Sales Performance of Door-to-Door Sales Slows Due to COVID-19 Concerns Including Korea Yakult

Online Mall and Home Shopping Sales Increase...Good Performance Expected

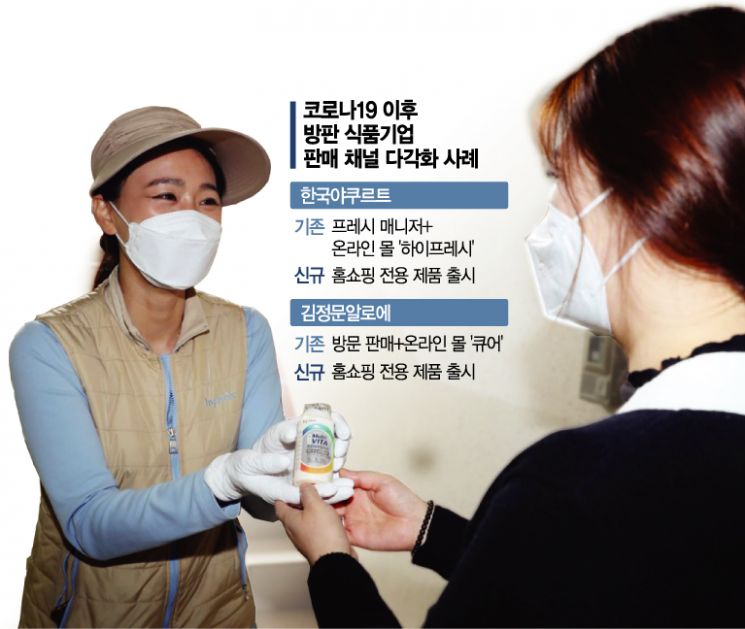

[Asia Economy Reporter Choi Saeng-hye] Food companies that have been promoting and selling products primarily through door-to-door sales (hereafter referred to as "bangpan") are overcoming the challenges posed by the COVID-19 pandemic by diversifying their sales channels. This is because bangpan inevitably suffered a sales hit as it emerged as a hotspot for COVID-19 cluster infections.

According to the food industry on the 15th, Korea Yakult, regarded as a leading player in bangpan, is expected to achieve its annual sales target smoothly as sales through new channels such as its online mall "HiFresh" and home shopping have increased beyond expectations, even though its bangpan performance this year remains at the previous year's level. According to Korea Yakult, the number of consumers preferring non-face-to-face transactions has significantly increased, and the first half sales of its online mall "HiFresh" have already exceeded last year's annual sales of 25 billion KRW. A company official explained, "We have revised the annual sales target upward to 50 billion KRW," adding, "We plan to increase the range of products handled by HiFresh and actively promote sales growth through events."

They have also diversified sales channels by launching products on home shopping. In April, Korea Yakult launched the diet health functional food "Kill Fat Diet" through GS Home Shopping. It is a health functional food that helps reduce both weight and fat. This product is not sold through bangpan but is currently available on home shopping channels such as CJ Mall and various open markets. The annual sales target for Kill Fat Diet is 10 billion KRW.

Bangpan accounts for more than 90% of Korea Yakult's total sales, making it an absolute majority. Out of approximately 1.07 trillion KRW in annual sales, over 900 billion KRW comes from bangpan. The number of fresh managers, once called "Yakult Ajumma," reaches about 11,000. Consequently, there were considerable concerns about the risk of COVID-19 infection. In fact, in February, the 43rd confirmed COVID-19 case in the Daegu and Gyeongbuk regions was identified as a fresh manager working at the Daegu Namgu Daemyeong-dong branch, leading some consumers to reduce the number of deliveries through fresh managers.

A Korea Yakult official stated, "Since the early stages of the COVID-19 outbreak, we have been strictly implementing quarantine measures, so the fresh manager organization has not been reduced, nor have sales significantly declined," adding, "While bangpan performance has stagnated, online mall sales have increased significantly, so this year's performance is expected to surpass last year's."

Kim Jung Moon Aloe, a specialized aloe company, has also sold health functional foods mainly through bangpan for over 40 years but has diversified its sales channels by launching home shopping-exclusive products after COVID-19. Sales of health functional foods through home shopping are encouraging. Sales of all products currently released by Kim Jung Moon Aloe are rapidly increasing.

A Kim Jung Moon Aloe official said, "Last month, we launched the health functional food 'Jang·Immunity N K Aloe' as a home shopping-exclusive product to strengthen contact points with consumers who prefer non-face-to-face transactions," adding, "Since the launch of the home shopping-exclusive product, the total sales of 14 health functional food items last month grew by 33% compared to May, showing positive changes." The number of "counselors," Kim Jung Moon Aloe's door-to-door salespersons, exceeds 3,000. Bangpan accounts for more than 60% of the company's total sales.

The food industry expects that as the non-face-to-face trend continues, the proportion of bangpan will continue to decline, while the share of new channels such as online and home shopping will keep increasing. An industry insider said, "Despite the growth of the e-commerce market, bangpan has remained an attractive channel by maintaining advantages that digital platforms cannot replace and handling a variety of items covering everyday life," adding, "However, due to COVID-19, consumer landscapes have changed, and companies now need to devise new sales methods that leverage the strengths of existing bangpan while meeting consumer demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)