Frequent Annual Strikes Due to Labor Negotiations Undermine Industrial Competitiveness

OECD Auto Industry Competitiveness Ranks 10th...Widening Gap Is a Bigger Issue

Priority Task: Securing Labor and Production Flexibility

Need to Introduce Multi-Product Small-Volume Production and Smart Factory Systems

[Asia Economy Reporter Su-yeon Woo] The change in perception between labor and management in the domestic automobile industry reflects the awareness that if labor productivity declines, the entire industry group could face a crisis due to an overall drop in competitiveness. Frequent strikes and wage increases resulting from the annual repetitive wage and collective bargaining (wage and collective agreement) negotiations are pointed out as boomerangs that erode industrial competitiveness.

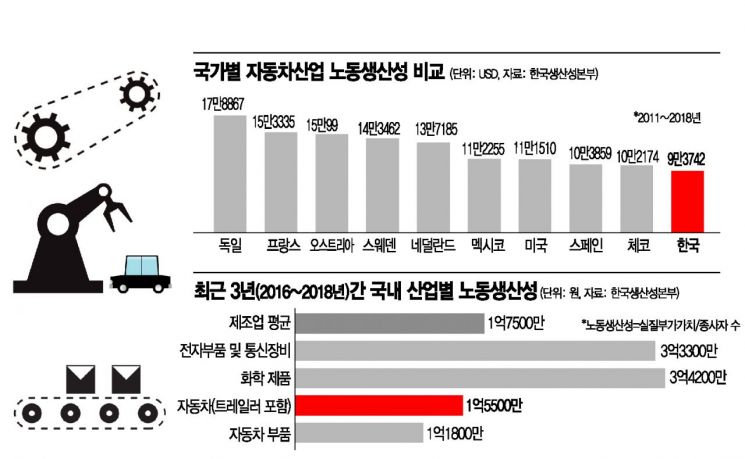

According to the Korea Productivity Center on the 28th, labor productivity (value added produced by one worker) in the Korean automobile industry from 2011 to 2018 was $93,742 (about 112 million KRW), which was only half of Germany's $178,867 (about 214 million KRW). During the same period, among 25 OECD countries, Korea's automobile industry's labor productivity ranked 10th.

Countries with higher productivity than Korea include Germany, Mexico, the United States, Spain, and the Czech Republic, where overseas factories of global automakers are concentrated. This means that when competing with factories in these countries in global order competitions, the competitiveness of Korean factories inevitably falls significantly. A bigger problem than low productivity is that the gap with these countries is gradually widening.

The gap is also clearly evident in domestic industry productivity comparisons. Over the past three years (2016?2018), the per capita labor productivity of the domestic automobile industry was 155 million KRW, which was lower than the manufacturing industry average of 175 million KRW. In the case of automobile parts, it was much lower at 118 million KRW. Han Pyeong-ho, Deputy Director of the Korea Productivity Center, pointed out, "From 2010 to 2018, Korea's labor productivity has continuously declined compared to competing countries over the past decade. Especially, our country's automobile industry is changing into a negative structure where labor productivity decreases and new employment also declines."

The most urgent measure to recover productivity is to secure flexibility in labor and production. Currently, even for the same company's production vehicles, the time from order to delivery can differ by more than six months depending on the model. To resolve this phenomenon, it is necessary to adjust production lines and input labor according to order volume, but it is not easy to reach agreements through negotiations with labor unions for each model. Repetitive strikes caused by annual wage and collective bargaining conflicts are also a chronic problem. During the summer when wage and collective bargaining negotiations begin in earnest, production volume inevitably plummets, and the resulting delivery delays directly affect consumers.

From the perspective of automakers and parts companies, even if there is a 'blockbuster' model that exceeds expectations, they cannot avoid headaches. To increase production volume, there remain hurdles such as negotiations with labor unions on production lines and additional work, and they must endure brand image damage caused by delivery delays. The gap between small and medium-sized parts companies is even greater. Although the average time from parts order to delivery is eight days, for small enterprises it can take up to 60 days.

The labor sector mentions the need to introduce a 'standard wage for the automobile industry' to simplify the exhausting labor-management negotiation process and reduce the wage gap between large and small companies. The ordinary wage, including base pay and bonuses, would be negotiated as a standard wage concept by industry, while other management performance bonuses and various allowances would be negotiated individually by company.

On the other hand, the management side emphasizes that the introduction of digitalization of factories, i.e., smart factories, is urgent to improve productivity such as efficient inventory management of parts companies. According to an online and offline survey conducted by the Korea Automobile Manufacturers Association and the Federation of Medium-sized Enterprises targeting 130 automakers and parts companies and 637 respondents, 69% answered that smart factory-related equipment had not been introduced. Regarding the difficulty of introducing and utilizing smart factory equipment, 63.6% answered that it was due to insufficient integration with existing factory equipment, and a significant portion (22%) said there was a lack of specialized personnel to operate the equipment. Chung Man-ki, Chairman of the Korea Automobile Manufacturers Association, said, "To expand mid- to long-term production capacity and improve productivity, it is urgent to increase investment in smart production systems along with future car-oriented investments. In particular, large-scale investment is needed for parts companies that are lagging behind in digital transformation innovation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)