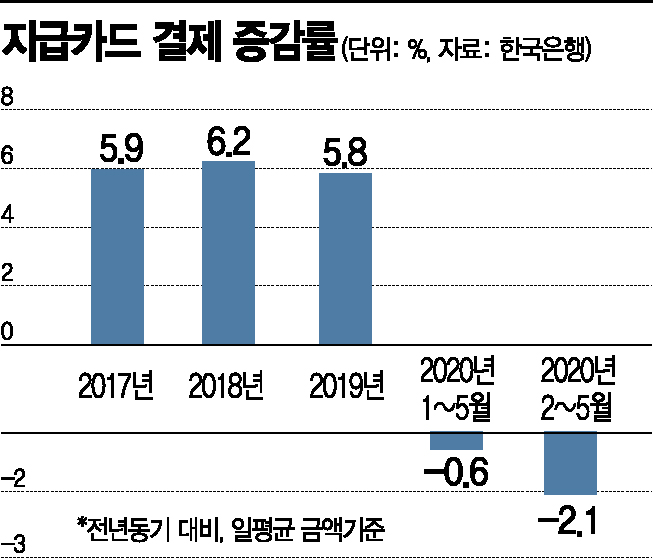

Card Usage Performance Decreased by 2% from February to May This Year Due to COVID-19 Impact

Fourth Decline Since Related Statistics Began in 2003

Attention on Disaster Relief Fund Effect Amid COVID-19 Impact

[Asia Economy Reporter Ki Ha-young] There are mixed forecasts regarding the credit card companies' performance in the second quarter of this year. The effect of the emergency disaster relief fund amid the spread of the novel coronavirus infection (COVID-19) is a variable. Attention is focused on whether credit card companies, which achieved surprising results in the first quarter through cost reduction, will continue their strong performance in the second quarter.

According to the Bank of Korea on the 15th, the usage performance of payment cards such as credit and check cards from February to May this year, when COVID-19 spread in earnest, decreased by about 2.1% compared to the previous year. This is the fourth decline since related statistics began in 2003.

Looking at each card type, both credit cards (-3.8%) and check cards (-0.1%) decreased, while only prepaid cards (+892.6%) increased sharply, supported by the use of the emergency disaster relief fund. Excluding prepaid cards, the usage performance of payment cards recorded -3.0%.

Monthly performance decreased the most in March at -7.4%, then turned to a 0.9% increase in May, supported by the slowdown in the increase of COVID-19 confirmed cases and the use of the emergency disaster relief fund.

The industry expects that the second quarter performance this year will not reach the level of the first quarter. This is because the effects of consumption contraction due to social distancing and interest repayment deferrals for small business owners are being fully reflected. The emergency disaster relief fund, which has been reflected since May, is also expected to have only a temporary effect. An industry insider expressed concern, saying, "The emergency disaster relief fund will have a temporary effect only for June."

On the other hand, the securities industry’s outlook is positive. In particular, there are views that Samsung Card will deliver an earnings surprise in the second quarter. This diagnosis is based on the fact that credit card companies are continuously making efforts to reduce costs and that consumption has been favorable due to the effects of disaster relief funds and others.

Earlier, in the first quarter, most credit card companies saw an increase in net profit. This is interpreted as the result of continuous cost reduction efforts, diversification of revenue, and strengthened risk management. The net profit of seven specialized credit card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, and Hana Card) in the first quarter was 521.7 billion KRW, an increase of 14.2% compared to the same period last year. While large credit card companies generally recorded favorable results, small and medium-sized companies saw a relatively large increase in net profit due to temporary factors and base effects. Shinhan Card and KB Kookmin Card recorded net profit increases of 3.5% and 5.3% year-on-year, respectively, and Hyundai Card also achieved a significant growth of 7.3%. The performance of small and medium-sized companies was also remarkable. Woori Card achieved a net profit growth of 112.5% year-on-year, Lotte Card 69.6%, and Hana Card 66.5% year-on-year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.