Mitsubishi Aircraft Faces Risk as Mitsubishi Heavy Industries Pushes Ahead with Canadian Small Jet Business Acquisition

"Japan's Traditional Conglomerate Puts Itself to the Test," Foreign Media Assess

Fitch Downgrades Japan's Credit Outlook from Stable to Negative

Airline Slump Negatively Impacts Major Shareholder Mitsubishi Heavy Industries... Limits of Conglomerates

Restructuring Around Core Businesses Becomes a Key Task... Attention Also on Mitsui and Sumitomo

[Asia Economy Reporter Kwon Jae-hee] Mitsubishi Group has become a barometer determining the fate of conglomerates that have led the Japanese economy. Mitsubishi is considered a representative fleet-type company that expanded its business tentacle-like during Japan's high-growth period after World War II. However, with the rise of specialized companies and overlapping crises such as the COVID-19 pandemic, it is now being evaluated that not only poor performance but also the weaknesses of fleet-type management have been exposed.

The group was brought to a critical juncture by one of its affiliates, Mitsubishi Aircraft. According to the Nihon Keizai Shimbun and others, the company recently decided to push forward with acquiring the small jet passenger aircraft business division of Canadian aircraft manufacturer Bombardier. Izumisawa Seiji, president of Mitsubishi Heavy Industries, the largest shareholder of Mitsubishi Aircraft, has decided to take on the risk for the group’s long-cherished aviation business. Originally, Mitsubishi Aircraft had decided last year to acquire this business for $550 million. However, with the global aircraft market collapsing due to COVID-19 this year, the acquisition faced the risk of collapse.

This decision attracted attention because the business acquisition could have a domino effect negatively impacting the performance of group affiliates. The deterioration of Mitsubishi Aircraft’s performance could lead to the insolvency of its largest shareholder, Mitsubishi Heavy Industries. Heavy Industries holds 87% of the aviation shares. Mitsubishi Aircraft recorded a debt excess of 464.6 billion yen (approximately 5.2597 trillion KRW) in the 2019 fiscal year (April 2019 to March 2020). Debt excess means liabilities exceed assets.

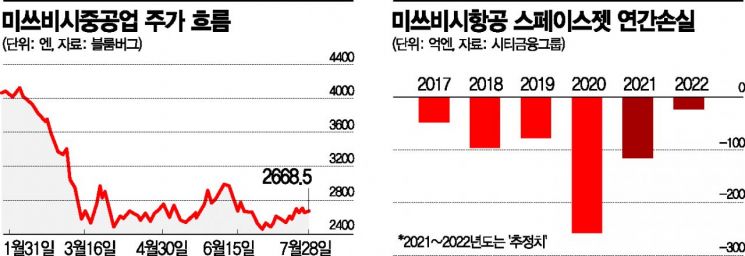

This also adversely affected the financial condition of Heavy Industries. Mitsubishi Heavy Industries posted an operating loss of 29.5 billion yen (approximately 337 billion KRW) last year, marking its first deficit in over 20 years. The Nihon Keizai Shimbun reported, "The deterioration in Mitsubishi Heavy Industries’ performance is due to the large losses from the small aircraft development project 'SpaceJet' being promoted by its subsidiary Mitsubishi Aircraft," adding, "Mitsubishi Heavy Industries has incurred business losses of 250 billion yen (approximately 2.9697 trillion KRW) over the past year solely on development costs related to this project."

Foreign media view the situation surrounding Mitsubishi’s aircraft acquisition as a clear example of the crisis facing Japanese fleet-type companies. It is widely assessed that fleet companies composed of diverse businesses lose synergy effects the more the economy struggles. Therefore, experts point out that when structurally entering an era of low growth, it is essential to reorganize businesses focusing on core businesses and capabilities. Tomohiko Sano, a JP Morgan analyst, evaluated, "Mitsubishi Heavy Industries is struggling to leverage the advantages of the conglomerate model."

The problem of fleet companies in Japan is not limited to Mitsubishi. Major conglomerates that have led the Japanese economy, such as Mitsui, Sumitomo, and Yasuda, have expanded their business through various affiliates including trading and finance. However, Mitsubishi draws particular attention as a representative Japanese fleet-type company. One foreign media outlet assessed, "Traditional Japanese conglomerates have put themselves to the test to see if they can transform into agile global players." Grammy McDonald, a Citigroup analyst, said, "Among investors, there is a view that Mitsubishi’s current reality symbolizes the problems of the Japanese economy," adding, "If you believe Japan is changing, then we need to pay attention to Mitsubishi’s transformation."

Mitsubishi is not entirely insensitive to change. Some affiliates are undergoing business restructuring. In the automotive sector, which along with aviation has revealed the greatest vulnerabilities during the COVID-19 crisis, Mitsubishi decided to close one domestic production base in Japan. Heavy Industries plans to focus its capabilities on aerospace fields such as Mars exploration probes. Recently, it launched a rocket carrying a Mars probe into space in collaboration with the United Arab Emirates (UAE). The Nihon Keizai Shimbun forecasted, "Companies leveraging digitalization are increasingly appearing among the top market capitalization rankings on the Tokyo Stock Exchange," adding, "Companies that rely on past legacies and refuse to change will sink." On the 29th, international credit rating agency Fitch downgraded Japan’s credit rating outlook from stable to negative.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.