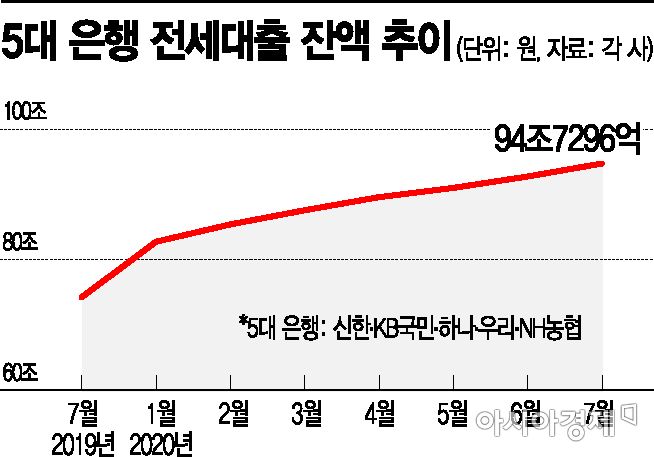

[Asia Economy Reporters Kangwook Cho, Minyoung Kim] It has been revealed that jeonse loan amounts at major commercial banks have surged by approximately 14 trillion won since the beginning of this year. Although the government introduced measures to restrict jeonse loans to stabilize the real estate market, it is interpreted that rising prices are driving the increase in jeonse loans.

According to the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?as of the end of July, the total outstanding balance of jeonse loans at these banks was 94.0556 trillion won. This is an increase of 2.0201 trillion won (2.2%) compared to the previous month. Compared to the balance at the end of last year, it increased by 13.6024 trillion won (16.9%).

The month-over-month increase in jeonse loans at these banks was 2.7034 trillion won in February this year, the largest since related statistics began in 2016. Subsequently, the amounts were 2.2051 trillion won in March and 2.0135 trillion won in April, consecutively recording over 2 trillion won. Then, the increase decreased to 1.4615 trillion won in May and 1.7363 trillion won in June but rose again to over 2 trillion won last month.

The sharp increase in July is considered somewhat unusual. Typically, July is an off-season for the rental market due to the rainy season and vacations, resulting in low moving demand, especially with fewer jeonse transactions.

In fact, jeonse contracts for housing in the metropolitan area have significantly decreased. According to the Seoul Real Estate Information Plaza, the number of jeonse apartment transactions in Seoul last month was 6,304, dropping to the 6,000 range for the first time in nine years since statistics began in 2011. Compared to February this year, which recorded the highest number at 13,661 transactions, it is only about 46%.

The number of apartment jeonse and monthly rent transactions listed on the Gyeonggi Real Estate Portal also decreased continuously from the record high of 27,103 in February to 12,326 last month. On the other hand, jeonse prices are soaring. According to KB Real Estate Live On, the jeonse price for housing in Seoul rose by 0.68% last month compared to June.

Therefore, experts interpret that the increase in jeonse loans is due to a mismatch between jeonse demand and supply. As housing sale prices rise, jeonse prices also increase, but the supply is insufficient, leading to a surge in jeonse loans.

However, forecasts for future jeonse loan trends are divided. Some believe that due to the implementation of the "Lease 3 Laws" (Jeonse and Monthly Rent Reporting System, Jeonse and Monthly Rent Cap System, Contract Renewal Request Right System), the shortage of supply will continue for the time being, causing jeonse prices to rise and jeonse loans to increase. On the other hand, some argue that with the law's enforcement limiting landlords to raise jeonse deposits by a maximum of 5%, the upward trend in jeonse prices will slow, and if cases of converting jeonse to monthly rent increase, the absolute deposit amounts will decrease, which will affect a reduction in loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.