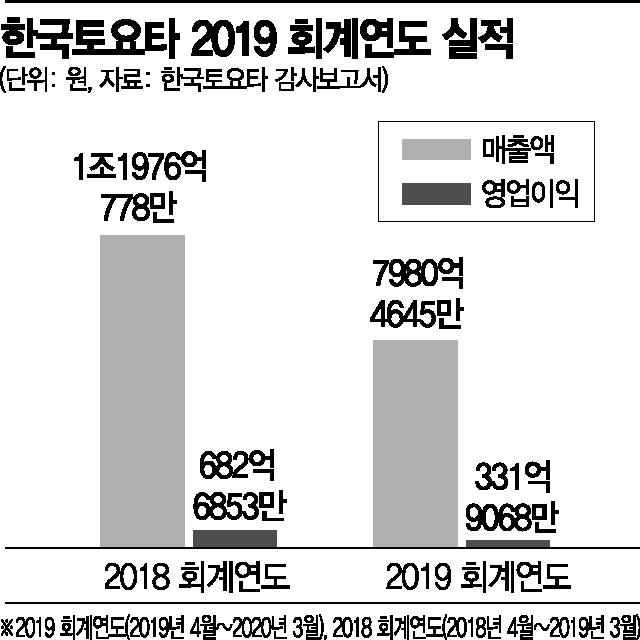

Toyota Korea's Operating Profit Plummets from 68.3 Billion KRW to 33.2 Billion KRW

[Asia Economy Reporter Kim Ji-hee] One year after the boycott of Japanese products began in earnest, the position of Japanese cars in the domestic imported car market is becoming precarious. Following Honda Korea's announcement of operating profits shrinking to one-tenth compared to the previous year, Toyota, which had the highest sales among Japanese car brands, also saw its operating profit drop by more than half.

According to the audit report of Korea Toyota Motor on the 13th, the operating profit for the last fiscal year (April 2019 to March 2020) was 33.19 billion KRW, a 51.4% decrease from 68.27 billion KRW the previous year. During this period, sales fell from 1.1976 trillion KRW to 798 billion KRW, a reduction of one-third. As a result, Korea Toyota Motor's annual sales, which first surpassed 1 trillion KRW in 2017, fell below 1 trillion KRW again after two years.

The sluggish performance of Korea Toyota Motor is attributed to the boycott of Japanese products that intensified from July last year. Sales of Japanese cars sharply declined in the second half of last year, recording only 36,661 units, nearly 10,000 units less than in 2018. During this period, market share also dropped from 17.4% to 15%. Unlike last year, when strong sales in the first half helped defend performance, the situation is more severe this year. Until June this year, domestic sales of Japanese brands barely reached 10,000 units, holding a market share of 7.8%.

Toyota's situation is relatively better. Honda and Nissan, considered the other two major Japanese car brands alongside Toyota, are facing even greater crises. According to Honda Korea's audit report released last month, operating profit for the same fiscal year last year was 1.98 billion KRW, only one-tenth of the previous year. In the first half of this year, Toyota (including Lexus) sales decreased by 56.4%, while Honda's sales plummeted by 74.4%. Nissan has decided to withdraw from the Korean market after 16 years.

From the second half of this year, there are expectations of a recovery supported by last year's base effect and aggressive marketing campaigns by Japanese car brands. An official from the imported car industry said, "Japanese car brands like Toyota, which were passive in promotions until last year, have started offering various benefits such as acquisition tax support," adding, "However, it will take a long time to rebuild brand image and fully recover to the pre-boycott levels."

The slump of Japanese car brands is also causing various changes in the imported car market. As the reduced demand for Japanese cars shifts to German brands, the market share of European car brands in the first half of this year recorded 78.8%, an increase of 9.7 percentage points compared to the previous year. On the other hand, despite the strong performance of imported cars, sales of imported hybrids, which Japanese cars had dominated, decreased by 11.5% compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.