Net Increase of 1.7 Trillion KRW in Credit Loans at 5 Major Banks Over First Half of This Month

Clear 'Balloon Effect' as Borrowers Shift to Credit Loans After 'June 17 Measures' Curb Mortgage Loans

July Expected to Set Record High on Monthly Basis

[Asia Economy Reporters Kangwook Cho, Minyoung Kim] Since the June 17 real estate measures, unsecured loans at major banks have surged. If this trend continues, the monthly net increase in July is expected to hit an all-time high. Analysts suggest that the 'balloon effect,' where demand for mortgage loans shifts to unsecured loans due to low interest rates amid the COVID-19 pandemic and the government's successive high-intensity real estate loan regulations, is becoming a reality. Additionally, financial authorities' announcement to strengthen monitoring of unsecured loans in the future seems to have triggered an anxiety-driven 'let's get it first and see' mentality.

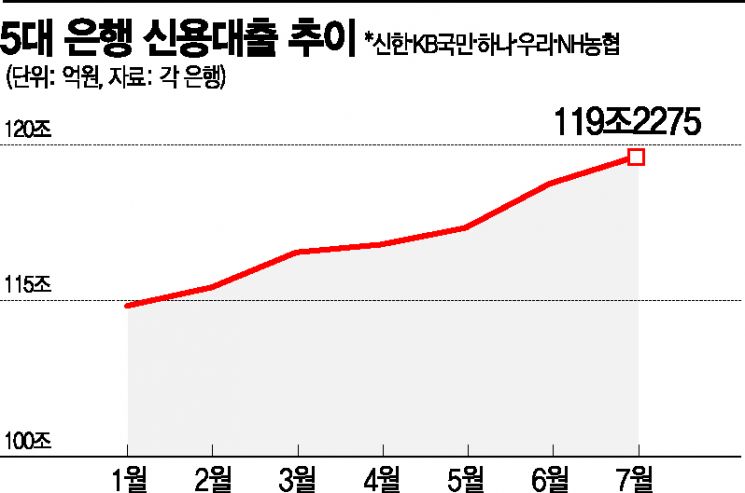

According to the financial sector on the 17th, the outstanding balance of personal unsecured loans at the five major domestic banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?amounted to 119.2275 trillion won from the 1st to the 15th of this month. This is an increase of 1.7043 trillion won compared to the end of last month. Considering that about 1.7 trillion won increased in just half of this month, a simple calculation suggests that the increase could double to 3.4 trillion won by the 31st. If this happens, it will far exceed last month's record increase of 2.8374 trillion won, setting a new record for the largest increase ever. This also surpasses the 3.1 trillion won increase in other household loans (including unsecured loans) across all banks last month, as compiled by the Bank of Korea.

The increase in personal unsecured loans at the five major banks doubled from 1.1925 trillion won in February to 2.2409 trillion won in March. It slowed to 500 billion won in April, then rose again to 1 trillion won in May and 2.8 trillion won in June. Over the first six months of this year, the increase in unsecured loans at major banks reached a staggering 7.6 trillion won, more than eight times the approximately 900 billion won increase during the same period last year.

On the other hand, the outstanding balance of mortgage loans as of the 15th of this month was 451.5766 trillion won, an increase of only 120.8 billion won from the previous month. Following this trend, the increase by the end of this month is expected to be only about 240 billion won. The increase in mortgage loans was 956.3 billion won in February, then surged sharply to 4.6 trillion won in both March and April. However, it decreased to 1.8 trillion won in May and shrank further to 800 billion won last month. So far, the decline is noticeably pronounced.

The general consensus is that the slowdown in mortgage loan growth and the unusual surge in unsecured loans are due to the high-intensity real estate regulations. The government's continuous tightening of real estate loan regulations has caused mortgage loan demand to be blocked, leading to a balloon effect where demand shifts to unsecured loans. This month, there is even a higher possibility that mortgage loans will decrease further while unsecured loans will exceed June's increase, raising concerns about financial sector soundness risks due to credit defaults.

Another factor driving loan demand is the anxiety that financial authorities' regulatory focus might shift to unsecured loans. After the balloon effect caused by the rapid increase in unsecured loans last month, financial authorities have been closely monitoring household loans and strengthening inspections.

Moreover, under the low-interest-rate environment, the decline in bank time deposits is accelerating. Over 10 trillion won was withdrawn from time deposits at the five major commercial banks in June alone. The outstanding balance of time deposits at these banks has been decreasing for three consecutive months since reaching 652.3277 trillion won in March. The month-to-month decrease widened significantly, with 2.7079 trillion won in April and 5.8499 trillion won in May.

The problem is that despite banks recently trying to slow the rapid growth of unsecured loans, the increase remains steep. Woori Bank changed the loan conditions for its non-face-to-face unsecured loan product, 'Woori WON Workplace Loan,' starting this month. While the maximum loan limit remains at 200 million won, the proportion of annual income recognized when calculating the loan limit has been lowered. Shinhan Bank also reduced the income-to-limit ratio for some unsecured loan products for employees of high-quality companies in the first half of this year.

Internet banks are no exception. KakaoBank's average interest rate on general unsecured loans (excluding microfinance) in May, as disclosed last month, was 2.99% per annum, higher than the five major commercial banks: Shinhan (2.41%), Woori (2.58%), Nonghyup (2.65%), Kookmin (2.73%), and Hana (2.76%). This contrasts sharply with the aggressive marketing at launch, when loan rates were lowered to the low 2% range.

Other banks are also reportedly preparing to raise the bar for unsecured loans soon. According to a recent loan behavior survey released by the Bank of Korea, loan officers at commercial banks indicated that from the third quarter of this year, they plan to tighten lending attitudes due to expanding domestic and external economic uncertainties, credit soundness management, and concerns about deteriorating debt repayment capacity.

A financial sector official said, "Unless the economic situation drastically reverses, soundness issues could become the biggest topic in the banking sector from early next year," adding, "If the balloon effect continues with mortgage loan demand shifting to unsecured loans due to government real estate regulations, adjustments to loan limits or interest rates will be inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.