KakaoBank Tops App Users, Continues Rapid Growth in Net Profit and Deposits

Determined K Bank Accelerates Comeback with Loan Products Developed Over 2 Years

[Asia Economy Reporter Kim Hyo-jin] As KakaoBank continues its rapid growth, K Bank is gearing up for a resurgence, heating up the non-face-to-face internet-only banking market. With the addition of Toss Bank, set to launch next year, the market is expected to expand even more rapidly.

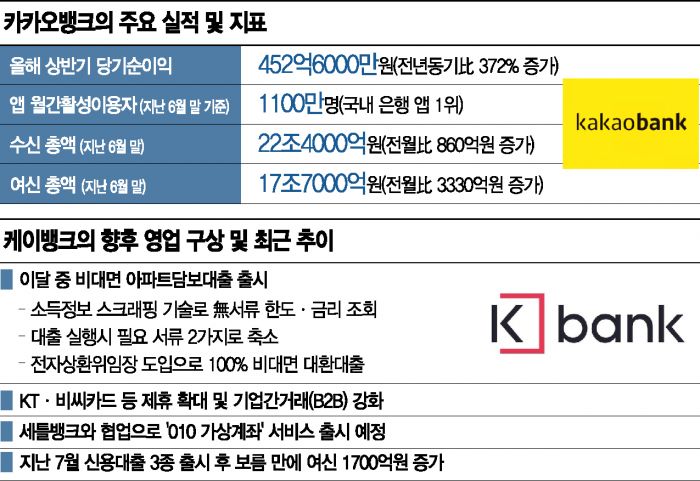

According to the banking sector on the 5th, KakaoBank recorded a net profit of approximately 26.8 billion KRW in the second quarter of this year. The cumulative net profit for the first half reached 45.3 billion KRW, a remarkable 372% increase compared to 9.6 billion KRW in the first half of last year.

As of the end of June, the asset size stood at 24.4 trillion KRW, growing by 1 trillion KRW compared to the previous quarter. Loan balances for key products such as credit loans and jeonse deposit loans rose from 14.88 trillion KRW to 17.68 trillion KRW during the first half. The transfer amount, which was 55 trillion KRW in the first half of last year, nearly doubled to 100 trillion KRW in the first half of this year.

During the same period, the supply of mid-interest rate loans, including Saetdol loans, amounted to 660 billion KRW. KakaoBank plans to expand its financial services for ordinary citizens by achieving a mid-interest loan supply of 1 trillion KRW this year, following last year.

The factor driving the strong performance is the steep increase in users. As of the end of June, KakaoBank's mobile application (app) monthly active users (MAU / combined Android and iOS, according to KoreanClick) reached approximately 11 million, ranking first among all domestic bank apps. Users accessing KakaoBank at least once a month increased from 10.62 million in December last year to 11.73 million in June. Account holders grew from 11.34 million at the end of last year to 12.75 million at the end of last month.

With a particularly high usage rate of 47% among those in their 20s and 30s, KakaoBank explained that the influx of relatively older users is also expanding due to the spread of non-face-to-face trends caused by COVID-19 and other factors, with the proportion of new account holders aged 50 and above reaching 17% in May.

Deposits and loans increased by 86 billion KRW and 333 billion KRW respectively from the previous month, reaching 22.4 trillion KRW and 17.7 trillion KRW. KakaoBank analyzed that the expansion of interest income driven by user and loan growth led to the strong performance.

In the non-interest sector, the deficit narrowed due to the impact of stock account opening applications and the launch of credit card recruitment agency services. KakaoBank's stock account opening applications nearly doubled from 1.14 million at the end of last year to 2.18 million at the end of June. KakaoBank currently operates stock account opening businesses with Korea Investment & Securities, NH Investment & Securities, and KB Securities, and plans to add more partners in the future.

Under Basel III standards, the capital adequacy ratio (BIS) was 14.03% at the end of June. The delinquency rate remained low at 0.22%. The nominal net interest margin (NIM) for the first half was 1.60%.

A KakaoBank official stated, "To sustain growth and capital expansion, we plan to start practical preparations for an initial public offering (IPO) in the second half of the year," adding, "We will further enhance consumer benefits through financial services completed on mobile."

First Internet-Only Bank K Bank Starts Revival

Leading with Apartment Mortgage Loans to Launch This Month

K Bank, the 'eldest brother' of internet-only banks that had been unable to conduct normal loan operations due to funding difficulties, is accelerating its resurgence by increasing its capital to 900 billion KRW through a large-scale capital increase. After over two years of development, K Bank plans to establish a growth foundation with the launch of a non-face-to-face apartment mortgage loan this month.

K Bank's apartment mortgage loan features the use of income information scraping technology, allowing users to easily check estimated limits and interest rates without issuing separate documents. The required documents for loan execution have been simplified to two: income verification documents (two years of withholding tax receipts or confirmation of withholding tax on earned income) and the registration certificate (deed). K Bank expects the time from loan application to approval to be shortened to as little as two days.

Following the launch of the parking account 'Plus Box' on the 1st of last month, K Bank introduced three types of credit loan products on the 13th, signaling the start of business normalization. K Bank's deposit balance increased by about 480 billion KRW compared to the previous month, and loan balances rose by 170 billion KRW within about half a month after product launches. K Bank plans to fully ramp up operations in the second half and double key indicators from current levels.

K Bank intends to diversify its operations through strengthened promotions linked with KT, collaboration on card business with BC Card, its largest shareholder, launching the '010 Virtual Account' service in partnership with fintech company Settle Bank, and expanding non-face-to-face financial operations into business-to-business (B2B) transactions.

A financial industry official said, "With KakaoBank leading the market and K Bank rapidly catching up, the launch of Toss Bank will accelerate the shift of finance toward non-face-to-face services," adding, "The expansion of the internet-only banking market is expected to speed up further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.