Two Types of Products Scheduled for Sale: Group and Individual Insurance Plans

[Asia Economy Reporter Ki Ha-young] Starting next month, drivers using personal passenger cars for delivery in shared transportation services will also be able to receive insurance coverage for accidents during transportation. As concerns arose that drivers on shared platforms such as Coupang Flex and Baemin Connect were in an insurance blind spot, financial authorities have expanded the special automobile insurance clause for paid transportation, which was previously available only for vehicles with seven or more seats, to include vehicles with six or fewer seats.

According to the industry on the 25th, from next month, drivers of passenger cars with six or fewer seats will be able to subscribe to the "Passenger Car Cargo Paid Transportation Special Clause," which provides accident coverage during paid transportation. The Financial Supervisory Service approved the special clause for cargo paid transportation for passenger cars with six or fewer seats on the 22nd.

Recently, with the activation of the sharing economy, the number of people delivering parcels using personal passenger cars through platforms like Coupang Flex and Baemin Connect has been increasing. These individuals transport parcels, food, and other items assigned via applications and shared platforms and receive transportation fees. The Financial Supervisory Service estimates that more than 100,000 people deliver parcels using passenger cars in this way.

However, the scope of insurance coverage for accidents occurring during delivery was limited. The paid transportation special clause was only available for vehicles with seven or more seats, and there were no related products for passenger cars with six or fewer seats.

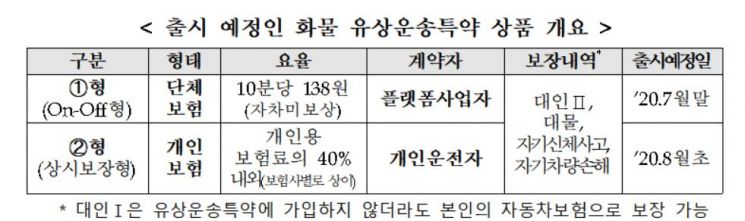

The newly established passenger car cargo paid transportation special clause is divided into two types: group insurance and individual insurance. The group insurance type is subscribed to by platform operators to cover accidents during paid transportation by their affiliated delivery drivers. The special clause premium is about 138 KRW per 10 minutes, charging insurance premiums in 10-minute increments of paid transportation time. Drivers indicate paid transportation on and off through the app to measure paid transportation time, and coverage applies only during transportation. However, drivers can only receive accident coverage during paid transportation if the platform operator subscribes to the group insurance.

The individual insurance type is subscribed to directly by the driver, with the special clause premium being about 40% of their personal automobile insurance premium. For example, if a personal automobile insurance premium is 650,000 KRW, subscribing to the newly introduced paid transportation special clause would raise the premium to 910,000 KRW. Drivers already insured can contact their insurance company around the 10th of next month to additionally subscribe to the paid transportation special clause.

A Financial Supervisory Service official said, "The paid transportation special clause will resolve the insurance blind spots for accident victims during transportation," and added, "It will also alleviate the economic burden on drivers participating in the sharing economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.