From New York and San Francisco to Tokyo and Seoul, Rent Prices Rise

China Shows Rapid Recovery... Hong Kong 'Shaken'

Essential Market Indicators Lag by at Least One Quarter... Full Assessment Possible in Second Half

New York (Photo by Getty Images Bank)

New York (Photo by Getty Images Bank)

[Asia Economy Reporter Minwoo Lee] An analysis has emerged that the impact of the novel coronavirus disease (COVID-19) has not yet fully manifested in the urban core office real estate leasing market. Given that the commercial real estate market’s response to changes in the economic environment tends to lag by at least two quarters, it is expected that the effects of COVID-19 will become apparent starting in the second half of the year.

On the 25th, Daishin Securities Research Center analyzed monthly performance fluctuations in the urban core office real estate leasing market and reported that rental rates and vacancy rates in most markets showed positive results compared to the previous month, previous quarter, or the same period last year. This indicates that the impact of COVID-19 has not yet been reflected in the market. Although some markets recorded negative results, the analysis suggests these were due to supply-side factors rather than demand-side effects related to COVID-19.

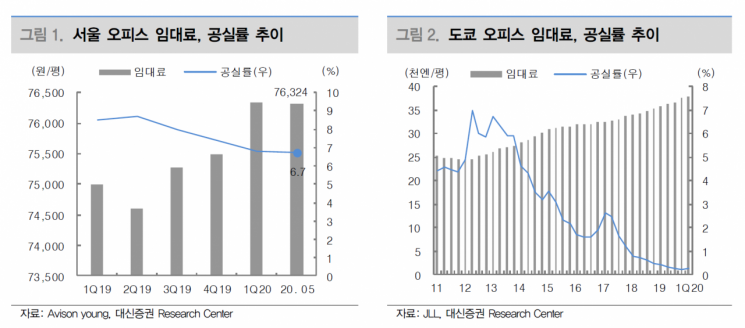

In Seoul, the monthly rent in May this year was recorded at 76,324 KRW per 3.3 square meters (㎡), a 2.4% increase compared to the same period last year. The vacancy rate remained steady at 6.7%, the same as the previous month. The Global Real Estate Team at Daishin Securities Research Center stated, "The vacancy rate in the Seoul office market had been on a continuous downward trend since 2018," adding, "While some interpret that this downward trend has started to be controlled due to COVID-19, it is necessary to confirm trend indicators through the next quarter."

In Tokyo, rents actually increased. The Global Real Estate Team at Daishin Securities Research Center noted, "The rent for Grade A prime offices rose by 7.2% compared to the same period last year, and vacancy rates in the five major wards of Tokyo remained very low." However, they added, "The vacancy rate in Chiyoda rose by 0.4 percentage points to 0.9% compared to the same period last year, which is due to the large-scale supply of Otemachi One Tower and is expected to be resolved with UBS Securities Japan’s move-in scheduled for the first quarter of 2021."

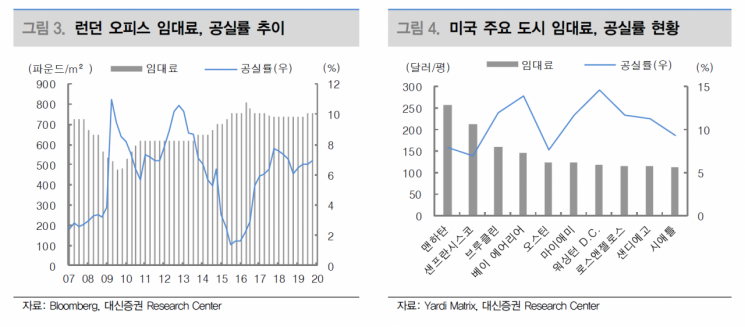

In the United States, as of May, the average monthly rent was $111 per 3.3㎡. Rent increases were particularly notable in New York Manhattan and San Francisco. Manhattan’s rent was $259 per 3.3㎡, and San Francisco’s was $212 per 3.3㎡, rising 15.5% and 9.9% respectively compared to the previous month. The vacancy rate increased by 0.1 percentage points to 13.2% compared to the previous month. The Global Real Estate Team at Daishin Securities Research Center interpreted this as, "The recent rise in vacancy rates in the U.S. was influenced by lease cancellations despite landlords not lowering rents, even amid ongoing shutdowns and the spread of remote work due to COVID-19."

In the Asia-Pacific (APAC) commercial real estate investment market, only China showed signs of recovery. Although it was the origin of COVID-19, China relatively quickly escaped the effects of the global pandemic, with transaction volumes increasing by about 50% compared to the same period last year. However, the overall transaction volume in the APAC region was approximately $16.273 billion, down about 60% compared to the same period. Particularly, Hong Kong’s investment market recorded a 91% decrease in transaction volume to $562 million, compounded by issues related to the Hong Kong National Security Law.

The Global Real Estate Team at Daishin Securities Research Center explained, "Even during the 2008 global financial crisis, the impact was mostly reflected in economic indicators and negative results became visible in housing market indicators first, with the commercial real estate market responding after about two quarters." They added, "Furthermore, both the leasing and investment markets in commercial real estate have the characteristic that essential market indicators are not released immediately but are delayed by at least one quarter before publication, so the impact of COVID-19 is expected to be identifiable starting in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.