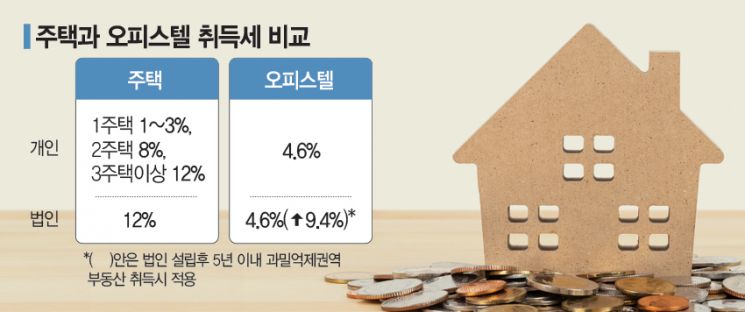

Acquisition Tax of 8%·12% Applies

When Purchasing Second Homes or Corporate Housing

Officetels Remain at 4.6%

High Rental Yield Also Draws Attention

[Asia Economy Reporter Donghyun Choi] #Kim Jeongwon (68, pseudonym), who is running a rental business after retirement, is recently considering investing in officetels instead of apartments. Previously, the acquisition tax for officetels was higher, but due to the government's July 10 real estate measures, the tax rates have reversed. When purchasing a 400 million KRW apartment, the increased acquisition tax rate requires paying 48 million KRW in acquisition tax, whereas an officetel of the same price only requires 18.4 million KRW, about one-third of the apartment's tax. Considering holding taxes and rental yields, the rental return rate may also be higher than that of apartments, which is another reason for the shift in investment strategy.

The July 10 measures, which focus on strengthening the tax burden on multi-homeowners, are showing signs of a balloon effect on income-generating real estate such as officetels and commercial properties. In particular, as the acquisition tax on housing has surged from the previous 1-3% to up to 12%, multi-homeowners feeling a heavy burden are expected to see officetels as an investment alternative.

According to the industry on the 13th, under the July 10 measures announced by the government last week, two-homeowners will have to pay 8% acquisition tax when purchasing a home, and those with three or more homes and corporations will pay 12%. Previously, owners of 1-3 homes paid 1-3% acquisition tax depending on the housing price, and those with four or more homes paid 4%. Officetels, representative income-generating real estate products, are classified as non-residential properties and thus are not subject to these regulations, so the acquisition tax remains at 4.6%, unchanged from before. Although there was a perception that officetel acquisition tax was expensive, this situation has reversed due to the July 10 measures, and demand is expected to increase, according to industry forecasts.

In fact, officetel prices have been rising this year, and transaction volumes are also increasing. The implementation of the December 16 and June 17 measures, which focus on loan regulations, has caused market liquidity to flow into officetels, which are outside the scope of these regulations. According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, the number of officetel sales transactions in the first half of this year was 18,409, a 27.7% increase from 14,417 during the same period last year. The increase in transaction volume was prominent in Seoul, Gyeonggi Province, and metropolitan cities. In the first half of this year, officetel transactions in Gyeonggi Province surged by 51.5% to 4,711 from 3,110 in the previous year. During the same period, Seoul's officetel transaction volume also rose by 42.4%. Officetel transactions also increased in Daegu (15.4%), Ulsan (13.8%), and Daejeon (3.8%). Last month, the Seoul officetel sales price index rose by 0.03% compared to the previous month. This index had a decreasing rate of increase from January to April, turned negative in May, and then rose again. Some large officetels in Seoul have been setting new record prices consecutively.

The industry views officetels as a major investment destination for rental income purposes going forward. Although capital gains are lower than apartments, rental yields are higher, so if apartment prices enter a full-fledged downward phase, officetels will become more attractive. An industry insider said, "Officetels still have a loan-to-value (LTV) ratio of 70%, allowing for high leverage effects," adding, "Apartment rental yields are usually around 3%, but various tax burdens may lower this further, so investments in officetels or commercial properties will attract attention in the future." Ham Youngjin, head of the Zigbang Big Data Lab, also said, "The recent surge in officetel transactions is because they are subject to relatively fewer regulations than apartments and have lower entry barriers."

However, there are also warnings that regional polarization is intensifying depending on the location conditions of officetels, so caution is needed when investing. Cho Hyuntaek, a researcher at the Commercial Property Information Research Institute, emphasized, "Demand for branded officetels is increasing in the officetel market, and locations such as areas near subway stations and business districts have become key factors determining officetel value," adding, "Polarization by region and product type will intensify further in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.