Acceleration After the COVID-19 Crisis

Claims Without Apps or Public Certificates

Expansion of Proxy Claim Services

Increase in Insurance Payments

Building Consumer Trust

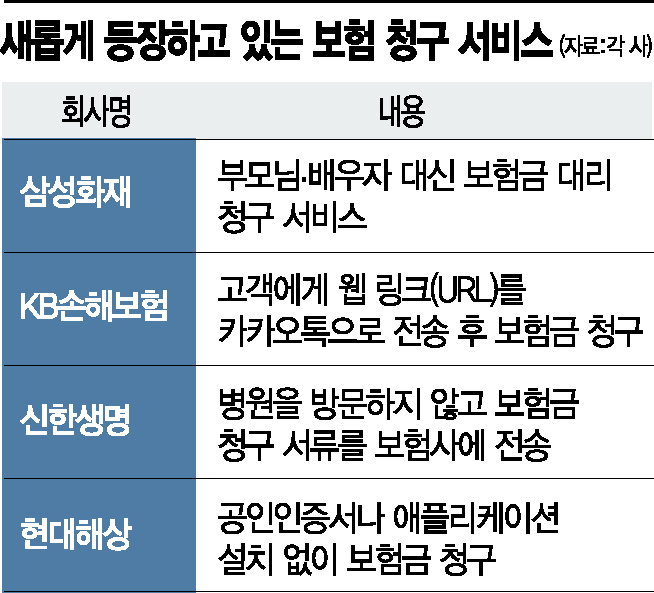

[Asia Economy Reporter Oh Hyung-gil] An unexpected 'insurance claim war' is breaking out in the insurance industry. Insurance companies are competitively revamping their claim services using internet websites or mobile applications (apps) to make it easier and more convenient for policyholders to file claims.

Since the outbreak of the novel coronavirus disease (COVID-19), the preference for non-face-to-face interactions has spread, accelerating the emergence of digital-based claim services.

Insurance Companies Successively Revamp Insurance Claim Procedures

According to the insurance industry on the 20th, Hyundai Marine & Fire Insurance plans to implement a service as early as next month that allows policyholders to file claims without using a public certificate or installing an app. This is a new mobile financial model following the recently introduced insurance contract loan service, where the claim process is conducted based on KakaoTalk chat.

Samsung Fire & Marine Insurance has been operating an insurance agent claim system since last month.

They introduced a 'proxy claim service' that allows filing insurance claims on behalf of parents or spouses through the mobile app. Previously, proxy claims were only possible for patients who had difficulty filing claims, such as dementia patients or those in a vegetative state. To file a claim as a proxy, the proxy had to be designated in advance before the claim.

However, Samsung Fire & Marine Insurance added a 'proxy insurance claim' function that allows proxies to easily file claims on behalf of policyholders who cannot file claims themselves.

KB Insurance also launched a service that enables easy insurance claims without installing a separate app.

They send a web link (URL) for claim filing to customers via KakaoTalk, allowing easy claim submission. Even if not the policyholder, a third party can file a claim by entering the insured person's authentication code.

Shinhan Life Insurance also quickly introduced a related service. They operate a service that allows claim documents to be sent directly to the insurer without visiting the hospital. Through a technical partnership with the healthcare company 'MediBloc,' this service is available at Samsung Seoul Hospital, Seoul National University Hospital, and Yonsei Severance Hospital, with plans to expand to more hospitals.

Insurtech companies such as Goodrich and Bomep also provide services that allow easy insurance claims across multiple insurers.

The more insurance claims there are, the more inevitable the increase in payouts becomes. An increase in insurance payouts leads to a rise in loss ratios. Although the industry is reluctant to openly welcome insurance claims, recently there has been a growing trend that building 'consumer trust' through claims and payouts is beneficial in the long term.

Also, the accelerated shift to a digital environment in the post-COVID era is cited as a major factor in simplifying procedures. The Korea Insurance Research Institute predicted that the COVID-19 pandemic would accelerate the use of digital technologies such as artificial intelligence (AI) in the insurance claim and payout process.

A representative from a major non-life insurer said, "The smaller the amount, the more policyholders find the claim process bothersome or difficult, but by resolving these issues, the perception that 'insurance companies do not pay well' can also be improved," adding, "Easy insurance claims will become a representative non-face-to-face service."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)