Support for up to 150 million KRW, with preferential interest rates up to 1.4%p

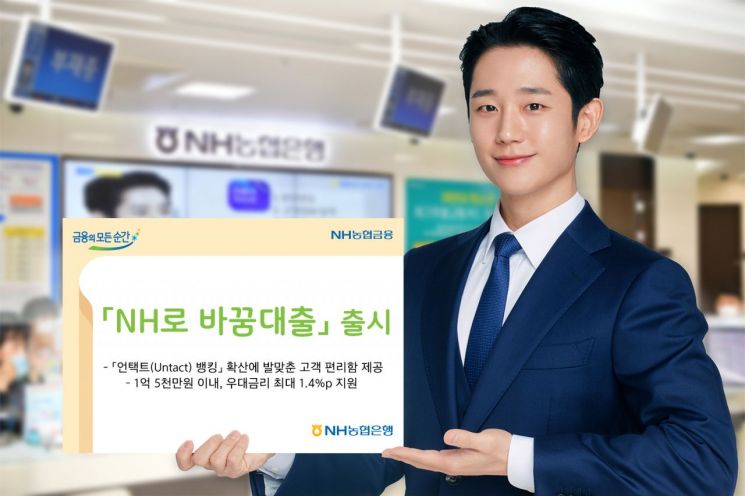

[Asia Economy Reporter Park Sun-mi] NH Nonghyup Bank announced on the 10th that it has launched 'NH Loan Switch,' which allows customers to easily switch credit loans from other banks to Nonghyup Bank through mobile.

By using 'NH Loan Switch,' customers can instantly check credit loan details, loan limits, and interest rates from multiple banks via the NH Nonghyup Bank Smart Banking app, and after applying for the loan, they can conveniently switch with just one visit to a branch.

The loan limit is up to 150 million KRW per individual, the interest rate starts at 1.65%, and the loan period is one year (with possible extension). Eligible borrowers are salaried workers with an annual income of over 30 million KRW who currently hold credit loans from commercial banks and have been employed at a corporate company for more than one year. To ease repayment burden, there is no penalty for early repayment.

Ham Yong-moon, Vice President of the Marketing Division at NH Nonghyup Bank, said, "In the untact era, we are able to provide more convenient financial services to our customers," adding, "We will continue to expand customer-centered digital products and services to become a digital human bank that gets closer to our customers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.