As the reduction in inspection frequency is inevitable, strict pinpoint inspections for high-risk products are enforced

[Asia Economy Reporter Jo Gang-wook] The Financial Supervisory Service's (FSS) comprehensive inspections of all financial companies are set to begin as early as the second week of next month. Due to the impact of the novel coronavirus disease (COVID-19), no comprehensive inspections have been conducted so far this year, making it inevitable to reduce the number of inspections originally planned for the year. However, following last year's large-scale principal loss caused by the overseas interest rate-linked derivative-linked fund (DLF) incident, and the successive failures such as Lime, Discovery, and Optimus incidents, the financial sector is on high alert as more meticulous and stringent "pinpoint" inspections of high-risk financial products are expected.

According to financial authorities and the financial sector on the 13th, the FSS plans to request data from financial companies subject to comprehensive inspections and start the inspections in earnest next month.

A senior official from the FSS said, "Usually, we notify financial companies one month in advance before conducting comprehensive inspections and request data," adding, "We plan to conduct comprehensive inspections of financial companies after the summer vacation."

The FSS's summer vacation break is from the 27th of this month to the 7th of next month. Therefore, it is highly likely that comprehensive inspections will start from the second week of August at the earliest.

Typically, the FSS's sector-specific inspection departments conduct comprehensive inspections in the first half of the year during April and May, then take a break during the vacation period in July and August. Afterwards, they conduct comprehensive inspections in the second half of the year, inspecting 2 to 3 financial companies annually. However, this year is different. Although the first half of the year has passed, COVID-19 continues to spread sporadically, making it impossible to predict when the infectious disease disaster alert level will be lowered. Due to the full-scale COVID-19 outbreak starting in March, no comprehensive inspections have been conducted this year.

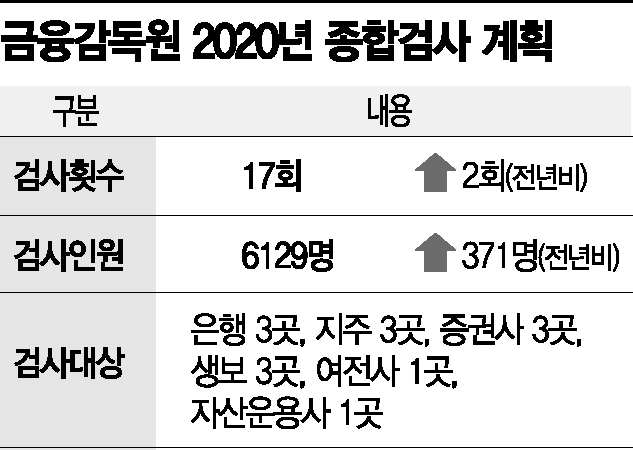

Accordingly, it seems difficult for the FSS to carry out the inspections as originally planned this year. Initially, the FSS planned to conduct comprehensive inspections on 17 financial companies, including 3 banks, 3 financial holding companies, 3 securities firms, 3 life insurance companies, 3 non-life insurance companies, 1 credit finance company, and 1 asset management company, deploying a total of 6,129 personnel. However, the number of targets in sectors where 3 inspections were planned is expected to decrease to 1 or 2. Comprehensive inspections require the mobilization of most personnel from the inspection departments, and the inspections last about a month, with considerable time needed for follow-up work.

The FSS plans to pay special attention to quarantine measures considering that the COVID-19 situation has not ended. For face-to-face investigations of financial company employees, they will bring partitions to the site and are also considering non-face-to-face investigation methods such as video interviews.

Among life insurance companies, Kyobo Life Insurance is reportedly the first to be selected as a comprehensive inspection target. The FSS recently requested Kyobo Life Insurance to submit preliminary data for the comprehensive inspection. After reviewing the submitted data, the FSS plans to conduct an on-site inspection in September. Comprehensive inspections typically proceed with a two-week preliminary inspection followed by a four-week main inspection. Previously, the FSS conducted comprehensive inspections on Hanwha Life Insurance and Samsung Life Insurance in the first and second halves of last year, respectively. Among the big three life insurance companies, only Kyobo Life Insurance had not undergone a comprehensive inspection. Hyundai Marine & Fire Insurance and Samsung Fire & Marine Insurance were also on the list of comprehensive inspection targets this year.

The FSS is expected to focus on governance and financial soundness during the Kyobo Life Insurance comprehensive inspection. Attention is on the impact on consumers of the lawsuit between Kyobo Life Insurance Chairman Shin Chang-jae and financial investors (FIs). Chairman Shin and the Affinity Consortium, among other FIs, are engaged in arbitration litigation related to the exercise of a put option (the right to sell shares at a specific price).

Among financial holding companies and banks, Woori Financial Group and Woori Bank, as well as Hana Financial Group and Hana Bank, are likely inspection targets. Among the five major financial holding companies and banks, NH Nonghyup Financial Group and NH Nonghyup Bank underwent comprehensive inspections in the second half of 2018; KB Financial Group and KB Kookmin Bank in the first half of last year; and Shinhan Financial Group and Shinhan Bank in the second half of last year.

Notably, Woori Bank and Hana Bank received six-month partial business suspension sanctions and fines from financial authorities in March this year due to the "DLF incident." The fines imposed on the two banks amounted to 16.78 billion KRW and 19.71 billion KRW, respectively. Additionally, Son Tae-seung, chairman of Woori Financial Group, and Vice Chairman Ham Young-joo, who were heads of the two banks during the DLF incident, received heavy disciplinary actions (written warnings). They filed for suspension of the enforcement of the FSS's disciplinary warnings, and the court accepted their request. Consequently, concerns have arisen about retaliatory inspections based on a "grudge" charge.

In May, Woori Bank and Hana Bank also submitted appeals against the fines imposed by financial authorities. This was 58 days after receiving notifications of fines of 19.7 billion KRW and 16.8 billion KRW from the Financial Services Commission on March 25.

Fines imposed by the Financial Services Commission can typically be reduced by 20% if paid within two weeks, but the two banks did not pay. After filing appeals, the enforcement of the fine imposition is suspended. Subsequently, trials will proceed according to the Non-Contentious Case Procedure Act.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.