No Sharp Solution to Close Gap with Real Economy

Some Tolerance for Asset Price Increase Inevitable for Now

Investors Understand Why Liquidity Withdrawal Is Difficult for Now

Belief That Real Estate and Stocks Will Rise Further Pushes Asset Prices Up

[Asia Economy Reporter Kim Eunbyeol] Despite concerns that the money injected to respond to the novel coronavirus infection (COVID-19) only inflates the bubble, central banks around the world, including the Bank of Korea, maintain that it is not yet time to withdraw the funds. Although the 'free money' procured by corporations and households under ultra-low interest rates has tended to raise stock and real estate prices, there is no sharp solution to resolve the disconnect with the real economy, so they have no choice but to observe the situation for the time being. Investors have already perceived this ironic situation. The U.S. economic media MarketWatch explained, "We know it’s a bubble. However, people also know that the bubble will inevitably grow larger for the time being." This means that because investors understand that the government has no choice but to tolerate the bubble, asset prices are expected to rise further for the time being.

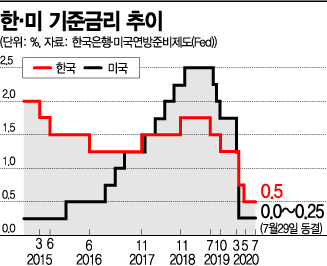

According to key officials at the Bank of Korea on the 11th, the consensus among the Bank’s executive officials is leaning toward maintaining the benchmark interest rate at the historically lowest level. Although there is criticism that the rapid rise in asset prices is due to low interest rates, the general opinion is that it is not yet time to withdraw the money. Some officials even argue that it is premature to consider the asset market a bubble.

The biggest reason is the sluggish real economy recovery. Although it is gradually improving, it is still far from returning to pre-COVID-19 levels. Particularly problematic is the relatively slow employment rate. According to Statistics Korea, the number of employed persons in June decreased by 352,000 compared to the previous year, marking the fourth consecutive month of decline. Many evaluations suggest that large-scale unpaid leave was a factor behind the better-than-expected performance of large corporations, and many people who took out livelihood loans at the beginning of the COVID-19 pandemic could be hit if the benchmark interest rate rises, which would impact households.

Another reason to maintain accommodative policies is that the effects of the massive money injection are only now beginning to appear gradually in industrial activity. The Bank of Korea’s broad money supply (M2) for June, to be announced this week, is expected to increase further compared to May. Although the M2 growth rate in May reached nearly 10% year-on-year and was cited as a cause of the rapid rise in asset prices, when broken down by economic agents, the M2 growth rate for corporations (16.0%) is much higher than that for households (7.1%). A Bank of Korea official stated, "Although household loans have increased sharply in the past month, overall, the money injected after COVID-19 was used to support corporations," adding, "Looking at the simultaneous rise in the three major indicators of industrial production, consumption, and investment in June, it can be seen that the money flowing to corporations has started to be used productively."

The fact that the world, including the United States, has not yet escaped the COVID-19 crisis also supports accommodative monetary policies. The U.S. Federal Reserve (Fed) is expected to maintain zero interest rates until 2022. The Bank of England (BOE) recently kept its benchmark interest rate at 0.1%, and the Reserve Bank of Australia (RBA) is maintaining its benchmark rate at 0.25%. In this context, if a non-reserve currency country like Korea were to implement tightening policies first, it could send negative signals to the market. Overseas institutions advise that emerging countries should maintain accommodative policies while working on industrial restructuring to prepare for the post-COVID-19 era. The International Monetary Fund (IMF), in its recent External Sector Report (ESR), stated, "Korea needs to continue accommodative fiscal and monetary policies to induce investment expansion," and added, "Policies that ease regulations and adjust the balance toward new growth engines and the service sector are necessary, while reforms to strengthen the social safety net are also required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.