Accelerating Eco-Friendly Financial Support Since 2017

Plan to Invest 20 Trillion KRW in Green Industries Over the Next Decade

Group Companies' Greenhouse Gas Reduction Achievements Also Highlighted

[Asia Economy Reporter Kim Hyo-jin] "We will build a world-class Shinhan based on eco-friendliness, coexistence, and trust."

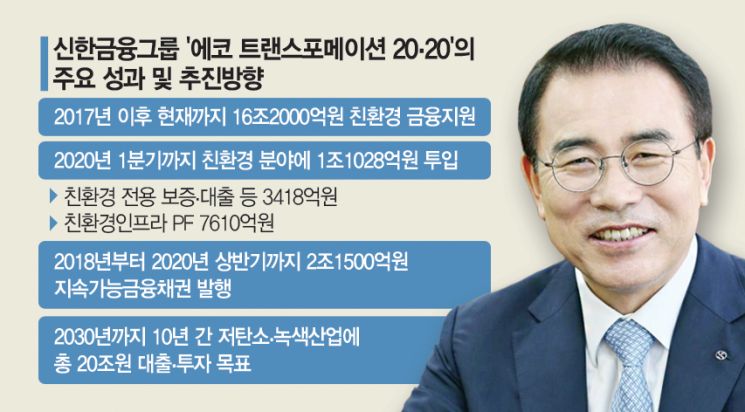

Shin Yong-byeong, Chairman of Shinhan Financial Group (photo), is shining with his 'eco-management.' Chairman Cho, who announced plans to invest and provide financial support worth 20 trillion KRW in the green industry by 2030, is receiving evaluations that his eco-friendly policies are showing external results.

According to the financial sector on the 14th, Shinhan Financial has implemented a total of 16.2 trillion KRW in eco-friendly financial support since 2017. Shinhan Financial's plan is to invest about 20 trillion KRW over 10 years until 2030 in the low-carbon green industry sector through loans and investments.

This achievement started from the management vision 'Eco Transformation 20·20,' declared in 2018, Chairman Cho's second year in office, which included three principles: ▲leading the low-carbon financial market ▲spreading eco-friendly management ▲strengthening environmental leadership and partnerships. Accordingly, Shinhan Financial has accelerated financial support for industries and companies related to new renewable high-efficiency energy.

This year, until the first quarter, about 1.1 trillion KRW was invested in the eco-friendly sector, including 341.8 billion KRW through eco-friendly exclusive guarantees and loans, and 761 billion KRW through eco-friendly infrastructure project financing (PF).

Socially responsible investment (ESG) funds, green bonds, and the green building project to establish eco-friendly buildings have also attracted attention in the financial sector. The holding company, Shinhan Bank, and Shinhan Card were the first among domestic financial companies to issue green and ESG bonds. The cumulative issuance amount has reached 2.09 trillion KRW to date.

In the case of Shinhan Bank, it is building a 'paperless' work environment by promoting robot-based process automation (RPA) combined with artificial intelligence (AI) technology for the first time among domestic banks. In addition, 12 sensitive industries that may cause environmental problems, such as mining, weapons and military supplies, oil refining, and coal processing, have been designated, and monitoring of loans to these companies has been strengthened.

Companies engaged in activities that violate environmental regulations are designated as 'conditional financial support targets' and managed accordingly.

Shinhan Financial is also significantly reducing greenhouse gas emissions by strengthening eco-friendly facilities in the group's workspaces. According to Shinhan Financial, the greenhouse gas emissions last year decreased by 19% compared to 2012, measured by multiplying the usage of electricity, gas, gasoline, etc., in group company buildings by the carbon dioxide conversion factor.

Meanwhile, Shinhan Financial executed about 17.2 trillion KRW in investments and loans to innovative companies last year. Based on the 'Triple K' project launched at the end of last year for systematic support of innovative growth companies and platforms, Shinhan Financial plans to take the lead in building an innovative company growth ecosystem.

Furthermore, Shinhan Financial plans to expand the 'Hope Society Project' for social minorities and vulnerable groups, including ▲support for low-credit recovery ▲community-tailored job projects for coexistence. Shinhan Financial invested a total of 37.8 billion KRW in this area last year. Through this, about 284,000 people received assistance, according to Shinhan Financial's tally.

Chairman Cho said in the '2019 Shinhan Financial Group Social Responsibility Report' published yesterday, which contains these activities, "We will go down a path no one has taken before," and "We will fulfill the role of finance supporting positive changes for customers and society."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.