Cumulative Total Revenue in June 226 Trillion KRW, Down 20.1 Trillion KRW YoY... Total Expenditure 316 Trillion KRW, Up 32.6 Trillion KRW YoY

Tax Revenue 132.9 Trillion KRW, Down 23.3 Trillion KRW YoY... Corporate Tax Plummets to 29.3 Trillion KRW

Central Government Debt 764.1 Trillion KRW, Down 0.2 Trillion KRW MoM

[Asia Economy Reporter Kwangho Lee] The country's real fiscal situation, as reflected in the managed fiscal balance up to June this year, has reached its worst level since statistics began being compiled in 2011. This is the result of increased spending without incoming tax revenue.

According to the 'Monthly Fiscal Trends August Issue' published by the Ministry of Economy and Finance on the 11th, the integrated fiscal balance for the first half of the year (January to June) recorded a deficit of 110.5 trillion won, and the managed fiscal balance recorded a deficit of 90 trillion won.

The Ministry of Economy and Finance stated, "The record high deficit in the managed fiscal balance in the first half of this year is the result of proactive fiscal management, including responses to the novel coronavirus infection (COVID-19)." It added, "Based on annual patterns, the managed fiscal balance deficit for this year is expected to be around 111.5 trillion won."

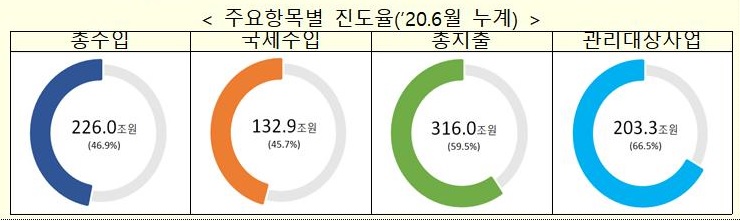

Total revenue in the first half was 226 trillion won, a decrease of 20.1 trillion won compared to the same period last year, while total expenditure increased by 31.4 trillion won to 316 trillion won, negatively impacting both the managed and integrated fiscal balances.

As the national treasury is depleting, central government debt is also rapidly increasing. Central government debt was 728.8 trillion won last year, but increased to 764.1 trillion won as of the end of June. If the current trend continues, it is expected to approach 800 trillion won by the end of this year.

National tax revenue in the first half was 132.9 trillion won, down 23.3 trillion won from the same period last year. The tax collection rate, which indicates the actual amount of taxes collected against the government's annual tax revenue target, also fell by 7.3 percentage points to 45.7%.

By tax category, corporate tax sharply declined due to worsening corporate performance. Corporate tax collected up to June was 29.3 trillion won, 13.5 trillion won less than a year earlier. During the same period, income tax and value-added tax were 40.9 trillion won and 31 trillion won respectively, down by 3.7 trillion won and 3.5 trillion won. Taxes such as transportation tax and customs duties also decreased.

The Ministry of Economy and Finance explained, "(The decrease in tax revenue) is due to the government postponing the payment deadlines for corporate tax and comprehensive income tax, and expanding the Earned Income Tax Credit to be paid semiannually, in order to support overcoming the damage caused by COVID-19."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)