[Asia Economy, reporters Koh Hyungkwang and Lee Minji] The KOSDAQ index has surpassed the 770 mark for the first time in about one year and nine months, showing a steep upward trend. Not only has it recovered from the losses caused by the COVID-19 outbreak, but it is also setting new annual highs day after day. Market capitalization has surged by more than 80% from its yearly low, significantly outpacing the KOSPI’s market cap growth rate of 48%. Analysts attribute this relative strength to abundant liquidity in the market flowing into KOSDAQ-listed bio and non-face-to-face (untact) related stocks.

According to the Korea Exchange on July 13, as of 11:00 a.m. that day, the KOSDAQ index stood at 776.83, up 0.5% from the previous trading day. This marks another record high, following new highs set on July 8 and 9. Compared to its plunge to 428.35 at the close on March 19 due to the impact of COVID-19, the index has rebounded by more than 80% in less than four months. On July 9, the KOSDAQ index (772.90) broke through the 770 level for the first time in about one year and nine months since October 5, 2018 (773.70).

As the index rebounded sharply, KOSDAQ’s market capitalization also increased significantly. As of the close on July 10, the total market capitalization of KOSDAQ was 286.4435 trillion won. Compared to the market cap at its yearly low on March 19 (157.0265 trillion won), this represents an increase of 82.4% (129.417 trillion won). During the same period, the KOSPI’s market cap rose from 982 trillion won to 1,455 trillion won, an increase of only 48.2%.

Investor funds are also flowing into KOSDAQ. On July 10 alone, KOSDAQ’s daily trading volume reached 12.8573 trillion won, surpassing KOSPI’s 12.084 trillion won. Since the beginning of the year, there have been frequent days when KOSDAQ’s trading volume has matched or exceeded that of KOSPI. Considering that the KOSPI market is more than five times larger than KOSDAQ in terms of market capitalization, this indicates that investors’ money is being concentrated in KOSDAQ.

The relative strength of KOSDAQ is attributed to two main factors: first, abundant liquidity with nowhere to go due to ultra-low interest rates has flowed into the market; and second, the market is concentrated in sectors that have benefited from COVID-19, such as pharmaceuticals, bio, gaming, media, and IT. As investment funds have poured into these sectors, the KOSDAQ index has rebounded rapidly. Since the beginning of the year, the pharmaceutical sector in KOSDAQ has risen by 42.1%, while software (26.6%) and IT software & services (25.3%) have also posted high growth rates. Seo Junghoon, a researcher at Samsung Securities, explained, “As liquidity supply continues in various countries, the relative performance of growth stocks at home and abroad is improving. In the U.S. as well, NASDAQ stocks are outperforming the Dow Jones for similar reasons.”

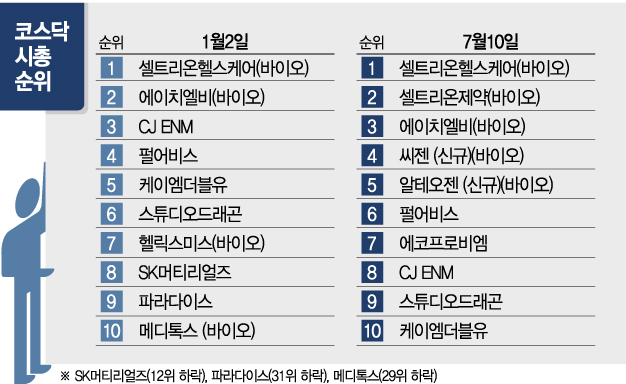

There is also fierce competition for market cap rankings within KOSDAQ. As bio stocks have surged due to the impact of COVID-19, there has been a major reshuffling among the top market cap stocks. As of July 10, the top KOSDAQ stocks by market capitalization were Celltrion Healthcare, Celltrion Pharm, Seegene, HLB, Alteogen, Pearl Abyss, Ecopro BM, CJ ENM, Studio Dragon, and KMW. Except for Celltrion, which has long held the number one spot, most positions have changed, and all of the top five are now bio stocks.

At the beginning of the year, the top ten were Celltrion Healthcare, HLB, CJ ENM, Pearl Abyss, KMW, Studio Dragon, Helixmith, SK Materials, Paradise, and Medytox. Six out of these ten were non-bio stocks, and even among the top ranks, non-bio stocks such as CJ ENM, Pearl Abyss, and KMW made the list.

With bio stocks emerging as the leading stocks in the KOSDAQ market, the current situation is reminiscent of the bio investment frenzy of 2017-2018. At that time (as of January 2, 2018), the top market cap rankings were Celltrion, Celltrion Healthcare, SillaJen, CJ ENM, TissueGene, Pearl Abyss, Medytox, Loen, ViroMed, and POSCO Chemtech. Except for Celltrion and POSCO Chemtech, which moved to the KOSPI market, and Loen, which merged with Kakao, all were bio stocks. Fueled by the bio boom, the KOSDAQ index surpassed the 900 mark in the first half of 2018.

According to the securities industry, the recent rise in bio stocks is largely due to increased interest from individual investors in pharmaceutical and bio-related stocks following COVID-19. Sun Minjeong, a researcher at Hana Financial Investment, analyzed, “This phenomenon is a result of individual investors’ preference for pharmaceutical and bio stocks, as well as the temporary ban on short selling. Since 2015, attention has been focused on the performance of various pipelines, and interest is now concentrated on companies whose earnings have surged due to the impact of COVID-19.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.