones in the U.S. was also limited due to the ongoing impact of COVID-19. The average smartphone price in the U.S. market in the second quarter was $503, down 10% year-on-year. This is attributed not only to mid-to-low-priced smartphones introduced by major brands such as Apple and Samsung Electronics but also to increased sales of ultra-low-priced smartphones from lesser-known brands like Unimax as part of support programs for low-income groups hit hard by COVID-19.

Vincent Thielke, an analyst at Canalys, explained, "Due to the COVID-19 pandemic, consumers stayed at home, which hindered 5G adoption in the U.S.," adding, "With more restricted purchasing power and insufficient 5G network coverage in suburban areas of the U.S., consumers found it better to purchase LTE devices."

Canalys predicted that mid-to-low-priced smartphones would expand further, centered on Android manufacturers. It explained that as economic difficulties are expected to continue, exposure of Android manufacturers such as Google in the sub-$400 segment will increase.

Additionally, about 70% of smartphones shipped in the U.S. in the second quarter were made in China, up from 60% in the previous quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.