Government to Amend Comprehensive Real Estate Tax and Capital Gains Tax Laws Separately from July 10 Measures

Increase Comprehensive Real Estate Tax Rates by Housing Price Including Single-Homeowners and Add Residence Period to Long-Term Holding Special Deduction for Capital Gains Tax

Market Responds, "The Government Raised Prices, So Why Blame Us?"

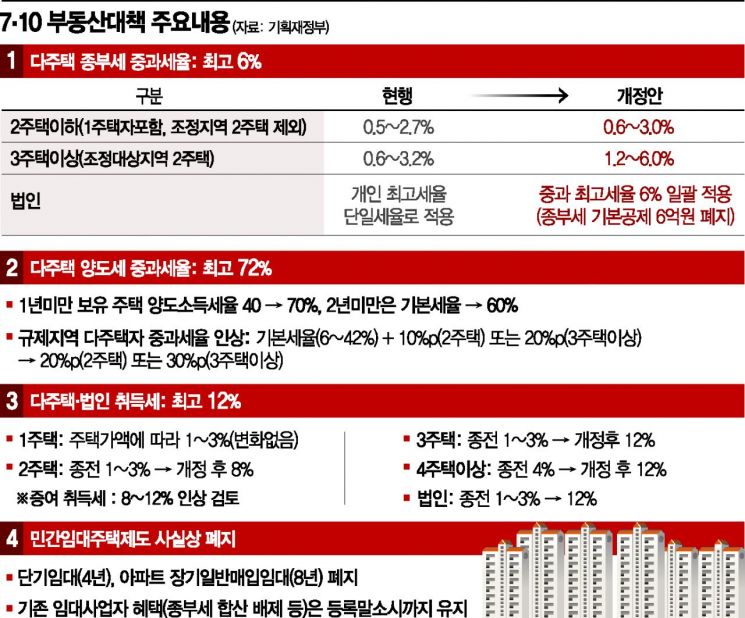

[Sejong=Asia Economy Reporters Kim Hyunjung, Kim Yuri] Following the significant increase in tax burdens on multi-homeowners through the recent 'July 10 Real Estate Measures,' the government plans to further strengthen the property tax rates for single-homeowners and transaction tax rates for long-term holders. The government, which initially aimed to protect genuine buyers and precisely target speculative gap investors with so-called 'pinpoint regulations,' appears to have completely shifted its stance to a 'hammer tax increase' approach.

According to the Ministry of Economy and Finance on the 13th, the government will push forward an amendment to the Comprehensive Real Estate Tax Act starting next year to raise the comprehensive real estate tax rates for single-homeowners from the current 0.5%?2.7% to 0.6%?3.0%. This was originally announced in the December 16 measures last year but was discarded after failing to pass the 20th National Assembly. Based on the taxable value brackets, the comprehensive real estate tax rate for properties valued at 300 million KRW or less (17 billion KRW or less for single-homeowners) will increase from 0.5% to 0.6%, and for properties exceeding 9.4 billion KRW (16.2 billion KRW for single-homeowners), the rate will rise from 2.7% to 3.0%, with higher rates applied to each bracket. The Ministry estimates that the tax revenue effect from this amendment, combined with the increases included in the December 16 and June 17 measures, will be approximately 1.65 trillion KRW.

An amendment to the Capital Gains Tax Act will also be pursued to add a residency period requirement to the special deduction for long-term holders who own one home. Currently, single-homeowners receive up to an 80% special deduction based on the holding period regardless of residency duration, but the amendment will calculate the deduction rate by dividing it equally between holding and residency periods at 40% each. According to this, even if one held the property for over 10 years without residing there in the past, they could receive an 80% deduction on capital gains tax, but going forward, only a 40% deduction will be allowed.

The market, including single-homeowners targeted by the tax increase, is in a state of confusion. After the government’s announcement, real estate agencies in the Gangnam area of Seoul were flooded with consultations from homeowners worried about tax burdens rather than transactions over the weekend. A representative from a real estate agency in Apgujeong-dong said, "Mainly multi-homeowners holding properties worth 4 to 5 billion KRW sought consultations," adding, "However, due to the increased capital gains tax, they are reluctant to sell, so no listings have been put up, and they seem deeply troubled." On online real estate forums, there are criticisms that the government is blaming high-priced homeowners and multi-homeowners for rising real estate prices caused by policy failures. Regarding the sudden reversal of government measures such as the abolition of the rental business system, complaints have emerged saying, "Those who were going to benefit already have, and those who were going to profit already have," and "Real estate investment has now become a first-come, first-served game mainly for wealthy investors with the capacity to respond." In this context, Ham Youngjin, head of the Big Data Lab at Zigbang, said, "With the exit blocked by the increased capital gains tax on multi-homeowners in regulated areas, raising the comprehensive real estate tax rate further raises concerns about tax resistance due to punitive taxation."

The opposition parties criticized that such a 'hammer tax increase' would unlikely succeed in stabilizing the real estate market. Kim Jongin, emergency committee chairman of the United Future Party, said at the emergency committee meeting held at the National Assembly that day, "I am very skeptical about the possibility of success of measures that do not address the fundamental causes of real estate price increases but only tighten tax policies based on the results," adding, "Taxpayers will adapt to the taxes, and tenants’ burdens will inevitably increase." Chairman Kim added, "Due to the novel coronavirus disease (COVID-19), unprecedented monetary expansion has occurred, the value of currency has fallen, and real asset values have risen," and "Therefore, it is common sense that people want to secure housing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)