[Asia Economy Reporter Ji-hwan Park] The Korea Exchange has decided not to make a decision on the delisting of SillaJen and has opted for a re-examination.

The Korea Exchange's Corporate Evaluation Committee announced on the 6th through a public disclosure that after reviewing the possibility of delisting SillaJen, it decided to continue the review. The schedule for the next steps has not been set.

Why has SillaJen, once the second largest market cap company on the KOSDAQ and a leading figure in the bio boom, ended up in its current situation?

SillaJen started in 2006 as a bio venture in industry-academic cooperation with Pusan National University. In 2013, former CEO Eun-sang Moon took over management and began full-scale development of the anticancer virus liver cancer treatment drug 'Pexa-Vec'. Pexa-Vec was highly anticipated as a 'dream drug' that selectively destroys only cancer cells.

After entering the KOSDAQ in 2016 through a technology special listing, expectations for 'Pexa-Vec' grew, and SillaJen rose to become the second largest by market capitalization on the KOSDAQ. The market began to pay attention to SillaJen starting in the second half of 2017. The stock price rose to 152,300 won on news that Pexa-Vec was entering the final stage before drug launch, the global Phase 3 clinical trial. At that time, SillaJen's market capitalization was 10 trillion won, marking the second largest on the KOSDAQ.

However, in August last year, the stock price began to plummet after the U.S. recommended halting the Pexa-Vec clinical trial. Within four days, the stock price was halved from 44,550 won to 15,300 won.

Additionally, in June, the Korea Exchange designated SillaJen for a substantial review of listing eligibility due to allegations of embezzlement and breach of trust by former CEO Eun-sang Moon and other executives. The embezzlement amount by the former management reached 194.7 billion won, approximately 344% of the company’s equity capital.

Trading of SillaJen shares has been suspended since early May when the substantial review reasons arose. SillaJen announced at the end of last month that it plans to hold a shareholders' meeting on the 7th of next month to address agenda items including partial amendments to the articles of incorporation and the appointment of directors.

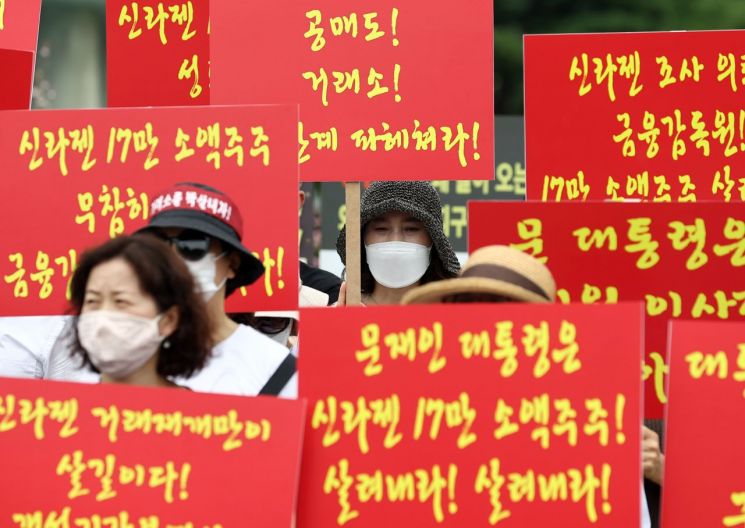

After the Korea Exchange designated SillaJen for substantial review last month, minority shareholders have held rallies daily urging the resumption of trading. As of the end of last year, there were 168,778 minority shareholders of SillaJen. Their shareholding ratio is 87.68%.

Minority shareholders claim, "The Korea Exchange’s suspension of SillaJen’s trading and decision to conduct a substantial review of listing eligibility due to allegations of breach of trust by former and current management before listing is an unfair act that infringes on the property rights of 170,000 minority shareholders."

The Korea Exchange’s inability to decide on SillaJen’s delisting after a marathon meeting lasting over five hours the day before is because the equity value of 170,000 minority shareholders amounts to 760 billion won. Experts interpret that the burden factor is that if delisting is decided, these shares could instantly become worthless.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)