Sale of Assets Worth 70 Billion KRW This Month

827 Real Estate Public Auction Bids in First Half

Active Branch Consolidation and Idle Property Clearance

Securing Funds Amid COVID-19 Uncertainty

[Asia Economy reporters Kangwook Cho and Eunbyeol Kim] Commercial banks facing a crisis in profitability management due to the prolonged COVID-19 pandemic are accelerating the sale of real estate. They are selling off idle buildings resulting from branch restructuring one after another. The scale of real estate put up for sale by banks this month alone amounts to 70 billion KRW. This is interpreted as a strategy to convert non-operating assets into cash to increase internal reserves and secure as much ammunition as possible amid deteriorating domestic and international business conditions.

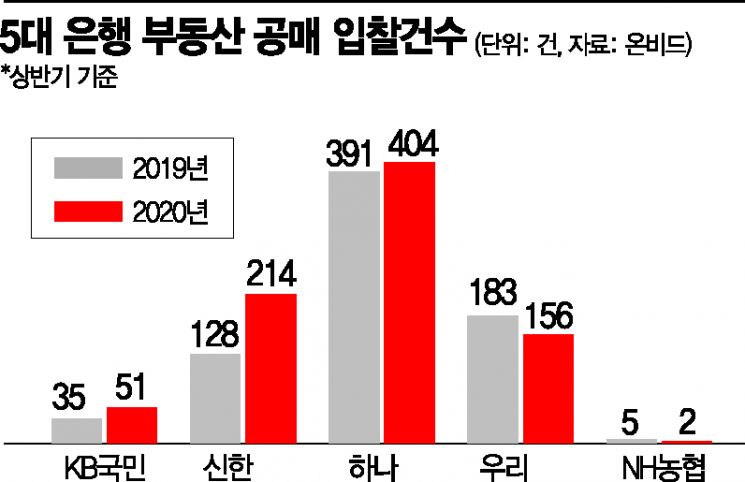

According to Onbid, the public auction system of the Korea Asset Management Corporation (KAMCO), the number of real estate auction contracts won by the five major commercial banks (KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup Bank) in the first half of this year reached 48 cases totaling 80.4 billion KRW. During the same period, the number of real estate auctions in which banks participated in bidding was 827 cases, an increase of 85 cases compared to 742 cases in the same period last year.

The increase in the number of real estate auctions bid on is related to banks accelerating branch consolidation as the COVID-19 pandemic prolonged. Recently, banks have started branch consolidation to manage profitability amid a low-interest-rate environment and a surge in loans. Additionally, the importance of branches has diminished as non-face-to-face (untact) transactions exceed 90%, which also plays a role.

NH Nonghyup Bank, which is selling three real estate properties as of this day, put up locations that were all used as branches but recently closed. These include Aeogae Station Branch (6.6 billion KRW), Imun-ro Branch (4.55 billion KRW), and Seoul Digital Branch (2.4 billion KRW). Although these are prime real estate properties, the decision was made that it is better to dispose of buildings that have become useless and secure cash. Successfully selling underutilized real estate increases non-operating income on financial statements, resulting in a net profit increase effect. The minimum auction price totals 13.55 billion KRW.

Shinhan Bank, which bid on six cases on the 14th, plans to dispose of one more case on the 20th. The total scale of real estate Shinhan Bank put up this month is 31.3 billion KRW. Earlier in April, it started selling the site of the Jincheon Training Center in Chungbuk. Although it planned to build the largest training center nationwide with an annual capacity of 100,000 people, the plan was scrapped last year. The estimated sale price of the training center site is about 50 billion KRW. KB Kookmin Bank and Hana Bank also put up 14 cases (47.2 billion KRW) and 25 cases (144.6 billion KRW) respectively last month, totaling 191.8 billion KRW.

The sale of idle real estate by banks is expected to continue actively. This is because branch restructuring is intensifying and cost efficiency is urgently needed to respond to the worsened management environment due to COVID-19. According to the Bank of Korea and the Financial Supervisory Service, the total number of bank branches (general + specialized banks) in the first quarter of this year was 6,853, down 51 from the previous quarter. Even considering that banks usually reduce the number of branches during organizational restructuring at the end and beginning of the year, the decrease in branches is more than twice as large compared to the same period last year, which saw a decrease of 22 branches in the first quarter of 2019. At least 46 more bank branches are scheduled to be closed in the second half of the year. Some banks are grouping regions and managing the number of personnel by promotion and rank to prepare for sudden branch consolidations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.