Tax Benefits for Registered Rental Businesses Maintained for Villas, One-Rooms, and Officetels

Seoul Multi-Family and Row House Transactions May Surpass 6,000 in June

Eunpyeong-gu Leads with 663 Cases

New Constructions Near Redevelopment and New Town Areas

Prices Rise with Record Highs Reported

[Asia Economy Reporter Donghyun Choi] As the government's real estate regulations, including the June 17 measures, have focused on apartments, a balloon effect is emerging in multi-family and row houses (villas). With investment concentrated in undervalued redevelopment areas in northern Seoul and real demand driven by school district demand in the Gangnam area, the transaction volume of multi-family and row houses has reached its highest level in 2 years and 4 months.

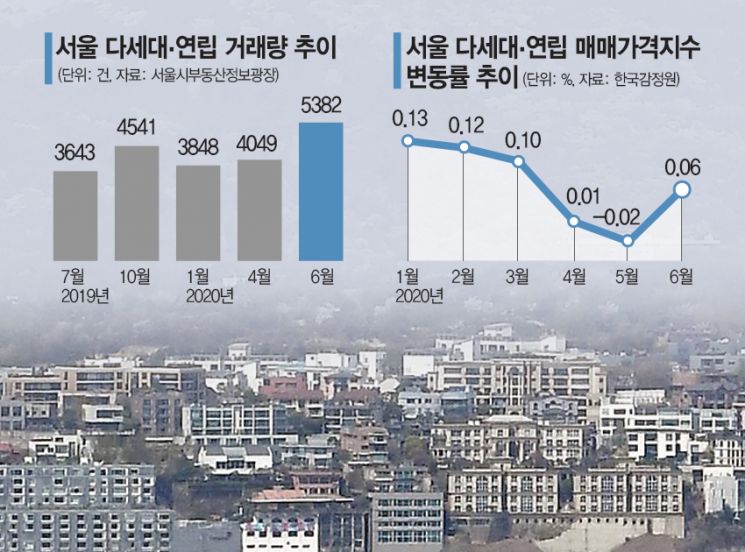

According to the Seoul Real Estate Information Plaza on the 15th, the transaction volume of multi-family and row houses in Seoul in June was recorded at 5,382 cases as of that day. This is the highest since March 2018, when 5,950 cases were recorded. Considering that there are still about half a month left for contract reports in June, the total transaction volume for June is likely to exceed 6,000 cases. The transaction volume for July has already surpassed about 1,100 cases.

By region, Eunpyeong-gu was the most active among the 25 autonomous districts in Seoul, with 663 transactions in June alone. According to local real estate agencies, buying demand has recently concentrated on newly built villas near redevelopment zones and New Town areas. Along with this, Gangseo-gu (409 cases), Yangcheon-gu (400 cases), and Songpa-gu (346 cases) also had high transaction volumes. It appears that transactions increased as educational demand gathered near excellent schools and academies in areas such as Mok-dong and Gangnam. A representative from real estate agency A in Munjeong-dong, Songpa-gu, said, "Just before the Jamsil-dong area in Songpa-gu was designated as a land transaction permission zone on the 23rd of last month, inquiries for villa purchases for gap investment or actual residence surged," adding, "As apartment prices rose too much and loans became difficult to obtain, many have recently been looking for villas."

Due to the soaring demand for villas, prices of row houses in good locations are also rising sharply, hitting record highs. According to the Ministry of Land, Infrastructure and Transport's actual transaction price system, on the 22nd of last month, two units of 'Dongnam Row House Building A' in Jayang-dong, Gwangjin-gu, with an exclusive area of 65.75㎡, were sold for 1.6 billion KRW each. Compared to two units sold for between 1.1 billion and 1.2 billion KRW just two days earlier, this is a price increase of over 400 million KRW. The 'Byeoksan Villa' in Mapo-dong, Mapo-gu, with an area of 228㎡, was sold for 2.4 billion KRW on the 8th. This is 600 million KRW higher than a wider 230㎡ unit sold for 1.8 billion KRW on the 13th of last month. The Korea Appraisal Board's Seoul row house and multi-family housing price index began to rebound from August last year. Although there was a brief decline in May, it returned to an upward trend last month.

The increase in transactions of row houses and multi-family houses is attributed to the gap-filling effect with the sharply rising apartment prices and the expectation that prices will rise, as well as the fact that these properties are outside the scope of the government's successive regulations. The December 16 measures last year banned mortgage loans for purchasing ultra-high-priced houses over 1.5 billion KRW, but this applied only to apartments. According to the June 17 measures, from the 10th of this month, if an apartment over 300 million KRW is purchased in regulated areas such as the metropolitan area, jeonse loans are restricted or recalled, but this regulation does not apply to row houses or multi-family houses. Thus, gap investment through jeonse loans is still possible. The July 10 measures also maintained tax benefits for registered rental businesses for villas, one-room units, officetels, etc., which is also a positive factor.

Kwon Dae-jung, a professor in the Department of Real Estate at Myongji University, said, "Due to the sharp increase in apartment holding taxes, the prices of villas and officetels are likely to rise," adding, "Since these residential areas house many vulnerable groups, the government should devote more effort to prevent the balloon effect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.