Microscopic Verification of Entire Acquisition, Holding, and Transfer Process... Plan to Notify Tax Authorities of Relevant Countries

23,167 Foreign Apartment Acquisitions Since 2017... Transaction Amount 7.6726 Trillion KRW

3,514 Acquisitions from January to May This Year... 26.9% Increase YoY... Chinese Buyers Rank First

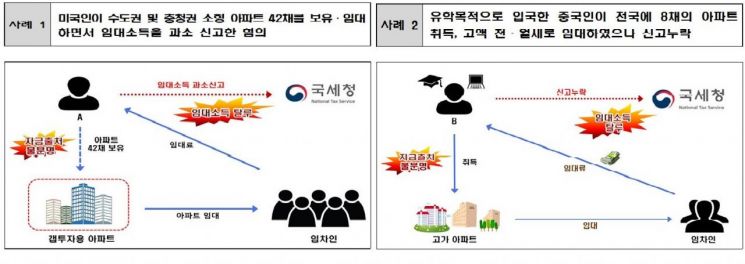

[Asia Economy Reporter Kwangho Lee]#Case 1= A foreigner with U.S. nationality, Mr. A, has been accused of underreporting rental income after acquiring 42 small apartments (worth approximately 6.7 billion KRW) in the Seoul metropolitan and Chungcheong regions through gap investment since 2018. Mr. A neither had significant income nor assets in Korea to acquire dozens of apartments, and there was no record of foreign exchange receipts from abroad at the time of acquisition, making the source of funds for the apartment purchases unclear. The National Tax Service (NTS) plans to verify the underreporting of housing rental income and the source of real estate acquisition funds and notify the tax authorities of the relevant country accordingly.

#Case 2= Mr. B, a Chinese national, entered Korea for study purposes and, after completing a Korean language course, found employment and currently resides in the Seoul metropolitan area. Recently, he acquired eight apartments in various locations nationwide, including high-priced apartments in Seoul, Gyeonggi, Incheon, and Busan, and rented out seven of them under lease or monthly rent agreements but is suspected of failing to report rental income. He neither had sufficient income nor assets in Korea to acquire multiple apartments in a short period. Although he had foreign exchange receipts amounting to several hundred million KRW from his home country, it was insufficient for the apartment acquisition funds. The NTS will conduct a thorough verification of the omitted housing rental income and the source of apartment acquisition funds and notify the tax authorities of the relevant country.

The National Tax Service will conduct tax investigations covering the entire process of acquisition, holding, and transfer for speculative foreign owners.

The NTS announced on the 3rd that it has launched tax investigations on 42 foreign multi-homeowners suspected of evading taxes on housing rental income.

Recently, as the housing market has overheated mainly in the Seoul metropolitan area, the number of apartments acquired by foreigners in Korea has also been increasing.

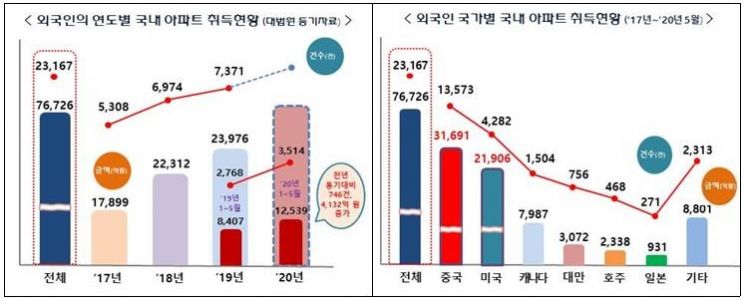

From 2017 to May of this year, 23,219 foreigners acquired 23,167 apartments in Korea (transaction amounting to 7.6726 trillion KRW). Especially this year, both the number of transactions and the amount have increased compared to the same period last year. From January to May this year, foreigners acquired 3,514 apartments (1.2539 trillion KRW), up 36.9% (746 cases) in number and 49.1% (413.2 billion KRW) in amount compared to the same period last year (2,768 cases, 840.7 billion KRW).

By nationality, Chinese nationals (13,573 cases) and U.S. nationals (4,282 cases) were the most numerous, followed by Canada, Taiwan, Australia, and Japan.

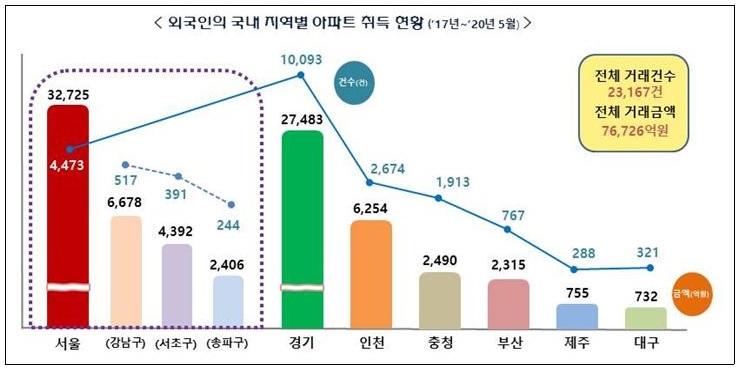

By region, Seoul had the highest number with 4,473 cases (3.2725 trillion KRW), followed by Gyeonggi Province with 10,093 cases (2.7483 trillion KRW), and Incheon City with 2,674 cases (625.4 billion KRW).

In particular, in the three Gangnam districts of Seoul, the number of acquisitions was 517 cases (667.8 billion KRW) in Gangnam-gu, 391 cases (439.2 billion KRW) in Seocho-gu, and 244 cases (240.6 billion KRW) in Songpa-gu.

There were 1,036 foreigners who acquired two or more apartments (866 with two homes, 105 with three homes, and 65 with four or more homes), acquiring a total of 2,467 apartments. Among them, there was a foreigner who acquired 42 apartments (worth 6.7 billion KRW).

Also, checking whether foreign apartment owners actually reside in their apartments revealed that out of the total 23,167 apartments acquired, 7,569 apartments (32.7%) were not occupied by their owners.

Im Kwang-hyun, Director of the Investigation Bureau, said, "It is generally suspected as speculative demand when foreigners acquire and hold multiple apartments in Korea without actually residing in them." He emphasized, "Through this investigation, we will thoroughly verify not only the evasion of rental income by the subjects but also the source of acquisition funds and, if transferred, the evasion of capital gains tax."

The NTS plans to notify the tax authorities of the resident countries of foreigners who hold apartments in Korea for speculative purposes rather than for actual residence, through information exchange under tax treaties.

Director Im said, "Going forward, the NTS will proactively block concerns about real estate price increases caused by foreign capital and conduct thorough tax verifications throughout the entire process of acquisition, holding, and transfer when speculative holdings are suspected. We will also strictly take action against tax evasion related to real estate without distinction between domestic and foreign nationals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.