Proactive Measures Including Cost Reduction

Shinhan, KB Kookmin, Hana

Double-Digit Growth in Net Profit for the First Half of the Year

[Asia Economy Reporter Ki Ha-young] Financial holding company-affiliated card companies achieved favorable results in the first half of this year. This is interpreted as a result of proactive measures through cost reduction in response to concerns about decreased profits due to the impact of the novel coronavirus disease (COVID-19).

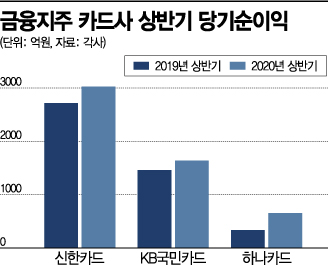

According to the card industry on the 27th, financial holding company-affiliated card companies that announced their earnings last week recorded double-digit growth in net profit in the first half of this year compared to the same period last year.

Shinhan Card recorded a net profit of 302.5 billion KRW, an increase of 11.5%, and KB Kookmin Card also recorded 163.8 billion KRW, growing 12.1% compared to the previous year. Hana Card achieved a net profit of 65.3 billion KRW, an increase of 93.9% year-on-year.

By quarter, Shinhan Card posted net profits of 126.5 billion KRW in Q1 and 176.0 billion KRW in Q2. KB Kookmin Card recorded 82.1 billion KRW in Q1 and 81.7 billion KRW in Q2, while Hana Card recorded 30.3 billion KRW in Q1 and 35.0 billion KRW in Q2.

The industry generally analyzes that this is due to continuous efforts to reduce costs, diversify revenue, and strengthen risk management. Net profits of card companies mostly increased in Q1 as well. The net profit of the seven specialized card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, and Hana Card) in Q1 was 521.7 billion KRW, up 14.2% from the same period last year.

The effect of disaster relief funds used since May is also considered to have appeared. About 70% of the approximately 14 trillion KRW in disaster relief funds were paid and used in the form of credit and check card recharges.

According to the Bank of Korea, although the usage of payment cards such as credit and check cards decreased by about 2.1% year-on-year from February to May this year when COVID-19 spread in earnest, it turned to a 0.9% increase in May thanks to the slowdown in the increase of COVID-19 confirmed cases and the use of emergency disaster relief funds.

Shinhan Card's credit card fee income in Q2 also increased by 137.0% compared to Q1. However, due to the effect of merchant fee reductions, card fee income in the first half of the year decreased by 2.2% compared to the previous year.

Although they performed well in the first half, concerns remain. It is difficult to predict how long the effects of various policies will last. An industry official said, "In the second half, the one-time effect of disaster relief funds will disappear, so we have no choice but to tighten our belts further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.