Individual investors are showing strong interest in SK Biopharm. Individuals purchased stocks worth 593.8 billion KRW within 9 days after SK Biopharm's listing.

On the other hand, foreign investors engaged in profit-taking through selling. Foreigners have been net sellers for 9 consecutive days since the listing, with a cumulative net sale amounting to 758.1 billion KRW as of the 14th.

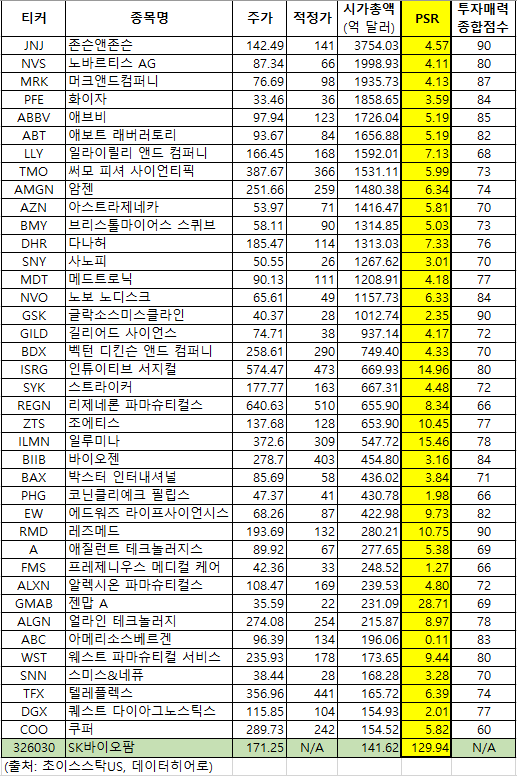

Market experts are voicing concerns about the overheating of SK Biopharm's stock price. Comparing it with healthcare-related stocks listed in the U.S. can help gauge the level of valuation SK Biopharm is receiving.

According to DataHero, a big data analytics company, as of the 9th, SK Biopharm's market capitalization stands at approximately $14.1 billion, which is about 30% of Biogen (BIIB)'s market cap of $45.8 billion. Biogen is famous as the first biotech company Warren Buffett invested in. Biogen's price-to-sales ratio (PSR) is 3.16x, while SK Biopharm's PSR is 129.94x, indicating that SK Biopharm is trading at over 41 times the PSR of Biogen.

Among U.S.-listed healthcare sector companies with an overall investment attractiveness score of 60 or higher and a market capitalization equal to or greater than SK Biopharm, the company with the highest PSR is Genmab A (GMAB) at 28.71x.

★ Check Johnson & Johnson's Investment Attractiveness and Fair Price

Other well-known global healthcare companies in Korea include Johnson & Johnson (JNJ) with a PSR of 4.57x, Novartis (NVS) at 4.11x, Merck & Company at 4.13x, and Pfizer at 3.59x. Most companies trade around a PSR of 4x. For investors who missed out on SK Biopharm's IPO subscription, seeking opportunities in U.S. healthcare stocks with verified sales and earnings that are undervalued might be a good strategy.

Below is a summary compiled by ChoiceStockUS using DataHero data. It lists U.S. healthcare-related stocks with market capitalizations higher than SK Biopharm and an investment attractiveness score of 60 or above as calculated by DataHero, sorted by market capitalization.

Since SK Biopharm recorded a loss in 2019, the price-to-sales ratio (PSR) was used for comparison with other companies based on sales. The fair price was calculated using DataHero's valuation algorithm, which reflects the company's past performance and future outlook.

★ 20 U.S. Stocks Expected to Show Steady Price Growth

ChoiceStock recommends promising companies among these, including Johnson & Johnson, Merck & Company, Pfizer, AbbVie, Biogen, and Amgen, which have high investment attractiveness scores and are trading at or below their fair prices.

ChoiceStock's main U.S. stock services include ▲ stock recommendations ▲ recommended portfolios ▲ investment attractiveness scores and fair prices for all stocks ▲ investment attractiveness rankings for all stocks ▲ lists of dividend and growth stocks ▲ 10-year financial charts and investment indicators ▲ dividend information, and more.

★ Apply for a Free Trial of ChoiceStockUS

Recent Hot Issue Stocks

Samsung Electronics, Kakao, Pharmicell, Hyundai Motor, SK Biopharm

※ This content is independent of Asia Economy's editorial direction, and all responsibility lies with the information provider.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)