July Personal Credit Loan Balance 120 Trillion

Up 2.28% from Previous Month, Rising for Two Consecutive Months

Low Interest Rate Burden Eases Funding Difficulties

Mortgage Loans Slow Due to Successive Real Estate Measures

[Asia Economy Reporters Kim Hyo-jin and Kim Min-young] Personal unsecured loans at major domestic banks increased significantly for two consecutive months. In contrast, the growth rate of mortgage loans (jumdae) showed a sluggish trend. This is interpreted as a result of the balloon effect caused by the government's high-intensity real estate measures combined with the low interest rate environment. It is also suggested that the surge in unsecured loans was driven by 'panic buying' due to soaring house prices and the 'Donghak Ant Movement,' where people borrow money to invest in stocks.

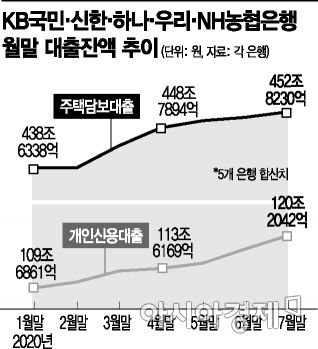

According to the financial sector on the 4th, the total balance of personal unsecured loans at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?stood at 120.2042 trillion KRW at the end of last month, an increase of 2.681 trillion KRW (2.28%) compared to the end of June. This is the second-largest increase following June's 2.8374 trillion KRW (2.47%), which was the largest increase this year. Except for January, personal unsecured loans at the five major banks have continuously increased. The growth slowed temporarily only in April (49.75 billion KRW).

Mortgage Loan Growth Rate 'Minimal'

The growth rate of mortgage loans is relatively minimal. At the end of last month, the total balance of mortgage loans at the five major banks was 452.823 trillion KRW, increasing by only 1.3671 trillion KRW (0.30%) compared to the end of June. Although this increase is slightly higher than June's 846.1 billion KRW (0.19%), it remains low compared to March, April, and May. This year, the mortgage loan growth rate at the five major banks has mostly stayed in the 0% range except for March and April. The average growth rate for mortgage loans from January to July is 0.48%, while the average growth rate for personal unsecured loans is 1.29%.

This trend is largely attributed to the government's series of real estate policies introduced over the past six months. Starting in December last year, the government reduced the loan-to-value ratio (LTV) for high-priced homes exceeding 900 million KRW and banned mortgage loans altogether for homes over 1.5 billion KRW. These policies aimed to curb apartment-centered real estate speculation and stabilize housing prices.

An official from a bank stated, "Considering the recently implemented policies, such as stricter verification of actual residence and a complete ban on mortgage loans for rental business operators, the trend of suppressing mortgage loans is expected to continue."

While mortgage loans have contracted, the realization of 'ultra-low interest rates' due to consecutive cuts in the base interest rate has increased demand for personal unsecured loans. According to the weighted average interest rate of financial institutions compiled by the Bank of Korea in June, the household loan interest rate fell by 0.14 percentage points to 2.67%, marking an all-time low. Among these, general unsecured loans (3.33% → 2.93%) entered the 2% range for the first time ever.

Unsecured Loan Interest Rates in the 2% Range Stimulate Loan Demand

Last month, the average interest rates for general unsecured loans at KB Kookmin Bank, Shinhan Bank, and Hana Bank were 2.63%, 2.38%, and 2.89% per annum, respectively. Woori and NH Nonghyup Banks recorded 2.49% and 2.55%, respectively. During the same period, the average interest rates for overdraft loans at these banks ranged from a low of 2.46% to a high of 2.97%. Some unsecured loan products with interest rates in the 1% range, targeting specific occupational groups, have also been launched.

A bank official explained, "Compared to before, many cases where funds would have been raised through mortgage loans are now being covered by unsecured loans. The increase in reliance on unsecured loans is also influenced by financial difficulties caused by the COVID-19 pandemic."

Meanwhile, the demand deposit balance at the five major banks stood at 523.3725 trillion KRW at the end of last month, down by 10.8041 trillion KRW (2.02%) compared to the end of June. This is the opposite trend from May and June, when demand deposits increased by over 17 trillion KRW and 23 trillion KRW, respectively. Demand deposits strongly represent idle funds in the market that have not found suitable investment destinations. Due to continued volatility in the financial market and a sharp drop in deposit interest rates, funds are believed to have shifted to alternative investments such as gold and dollars.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)