Credit Score Bonus Linked to Diligent Payment Period

2021 National Pension Big Data Portal Service Construction

[Asia Economy Reporter Hyun-ui Cho] The Ministry of Health and Welfare and the Financial Services Commission announced on the 14th that they have completed the development of a credit evaluation model utilizing National Pension payment information in collaboration with the National Pension Service and Korea Credit Bureau (KCB), and will apply it starting this October. They also plan to establish a big data portal system to promote various services.

◆ Pension Payment Information Utilized in Credit Evaluation=First, credit ratings can be improved by reflecting National Pension payment information in credit evaluations. The Ministry of Health and Welfare and the National Pension Service have participated jointly with the credit evaluation agency KCB in improving the credit evaluation model considering the use of non-financial information and security, based on vast payment data.

Analysis of data from about 2.35 million National Pension subscribers showed that the more faithfully the National Pension is paid, the lower the loan delinquency in the financial sector. Accordingly, they plan to grant credit score bonuses linked to the period of faithful payment.

Since the Financial Services Commission designated homomorphic encryption technology as an innovative financial service through the financial regulatory sandbox in December last year, it has become possible to safely combine and analyze KCB’s credit information and the National Pension Service’s pension payment information to provide credit evaluation services. Existing credit evaluations granted bonuses by reflecting non-financial payment details such as National Pension and health insurance, but did not consider the correlation between faithful payment periods and creditworthiness.

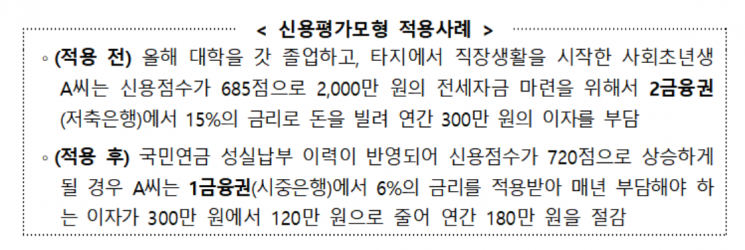

Accordingly, starting this October, when KCB applies the new credit evaluation model, individuals registered with non-financial information among KCB customers will be able to receive up to 41 points (on a 1000-point scale) as a credit evaluation bonus depending on their faithful payment period. It is expected that the credit scores of up to 550,000 National Pension subscribers registered with KCB will increase.

If the faithful payment period of the National Pension is 36 months or more, the highest credit score bonus can be received, and differential bonuses will be given according to the number of months of faithful payment. In particular, thin filers such as young adults with little financial transaction history will be able to receive more reasonable credit evaluations by reflecting non-financial information. Among the 550,000 people whose credit scores will rise due to National Pension payment data, 240,000 are expected to be young people aged 34 or younger.

The Ministry of Health and Welfare emphasized that the development of this credit evaluation model is meaningful in that the world’s first use of ‘homomorphic encryption’ technology, which enables data combination and analysis in an encrypted state for safe use of personal information, was applied. Homomorphic encryption is a technology that allows data to be analyzed while encrypted, enabling safe use without leakage of personal information.

◆ Big Data Portal Service to be Established in 2021=A National Pension big data portal service accessible to everyone will also be established. The Ministry of Health and Welfare and the National Pension Service hold and utilize about 480 billion pieces of data on National Pension subscription, payment, and benefit information covering the entire life cycle of the entire population. To effectively support public and private sector activities, they plan to open the ‘National Pension Big Data Analysis Center’ in August and build the ‘National Pension Big Data Portal System’ by 2021.

The National Pension Big Data Analysis Center will be a space where users who want to utilize National Pension big data can visit directly, analyze desired data, and extract results. It is scheduled to open in August.

The big data portal system will be accessible to all citizens including government and local governments, and is expected to meet various data demands by spreading 83 types of welfare, business, and job information currently provided to 121 cities, counties, and districts, and linking with the big data analysis center. Through this, the government and local governments can enhance citizen convenience in various fields through data-driven administrative services, and it is expected to be usefully utilized in the private sector such as startups.

Lee Hyung-hoon, Director of the Pension Policy Bureau at the Ministry of Health and Welfare, stated, “We will actively utilize National Pension big data to contribute to accelerating the spread of the Digital New Deal, improve credit evaluations for young people, develop life policies, and continuously discover and strengthen services that citizens can feel.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.