Best Value Sparkling Alcoholic Beverages Popular... Intense Competition in Non-Alcoholic Beer Too

[Asia Economy Reporter Choi Saeng-hye] As the spread of the novel coronavirus infection (COVID-19) prolongs, interest in healthy food and value consumption is increasing. Globally, demand for alternative foods such as plant-based products is rising, and in the alcoholic beverage sector, more people are seeking sparkling beers and non-alcoholic drinks that reduce cost and health burdens.

According to the alcoholic beverage industry on the 8th, 'Filite' launched by HiteJinro quickly established itself as the market leader in the sparkling beer segment. Filite is the first sparkling beer launched domestically by HiteJinro in April 2017. According to IBK Investment & Securities, following COVID-19, demand for less burdensome alcohol has increased, and cumulative sales of Filite reached 900 million cans last month.

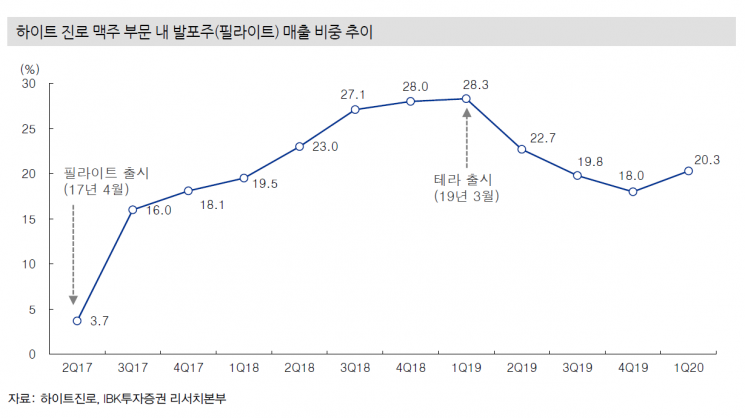

The sales proportion of Filite within HiteJinro's beer division expanded significantly from 3.7% in Q2 2017 at launch to 28.3% in Q1 last year. Although the sales share slightly decreased due to the launch of Terra, it has expanded again since early this year when COVID-19 spread began, currently maintaining around 20.3%.

Kim Tae-hyun, a researcher at IBK Investment & Securities, said, "Sparkling beer contains less than 10% malt and is taxed at about half the rate of regular beer, making it affordable for young consumers in their 20s and 30s who value cost-effectiveness. The industry interprets that sparkling beer has already established itself as a substitute for regular beer in Korea."

In fact, the sparkling beer market is gradually expanding. In May, Muhak Group's Muhak Liquor Trading launched 'Croco Real Fresh,' jointly developed with the Dutch beer company Royal Swinkels. OB Beer recently released a new product, 'Filgood Seven,' in its sparkling beer line 'Filgood.'

The non-alcoholic beverage market is also growing. According to the alcoholic beverage industry, the global non-alcoholic market size is expected to grow at an average annual rate of 7.6% from $16 billion in 2017 to 2024. Especially after COVID-19, with increased health awareness, demand for non-alcoholic beer, which has less than half the calories of regular beer, is rising domestically. The domestic non-alcoholic beer market is estimated by the industry to be about 10 billion KRW in size.

HiteJinro's performance stands out in the non-alcoholic beverage market as well. Sales of HiteJinro's non-alcoholic beer 'Hite Zero 0.00,' launched in 2012, increased by 29% in April-May compared to the same period last year.

Lotte Chilsung Beverage's 'Cloud Clear Zero,' launched in 2017, saw only a 2% increase in sales last year compared to the previous year, but sales through April this year surged by more than 50% compared to the same period last year. Lotte Chilsung Beverage recently redesigned its packaging to enhance brand image amid the spreading trend of health-conscious drinking.

In June, Tsingtao launched 'Tsingtao Non-Alcoholic.' OB Beer plans to launch a non-alcoholic beer within this year. OB Beer has already registered trademarks for non-alcoholic beers such as 'Cass Zero' a year ago. As OB Beer is the number one beer company in Korea, the competition in the domestic non-alcoholic market is expected to intensify if OB Beer releases a non-alcoholic beer.

A food and beverage industry official said, "As a healthy drinking culture spreads, sales of non-alcoholic beverages are increasing," adding, "The current domestic non-alcoholic beverage market, valued at 10 billion KRW, is expected to grow to 200 billion KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)