National Assembly Budget Office 'Recent Trends and Implications of Private Credit Growth in Korea'

Steep Increase in Private Credit Growth Rate Relative to GDP

[Asia Economy Reporter Eunbyeol Kim] Amid the surge in household and corporate debt due to the COVID-19 pandemic, concerns have been raised not only about the absolute scale but also about the rapid pace at which debt is increasing.

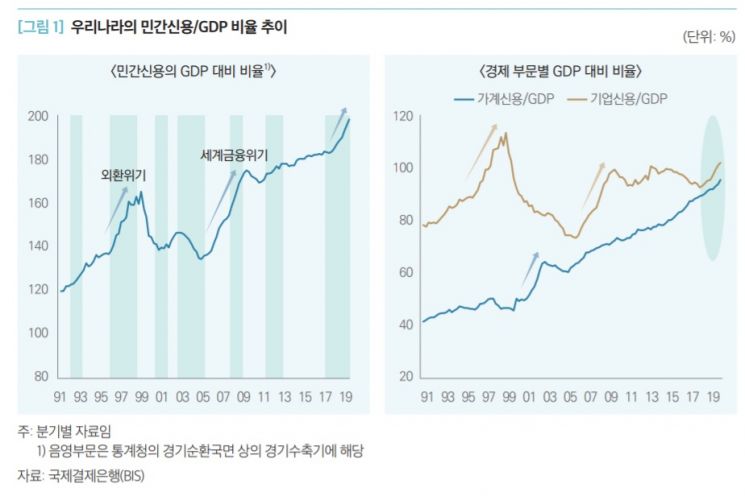

According to the National Assembly Budget Office's report titled "Recent Trends and Implications of Private Credit Growth in South Korea" released on the 14th, the ratio of private credit to nominal Gross Domestic Product (GDP) is expected to reach approximately 208% this year, marking an increase of more than 10 percentage points compared to last year. Private credit refers to liabilities such as household and corporate loans, bonds, and government loans.

The Budget Office estimated this year's private credit-to-GDP ratio by applying the average growth rate of private credit relative to GDP over the past two years (6.1%) and the projected nominal GDP growth rate of 0.8%. Hwang Jong-ryul, an analyst at the Macroeconomic Analysis Division of the Budget Office's Economic Analysis Bureau, stated, "With the continuation of low interest rates under an accommodative monetary policy in response to the COVID-19 shock, if economic growth slows, the private credit-to-GDP ratio is expected to rise even more steeply."

Earlier, according to the Bank of Korea's "Financial Stability Report" released last month, the private credit-to-nominal GDP ratio as of the end of the first quarter of this year was 201.1%, already surpassing 200%, which is a 12.3 percentage point increase compared to the same period last year. The debt growth rate accelerated to 7.6% from 6.0% in the first quarter of last year, while GDP growth slowed from 2.7% to 1.0%.

Recently, South Korea's private credit-to-GDP ratio has shown the steepest increase since the periods surrounding the 1998 Asian Financial Crisis and the 2008 Global Financial Crisis. According to the Bank for International Settlements (BIS) and others, South Korea's private credit-to-GDP ratio showed a gradual increase after the financial crisis but surged by 15.5 percentage points over eight quarters from the fourth quarter of 2018 to the end of last year. The ratio at the end of last year was 197.6%, a 10 percentage point increase from the previous year (187.6%).

In terms of the magnitude of increase, South Korea ranks second among comparable countries, following Chile (11.1 percentage points). The ratio itself is 41.5 percentage points and 29.0 percentage points higher than the averages of 43 major countries (156.1%) and advanced countries (168.6%), respectively.

As the private credit-to-GDP ratio surges, the credit gap, an indicator used to measure credit risk, is also rising rapidly. The credit gap shows how much the ratio of private credit to GDP deviates from its long-term trend and is used as an indicator of countercyclical capital buffers. A larger credit gap means that if an economic shock worsens conditions, the ability to raise funds in response may decline, increasing the risk of a credit crisis. If the credit gap is below 2 percentage points, it is classified as 'normal'; between 2 and 10 percentage points as 'caution'; and above 10 percentage points as 'warning.'

As of the end of last year, South Korea's credit gap was 7.0 percentage points, entering the 'caution' stage. During the Asian Financial Crisis and the 2009 Global Financial Crisis, it exceeded 10 percentage points, and the recent level is the highest since the second quarter of 2010 (6.8 percentage points) following the financial crisis.

The recent high ratio of private credit to GDP is mainly due to the decline in South Korea's nominal GDP growth rate. Analyst Hwang noted, "Even if the recent increase is mainly due to the decline in nominal GDP growth, it is important to pay attention to the fact that a decline in nominal GDP growth is likely to lead to reduced household income and corporate profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.