Samsung Electronics Ranks 2nd in India's 2Q Smartphone Market and 1st in Mobile Phones

Increasing Market Share Through Omni-Channel Sales Strategy

[Asia Economy Reporter Han Jinju] Samsung Electronics is engaged in a fierce battle with Xiaomi for the number one spot in the smartphone market in India. In the second quarter, Samsung ranked second in the smartphone market and first in the overall mobile phone market.

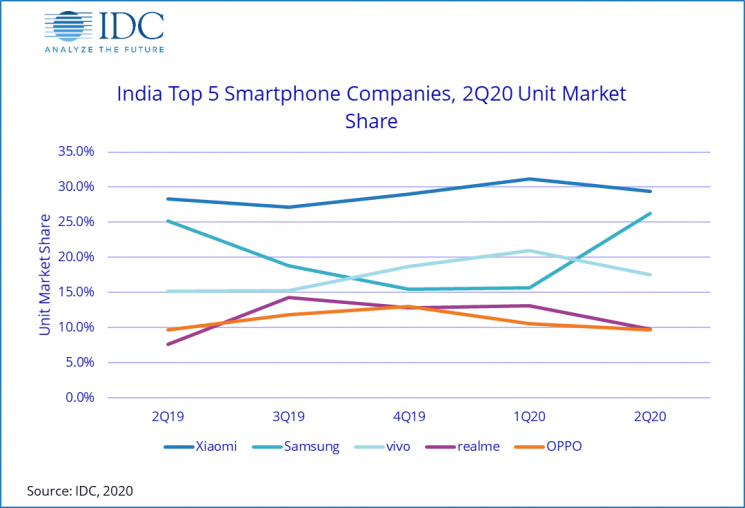

According to market research firm IDC on the 8th (local time), Samsung Electronics shipped 4.8 million smartphones in India in the second quarter of 2020, ranking second behind Xiaomi's 5.4 million units. Its market share increased by 1.1 percentage points year-on-year to 26.3%, rapidly closing the gap with Xiaomi (29.4%).

Including feature phones, Samsung held the top position with a 24% share of the overall mobile phone market. Xiaomi and Vivo followed with high market shares. Feature phone shipments accounted for 10 million units, representing 33.5% of the total mobile phone shipments.

Due to the impact of the novel coronavirus disease (COVID-19), smartphone shipments in India in the second quarter fell 50.6% year-on-year to 18.2 million units. Although supply chains were disrupted around April, suppressed purchasing demand began to revive from June, leading to a recovery in sales.

Samsung Electronics launched the Galaxy M21, an affordable smartphone priced around 300,000 KRW, in India last May. Thanks to a simultaneous online and offline sales strategy in India, where online distribution channels are rapidly growing, Samsung secured a 22.8% share in online channels, ranking second, and a 29.1% share offline, ranking first. To comply with social distancing, Samsung also implemented policies allowing offline retailers to partner with online platforms such as Facebook for sales. Although Samsung's market share in India slipped to third place in the fourth quarter of last year, it has maintained the second position this year.

Meanwhile, Xiaomi ranked first with shipments of 5.4 million units in the second quarter. Four of the top five models sold in India were Xiaomi products. Xiaomi maintained an online market share of 42.3% by launching the omni-channel platform 'Mi Commerce Solution.' Vivo ranked third with 3.2 million units shipped in the second quarter, Realme was fourth with 1.78 million units, and Oppo ranked fifth with 1.76 million units.

IDC analyzed, "The trend of increasing suppressed purchasing demand is expected to continue through the third quarter, making steady smartphone supply necessary. With the festival season approaching, when most consumers purchase mid- to low-priced smartphones, the market is expected to show signs of recovery in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.