Busan Chamber of Commerce, Analysis Report on New Growth Industries Based on Export Statistics

Lagging Behind Incheon and Ranking Last in Busan, Ulsan, and Gyeongnam Regions

[Asia Economy Yeongnam Reporting Headquarters Reporter Kim Yong-woo] Is there no new growth engine to lead Busan's future?

In the new growth industry sector that will drive the future of Busan's economy, Busan's status is at a worrying level compared to the metropolitan areas such as Seoul, Incheon, Gyeonggi, as well as other major regional cities.

The Busan Chamber of Commerce and Industry announced this on the 6th through an analysis report titled "The Status and Challenges of Busan's New Growth Industries Based on Export Statistics by Item." This data compares and analyzes the export performance of a total of 11 item groups classified as new growth industries and export growth engine industries selected by the Ministry of Trade, Industry and Energy.

According to the report, although the total regional export amount decreased by an average of 3.9% annually over the recent three years from 2017 to last year, the export performance of item groups classified as new growth industries actually increased by 3.6% during the same period.

This is in stark contrast to the main industry groups such as automobiles and parts, steel, shipbuilding equipment, and machinery, whose export performance decreased by an average of 7.4% annually during the same period.

However, despite this steady export growth trend, the export status of Busan's new growth industry item groups is very low compared to other regions.

In fact, last year, the export performance of new growth industry item groups in Busan was 2.5 billion dollars, which is one-fifth of Seoul's 12.6 billion dollars and one-fourth of Incheon's 11.2 billion dollars.

Even within the entire Busan-Ulsan-Gyeongnam (BUG) region, Busan's share was the lowest at 19% of the 12.3 billion dollars export performance of new growth industry item groups last year. Ulsan accounted for the largest share at 5.8 billion dollars or 53.4%, and Gyeongnam accounted for 4 billion dollars or 27.6%, showing a significant gap with Busan.

Moreover, despite the COVID-19 pandemic, while the export of domestic new growth industry item groups increased by 4.5% in the first half of this year compared to the first half of last year, Busan's exports decreased by 14.6%.

The relatively large impact of COVID-19 on the export of Busan's new growth industry item groups is interpreted as due to the quantitative and qualitative weakness of the item groups leading the export of new growth industries compared to other major cities.

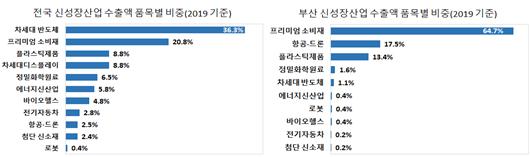

As of 2019, looking at the export share of new growth industry item groups, Busan overwhelmingly accounted for 64.7% in premium consumer goods such as agricultural and marine products, cosmetics, daily necessities, and fashion clothing.

Next were aviation and drones at 17.5%, plastic products at 13.4%, and fine chemical raw materials at 1.6%. In contrast, nationwide, next-generation semiconductors, which have excellent industrial scale and value-added creation power, accounted for the highest share at 36.3%, followed by premium consumer goods at 20.8%, plastic products at 8.8%, next-generation displays at 8.8%, and fine chemical raw materials at 6.5%, showing a contrast to Busan's reality.

In particular, while Busan accounted for only 1.1% of next-generation semiconductor exports, which have the highest national share, Chungnam, which has the highest export share of new growth industry item groups nationwide, had the highest share of next-generation semiconductor exports. Metropolitan cities such as Seoul, Gyeonggi, and Incheon also have next-generation semiconductors as major export items.

Furthermore, despite automobiles being a key industry in Busan, exports related to electric vehicles accounted for only 0.2%. The aviation and drone sector, which has the second-highest regional share, was highly dependent on specific companies. Premium consumer goods also showed high dependence on marine products, indicating an urgent need for diversification by increasing exports of higher value-added cosmetics, daily necessities, and fashion clothing.

The concentration phenomenon of new growth industry item group export performance by region also appeared in the metropolitan area and adjacent regions, which was divided depending on whether next-generation semiconductors were included as major export items.

Last year, 75% of the total domestic new growth industry export performance was concentrated in Seoul, Incheon, Gyeonggi, Chungnam, and Chungbuk, but the Yeongnam region including Busan, Ulsan, Daegu, Gyeongbuk, and Gyeongnam, where next-generation semiconductors were not major or were negligible export items, accounted for only 15% of the total.

A Busan Chamber of Commerce and Industry official said, "Since the new growth industries designated by the government have great potential as future growth engines for the regional economy, it is urgent to promptly secure the foundation for fostering advanced industries such as the Gadeokdo New Airport to attract core growth industries like next-generation semiconductors."

He also emphasized, "For growth industries with a large regional share such as aviation and drones, it is necessary to induce local small and medium-sized manufacturing companies to participate in the market and systematically nurture production bases related to eco-friendly mobility such as electric and hydrogen vehicles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.