Global Top 100 ICT Companies: 57 in the US, 12 in China, 11 in Japan... Only 1 in Korea

Combined Market Cap of Korea's ICT Big 5 (530 trillion KRW) is 1/15 of the US (8,092 trillion KRW) and 1/4 of China (2,211 trillion KRW)

21st Century Industrial Innovation Centers on Manufacturing-IT Convergence... Success Models Like MS and Tesla as References

[Asia Economy Reporter Kim Hyewon] An analysis revealed that the corporate value of the top five domestic information and communication technology (ICT) companies, including Samsung Electronics, is only one-fifteenth and one-quarter compared to U.S. and Chinese companies, respectively. Among the top 100 global ICT companies by market capitalization, only Samsung Electronics ranked 11th, with a market share of just 1%.

As the COVID-19 pandemic accelerated the transition to a digital economy, it has been pointed out that to expand growth opportunities for domestic manufacturing, solutions must be found in successful digital innovation models such as Microsoft (MS) and Tesla.

On the 10th, the Federation of Korean Industries analyzed changes over the past decade in the top five ICT companies by market capitalization in major countries including Korea, the U.S., and China, revealing these findings.

The difference in corporate value by country was stark in the combined market capitalization of the top five ICT companies in the three countries' stock markets. As of the closing price on the 4th, the U.S. had a combined market capitalization of approximately KRW 8,092.4 trillion for five companies: Apple, MS, Amazon, Alphabet, and Facebook. This is 16 times the size of the Korean government's main budget for this year (KRW 512 trillion).

China, led by Alibaba, Tencent, Ping An Insurance, Meituan Dianping, and JD.com, followed with KRW 2,211.4 trillion. In contrast, the combined market capitalization of Korea's top five ICT companies (Samsung Electronics, SK Hynix, Naver, LG Chem, and Kakao) was about KRW 530 trillion, only one-fifteenth of the U.S. and one-quarter of China.

There was a particularly large gap between internet portal and e-commerce companies. The combined market capitalization of two companies, Naver and Kakao, was about KRW 83 trillion, significantly less than that of China's single company JD.com, which was KRW 120 trillion. The Federation of Korean Industries noted that Naver's overseas sales ratio is in the 30% range, while Kakao lacks official statistics, and analyzed that their global influence is minimal compared to U.S. and Chinese competitors, resulting in relatively slower growth. Apple and Alphabet's overseas sales ratios are approximately 60% and 54%, respectively.

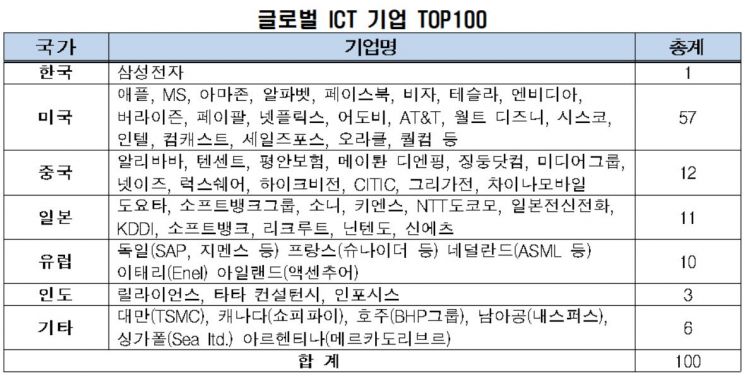

Expanding to the top 100 global ICT companies by market capitalization, Korea's status as an 'ICT powerhouse' appears even more modest. The country with the most companies is the U.S., with 54 companies including Apple, Netflix, and Tesla. China had 12 companies including Alibaba, Japan and Europe had 11 and 10 companies respectively. India appeared with three companies including Reliance, while Korea had only Samsung Electronics ranked 11th.

The growth rate of market capitalization for major ICT companies was also relatively low in Korea. Over the past decade, the average annual growth rate of the combined market capitalization of the five U.S. companies was 29.4%, China recorded 70.4%, while Korea, despite Kakao's explosive growth (63.1%), only achieved an average annual growth rate of 23.4%. Other domestic companies showed annual growth rates ranging from 7% to 18%.

The Federation of Korean Industries judged that although the market capitalization of domestic ICT companies is rapidly increasing amid the COVID-19 situation, the full-scale transformation into a digital industry encompassing the entire market is insufficient compared to the U.S. and China.

In particular, in the U.S., ExxonMobil, a petroleum company, was the undisputed number one in market capitalization 10 years ago, but since Apple took the top spot in 2012, it has maintained a leading position. In the retail service sector, Amazon (39.6%) and Walmart (7.1%) showed a clear difference in average annual market capitalization growth over 10 years, highlighting the growth of ICT companies. As of the 4th, five of the top 10 companies in the U.S. stock market are IT and digital-related companies. The Federation of Korean Industries analyzed that the portfolio was successfully reorganized, increasing from two companies to five in 10 years.

The Federation of Korean Industries advised that the fusion between existing manufacturing and IT sectors is a challenge that must be solved in future global competition, and that successful models of digital innovation and fusion in traditional industries such as MS and Tesla should be referenced. For example, Tesla, which shifted the paradigm by developing cars as digital devices, recorded an average annual market capitalization growth rate of 64.3% over the past decade, nearing entry into the global top 10. During the same period, the world's number one Toyota's market capitalization growth rate was only 4.5%.

Kim Bongman, head of international cooperation at the Federation of Korean Industries, said, "Corporate value through market capitalization shows the future outlook that the actual market perceives, so it is meaningful in presenting the future direction for our companies and economy." He added, "Although the entry of Kakao into the top 10 market capitalization in May attracted the spotlight, marking a turning point for Korea's manufacturing-centered economy toward a digital economy, the digitalization of our economy is indeed slower compared to major countries." He emphasized, "For IT powerhouse Korea to maintain its status in the global digital economy, creative efforts are needed to combine digital innovation with existing industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.