[Asia Economy Reporter Oh Ju-yeon] Domestic bond industry workers predicted that the Bank of Korea will keep the base interest rate unchanged in July.

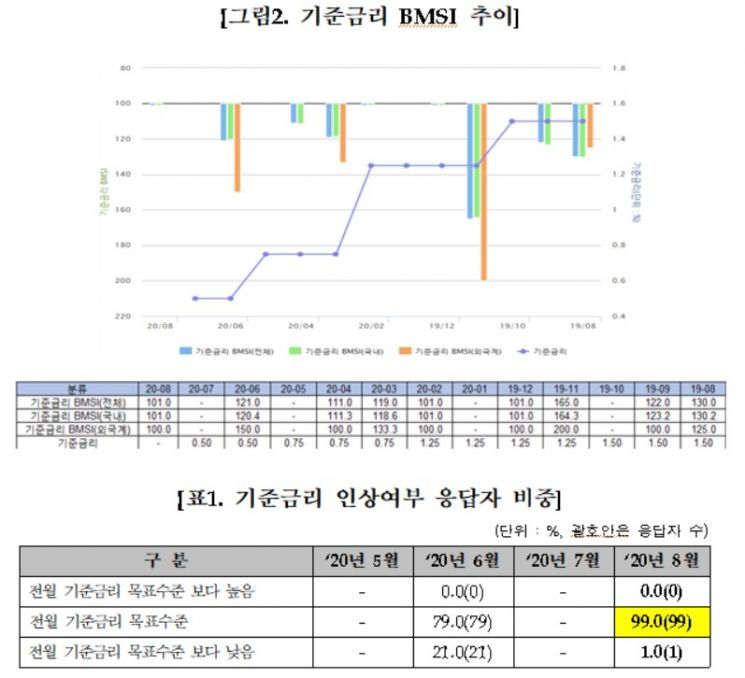

On the 14th, the Korea Financial Investment Association announced that it calculated the 'August 2020 Bond Market Sentiment Index (BMSI)' based on a survey of 200 bond-related workers conducted from the 2nd to the 8th, and the composite index was recorded at 98.3, down 6.1 points from the previous month.

The BMSI is calculated based on the responses of survey participants, where a value above 100 indicates market improvement, 100 indicates stability, and below 100 indicates deterioration. Amid global concerns over the resurgence of COVID-19, the accommodative monetary policy stance of major countries is expected to continue, resulting in a slight deterioration in bond market sentiment in August.

The base interest rate index was surveyed at 101.0, down 20.0 points from the previous month, indicating a deterioration compared to the prior month.

Additionally, 99.0% of respondents predicted that the Bank of Korea will keep the base interest rate unchanged in July, while only 1.0% expected a rate cut. Although the prolonged COVID-19 situation is expected to continue slowing domestic and international economies, the scope for further rate cuts appears limited, leading to the expectation that the base interest rate will remain unchanged in July.

The interest rate outlook index fell 11.0 points from the previous month to 100.0, indicating a slight deterioration in bond market sentiment related to market interest rates compared to the previous month.

This is because the increase in deficit bond issuance is expected to act as a supply burden on the bond market.

The inflation BMSI dropped from 109.0 in the previous month to 73.0, showing a deterioration in bond market sentiment related to inflation compared to the previous month. The proportion of respondents expecting inflation to rise increased by 13.0 percentage points from 21.0% to 34.0%.

The exchange rate BMSI was recorded at 88.0, showing a slight improvement in bond market sentiment related to exchange rates compared to 80.0 in the previous month. Although concerns over the resurgence of COVID-19 persist, the recent sharp rise in global stock markets and the preference for risk assets have acted as downward pressure factors on the exchange rate, leading to a decrease in the proportion of respondents expecting exchange rate increases in August. 21.0% of respondents expected exchange rate increases, while 70.0% expected exchange rate stability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.