Foreigners Net Buy 582 Billion KRW in Domestic Stock Market

Bond Holdings Reach 150.2 Trillion KRW 'All-Time High'

[Asia Economy Reporter Minji Lee] Foreign investors purchased both stocks and bonds in the domestic securities market for the first time in six months. Due to the ongoing preference for safe assets amid the impact of the novel coronavirus infection (COVID-19), foreign investors had been buying only bonds, but they switched to net buying of stocks after six months.

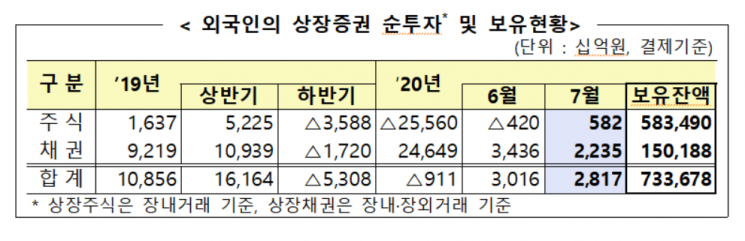

According to the 'July Foreign Securities Investment Trends' announced by the Financial Supervisory Service on the 10th, foreign investors net purchased 582 billion KRW worth of listed stocks last month and also made net investments of 2.235 trillion KRW in listed bonds. As a result, as of the end of last month, foreign investors held a total of 737.7 trillion KRW in listed securities, including 583.5 trillion KRW (30.8% of market capitalization) in listed stocks and 150.2 trillion KRW (7.5% of listed balance) in listed bonds.

In the listed stock market last month, foreign investors net purchased 582 billion KRW. They net bought 634 billion KRW in the KOSPI market but net sold 51 billion KRW in the KOSDAQ market, marking a shift to net buying for the first time since January this year.

By region, Europe and Asia net purchased 2.2 trillion KRW and 400 billion KRW respectively, while the Americas and the Middle East net sold 1.5 trillion KRW and 200 billion KRW respectively. By country, the UK (800 billion KRW), Ireland (400 billion KRW), and Luxembourg (300 billion KRW) were net buyers, whereas the United States (-1.2 trillion KRW), Cayman Islands (-300 billion KRW), and Canada (-300 billion KRW) were net sellers.

In terms of holdings, the United States accounted for 243.1 trillion KRW, representing 41.7% of the total foreign holdings. This was followed by Europe with 173.6 trillion KRW (29.8%), Asia with 78.3 trillion KRW (13.4%), and the Middle East with 22 trillion KRW (3.8%).

In the domestic listed bond market, foreign investors net purchased bonds worth 6.336 trillion KRW, and despite 4.102 trillion KRW maturing and being repaid, a net investment of 2.235 trillion KRW was made. This marked the seventh consecutive month of net investment since January. With the continuation of the net investment trend, foreign investors' domestic bond holdings increased by 3.6 trillion KRW compared to the previous month, reaching a record high of 150.2 trillion KRW (7.5%) as of the end of July.

By region, Asia and Europe net invested 1.1 trillion KRW and 600 billion KRW respectively, while the Middle East (90 billion KRW) and the Americas (80 billion KRW) also saw net investments. In terms of holdings, Asia had the largest share with 70.1 trillion KRW, accounting for 46.7% of total foreign investment. This was followed by Europe (47.1 trillion KRW, 31.3%) and the Americas (12 trillion KRW, 8%).

By type, net investment occurred in government bonds (2.3 trillion KRW), while net redemption occurred in Monetary Stabilization Bonds (200 billion KRW). The holding balance was dominated by government bonds at 119.2 trillion KRW, accounting for 79.3%. By remaining maturity, net investments were mainly made in bonds with 1 to less than 5 years (3.3 trillion KRW) and over 5 years (900 billion KRW),

while net redemptions occurred in bonds with less than 1 year (200 billion KRW). The holding balance was highest for bonds with remaining maturity of 1 to less than 5 years at 57.5 trillion KRW (38.3%), followed by less than 1 year (31.8%) and over 5 years (30%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.