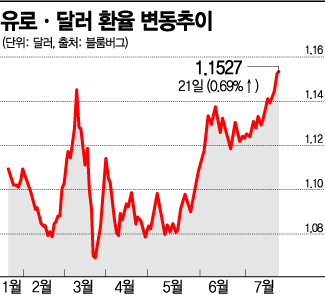

Euro-Dollar Exchange Rate at $1.1527... Rising Expectations for European Economic Recovery

Dollar Value Declines... "Dollar Hegemony Threat Revives"

Ursula von der Leyen, President of the European Commission (left), and Charles Michel, President of the European Council, are seen exchanging elbow greetings after a press conference at the EU summit held in Brussels, Belgium, on the 21st (local time).

Ursula von der Leyen, President of the European Commission (left), and Charles Michel, President of the European Council, are seen exchanging elbow greetings after a press conference at the EU summit held in Brussels, Belgium, on the 21st (local time). [Image source=Yonhap News]

[Asia Economy Reporter Hyunjin Jung] The value of the euro has reached its highest level in 18 months. This is the result of growing expectations that the economy will improve after the European Union (EU) agreed to establish a recovery fund worth 750 billion euros (approximately 1,031 trillion won) to respond to the COVID-19 pandemic. The dollar showed relative weakness, leading to premature assessments that the euro has begun to challenge the dollar's dominance.

According to Bloomberg and other sources on the 21st (local time), the euro-to-dollar exchange rate rose 0.69% from the previous day to $1.1527 per euro. This is the highest level in 18 months since January 9 last year ($1.1543).

The boost to the euro's value came from the EU recovery fund agreement announced early that day. After a five-day marathon negotiation, EU leaders agreed on a recovery fund consisting of 390 billion euros in grants and 360 billion euros in low-interest loans. Countries severely affected by COVID-19, such as Italy, Spain, and France, will receive large-scale support, while Northern European countries including the Netherlands will receive rebates returning part of their EU financial contributions. With the eurozone's GDP expected to shrink by 8.7% this year compared to the previous year, expectations have grown that this large-scale economic stimulus will help revive the European economy.

Meanwhile, the dollar's value continued to decline. The dollar index fell 0.74% from the previous day to 95.117. After fluctuating since March 20 (102.817), the dollar index recorded its lowest level in four months. Concerns over the spread of COVID-19 in the U.S. and the fiscal deficit caused by large-scale economic stimulus measures have significantly reduced the dollar demand that peaked in March.

Bloomberg stated, "The EU recovery fund has revived the threat to the dollar's global dominance," adding, "The dollar faces new questions regarding its status as the world's primary reserve currency." Wolf Lindahl, CEO of foreign exchange management firm AG Visset Association, predicted, "(The euro) will rise more than 30% against the dollar within 16 months," noting that the euro exchange rate surpassed $1.14 earlier this month and has entered an upward trajectory with further gains expected.

In particular, the European market is pinning hopes on the large-scale bonds jointly issued by the EU to finance the recovery fund. If these bonds are perceived as safe assets comparable to U.S. Treasury bonds, the euro's value could rise further. Bloomberg reported that with the recent rise in European stock markets and investors seeking to diversify funds previously concentrated in the dollar, "EU joint bonds with high credit ratings could be recognized as safe assets and offered as alternatives to U.S. Treasuries."

International credit rating agencies Moody's and Fitch rate the EU's credit rating as 'AAA,' while S&P rates it as 'AA.' Antoine Bouvier, Senior Currency Strategist at ING, estimated that if the EU secures funds for the entire 750 billion euro recovery fund through the bond market, the issuance volume would be 262.5 billion euros in 2021-2022 and 225 billion euros in 2023. Fueled by these expectations, the spread between German and Italian government bonds in the European bond market narrowed to 1.554 percentage points on this day from 2.7888 percentage points on March 17, when the COVID-19 crisis was at its peak, marking the narrowest gap since February. The reduction in the bond spread between the two countries indicates a decrease in political and financial risks within the eurozone.

However, the path for the euro to replace the dollar remains long. The dollar accounts for more than 60% of the world's reserve currencies and is the most widely used currency in international transactions. About half of trade transaction settlements are conducted in dollars. The euro's share in foreign exchange trading peaked at 28% in 2009 but has since declined to around 20% currently.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)