[Asia Economy Reporter Jo Gang-wook] As the novel coronavirus disease (COVID-19) prolongs, concerns are growing over the decline in earnings and deterioration in asset quality of commercial banks in the second half of the year due to worsening profitability and increasing non-performing loans. On the other hand, some predict that the third quarter may mark the bottom, with a recovery phase beginning in the fourth quarter. This analysis is based on the flattening of the sharply rising loan growth rate curve in the first half of the year and the increase in low-cost deposits, which could lead to a recovery in the core profit source, net interest margin (NIM), after the third quarter.

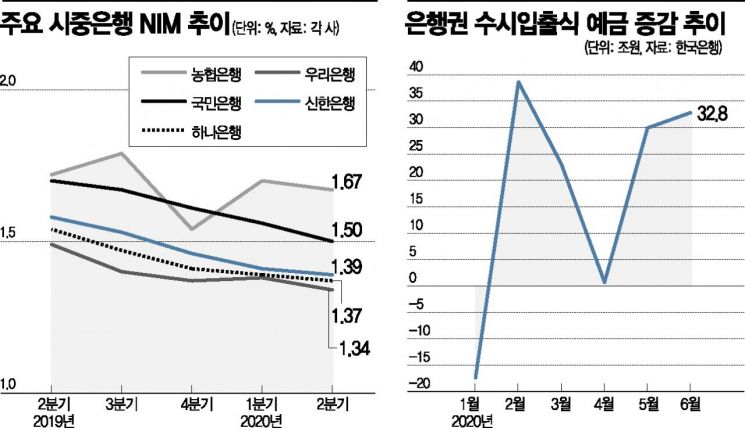

According to the financial sector on the 10th, the NIM of commercial banks in July is estimated to have declined by only about 1 basis point compared to the previous month, maintaining a fairly favorable level. Initially, the financial sector expected the most significant negative impact of the Bank of Korea's 50 basis point rate cut in March and 25 basis point cut in May to appear in the third quarter. Most forecasts predicted that the third-quarter NIM would fall by up to 5 basis points. However, the current consensus leans toward a decline of only 2 to 3 basis points.

Choi Jung-wook, a researcher at Hana Financial Investment, said, "The previous expectation was that NIM would fall an additional 1 to 2 basis points in the fourth quarter and bottom out during that period. However, if the current trend continues and there are no further rate cuts, NIM is likely to form a bottom in the third quarter."

This is analyzed to be due to the slowdown in loan growth rates and the continued surge in low-cost deposits. Commercial banks have already met most of their loan growth targets for the year in the first half. KB Kookmin Bank, which projected an annual loan growth rate of 5-6% in its first-quarter earnings announcement, saw a 6.77% increase in the first half. Shinhan Bank recorded 8.17% (targeting around 5%), KEB Hana Bank 4.30% (3-4%), Woori Bank 4.61% (5%), and NH Nonghyup Bank 6.11% (5.2%). Accordingly, banks have begun selecting management sectors at the start of the second half, sorting corporate loans carefully, and raising thresholds for household loans by adjusting limits to manage risks from the rapidly rising unsecured loans in the first half.

Strategies to reduce funding costs by expanding low-cost deposits such as demand deposits and short-term savings deposits are also ongoing. These deposits require relatively less interest payment to customers compared to time deposits and other savings products. According to the Bank of Korea, the increase in demand deposits was 29.9 trillion won in May and 32.8 trillion won in June, showing a significant rise mainly from corporate and individual funds. In contrast, time deposits decreased by 3.3 trillion won in May and further dropped by 9.8 trillion won in June.

Additionally, expectations that the burden of loan loss provisions will decrease in the second half contribute to the third-quarter bottom theory. The five major financial groups set aside a total of 2.6554 trillion won in provisions in the first half of this year, double the 1.3903 trillion won in the first half of last year. Notably, 1.8425 trillion won was provisioned in the second quarter alone, accumulating last year's first-half amount in just one quarter. This was a preemptive measure in response to the COVID-19 impact. As a result of these efforts, the international credit rating agency Moody's recently decided not to downgrade the credit ratings of domestic banks. Moody's analyzed that Korea's fiscal and financial policies have largely offset previous concerns about the banking sector.

Moody's forecasted, "As corporate and regional banks' loan growth normalizes from the second half of this year, economic capital adequacy will temporarily weaken but is expected to recover over the next two to three years."

However, despite such optimism, concerns about deterioration in the second half remain high. Recently, the government has leaned toward extending the maturity and interest repayment deferral measures related to so-called 'COVID loans,' raising fears that these could become future non-performing loan triggers. In fact, economic agents, including corporations and self-employed individuals, borrowed over 100 trillion won from banks during the five months from February to June this year. Consequently, there are warnings that indiscriminate 'hot potato' lending without proper screening could lead to a non-performing loan crisis similar to the 2003 'card crisis.'

The so-called 'Evergreen Loan,' where financial institutions continuously extend loan maturities despite borrowers' inability to repay, appears as normal loans on the surface but are essentially non-performing loans. For this reason, some argue that extending loan maturities and deferring interest payments for marginal borrowers resembles the refinancing loans during the 2003 card crisis.

During the 2003 card crisis, the publicly disclosed delinquency rate (over one month overdue) in the credit card industry remained steady at 9-10% until September. However, refinancing loans originating from delinquent loans surged sharply during this period, and the delinquency rate including refinancing loans rose from 11.6% at the end of 2002 to 32.1% by the end of September 2003. This eventually led to the liquidity crisis of LG Card in November 2003, triggering the bursting of the accumulated bubble. The card crisis is a representative failure case of household loans, causing massive losses of 9 trillion won among specialized credit card companies during 2003-2004.

A financial sector official said, "Currently, banks classify all loans with extended maturities and deferred interest payments under government policy as normal loans without problems. The current improvement in indicators is likely an 'optical illusion,' and the real COVID-19 debt crisis is expected to begin in earnest next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)