7·10 Real Estate Measures' First-Time Purchase Support Also Causes Frustration

50% Reduction for Under 400 Million KRW in Seoul Metropolitan Area

100% Reduction for Under 150 Million KRW

Only 16% Eligible for Reduction, 1.5% for Full Exemption

Young Policy Targets Criticize as "Token Gesture"

Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki and Minister of Land, Infrastructure and Transport Kim Hyun-mi are leaving the briefing room after announcing a comprehensive real estate plan, including strengthening the comprehensive real estate holding tax for multi-homeowners, at the Government Seoul Office in Jongno-gu, Seoul, on the 10th. Photo by Kang Jin-hyung aymsdream@

Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki and Minister of Land, Infrastructure and Transport Kim Hyun-mi are leaving the briefing room after announcing a comprehensive real estate plan, including strengthening the comprehensive real estate holding tax for multi-homeowners, at the Government Seoul Office in Jongno-gu, Seoul, on the 10th. Photo by Kang Jin-hyung aymsdream@

[Asia Economy Reporter Lee Chun-hee] Although the government announced plans to expand the acquisition tax reduction targets for first-time homebuyers through the July 10 real estate measures, criticism is emerging even among young people that it is a superficial policy with no practical effect. Since recent house price increases were not taken into account, the eligible homes are limited, leading to complaints such as "Are they telling us to buy isolated apartments in the outskirts where prices don’t even rise?"

According to the Ministry of Land, Infrastructure and Transport on the 14th, the eligible homes for acquisition tax reduction for first-time homebuyers in Seoul account for about 16% of all homes.

This is due to the expansion of the 50% acquisition tax reduction, which was previously applied only to newlyweds purchasing homes under 60㎡ (exclusive area) and priced under 300 million KRW (400 million KRW in the metropolitan area), to all first-time homebuyers regardless of age or marital status under the July 10 measures. Among these, homes priced under 150 million KRW receive a 100% acquisition tax exemption.

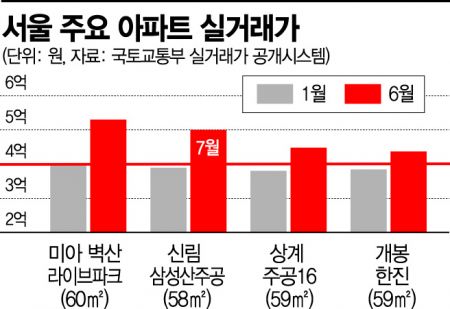

According to the Ministry of Land, Infrastructure and Transport’s real transaction price disclosure system, the total number of apartment transactions reported in Seoul this year up to this date is 41,604. Among these, transactions eligible for acquisition tax reduction in the metropolitan area?homes under 60㎡ and priced under 400 million KRW?amount to 6,952 cases, or 16.7%. The Ministry of the Interior and Safety explained that the 400 million KRW threshold was set by referencing the median housing price of 433 million KRW in the metropolitan area.

Although this appears to be a considerable proportion on the surface, young people’s dissatisfaction stems from the fact that most of the eligible homes are old, isolated apartments where price appreciation is unlikely. Even newly built apartments tend to be closer to 'urban-type residential housing' or officetels rather than typical apartments. In fact, sellers often promote these homes as one-room units, villas, or officetels.

In terms of area, homes under 43㎡, which is the minimum residential area for a four-person household, account for 3,069 cases or 44.1%. Most of these homes are unsuitable for families with children to live in long-term. This is why it is difficult to avoid criticism that the policy is more about appearances than meeting the actual needs of the demand segment.

Acquisition Tax Reduction Eligible Apartments Rapidly Disappearing Amid Soaring House Prices

Just a few months ago, properties priced under 400 million KRW could be found in large complexes on the outskirts of Seoul, but these are rapidly disappearing due to the recent surge in house prices, raising doubts about the policy’s effectiveness.

At Hanjin Apartment 59㎡ in Gaebong-dong, Guro-gu, there were 16 transactions under 400 million KRW this year. However, since May, transactions at this price level have disappeared. All 11 transactions after May 16, when a unit changed hands at 395 million KRW, were above 400 million KRW. On the 22nd of last month, prices soared to 437 million KRW.

The situation is similar at Sangye Jugong Complex 16, 59㎡ in Nowon-gu, where 47 transactions under 400 million KRW occurred this year. Since the June 17 measures last month, only one transaction was below 400 million KRW. The last recorded transaction price in this complex was 435 million KRW on the 27th of last month.

Moreover, apartments priced under 150 million KRW, which qualify for a full acquisition tax exemption, account for only 1.52% (631 cases) of transactions in Seoul. Looking at the area, only three transactions under 150 million KRW occurred in units 59㎡ or larger, which are popular among newlyweds.

The actual acquisition tax reduction amount is also minimal. Currently, homes under 600 million KRW and 85㎡ or less have an acquisition tax rate of only 1%, so even purchasing a 400 million KRW home results in a tax reduction of only about 2 million KRW.

Additionally, since income requirements still exist, the number of people who can actually benefit from the reduction is expected to be even more limited. Through this measure, the government plans to change the current income criteria from 50 million KRW for single-income households and 70 million KRW for dual-income households to a combined 70 million KRW for couples without separate distinctions.

However, critics point out that this is not much different from the previously criticized special supply income criteria. When divided by monthly income, 5.83 million KRW is similar to the average monthly income of 5.55 million KRW for a three-person urban worker household. The 100% standard has been criticized as too narrow, and the government has decided to apply a 130% standard for first-time special supply in private housing through this measure. Therefore, the number of additional beneficiaries is inevitably limited.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.