Bank of Korea 'Survey Results on Lending Practices of Financial Institutions'

[Asia Economy Reporter Kim Eunbyeol] As the impact of the novel coronavirus infection (COVID-19) continues for a long time and uncertainty grows, the lending standards of financial institutions are expected to become stricter in the third quarter.

According to the "Financial Institution Lending Behavior Survey Results" announced by the Bank of Korea on the 13th, the lending attitude of domestic banks in the third quarter of this year is expected to somewhat tighten, mainly for corporate and household housing-related loans.

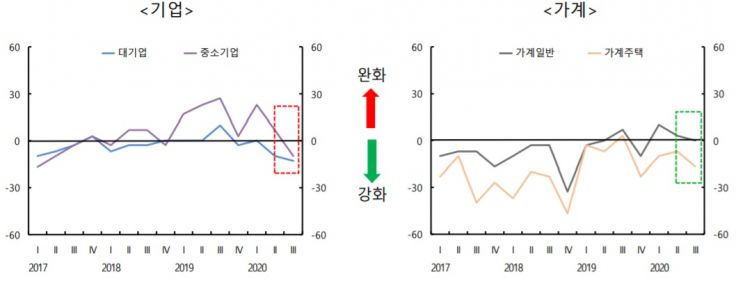

The comprehensive lending attitude index of domestic banks for the third quarter turned negative at -11, down from 1 in the second quarter. The lending attitude toward large corporations in the third quarter was -13, showing a further tightening compared to -10 in the second quarter, and the lending behavior index for small and medium-sized enterprises (SMEs) also dropped from 7 to -10, indicating that loan screening and other measures are expected to be strengthened.

Lee Jonghan, head of the Bank Analysis Team at the Financial System Analysis Department of the Financial Stability Bureau, explained, "Banks are expected to tighten their lending attitudes toward companies as they manage credit soundness and the debt repayment ability of vulnerable industries deteriorates." This means that banks may strengthen conditions for loan extensions, re-issuance, collateral, and guarantees as part of risk management in response to the prolonged COVID-19 situation.

The lending behavior index for household housing loans also widened its negative margin from -7 to -17. Lee predicted, "Due to increasing domestic and international economic uncertainties and the government's housing market stabilization measures, lending attitudes are expected to tighten, especially for housing-related loans."

The lending attitude index ranges between 100 and -100. A positive (+) index means more institutions intend to ease loan screening, while a negative (-) index means more institutions plan to tighten it.

Domestic banks expect credit risks for companies, especially in vulnerable industries, to increase in the third quarter. The comprehensive credit risk index of domestic banks is forecasted to rise from 42 in the second quarter to 45 in the third quarter. In particular, SMEs are expected to show a high level of caution regarding credit risk as their debt repayment ability declines due to sluggish real economic conditions. Households are also expected to face higher credit risks, especially among low-credit and low-income vulnerable borrowers.

Loan demand is expected to increase across large corporations, SMEs, and general household loans, making it more difficult to borrow additional funds despite the impact of COVID-19 starting from the third quarter.

The lending attitude of non-bank institutions is also expected to tighten in most sectors except for credit card companies. The negative margin of the lending attitude index widened for mutual savings banks (-20→-21) and mutual financial cooperatives (-17→-18). Credit card companies, whose loan performance in the second quarter fell short of expectations, are expected to ease lending attitudes in the third quarter to strengthen loan operations.

Credit risk is expected to increase across all sectors, and loan demand is forecasted to rise in most sectors, especially centered on mutual savings banks. As economic uncertainty continues, demand to secure liquidity is expected to increase significantly not only in banks but also in savings banks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.