Amid Soaring Stocks and Real Estate Due to Low Interest Rates, Rate Freeze Expected

Not Yet Time to Consider Exit Strategy for Monetary Policy

High Possibility of Freeze Until Real Economy Recovers

Additional Cuts Considered if US Announces Further Easing Measures

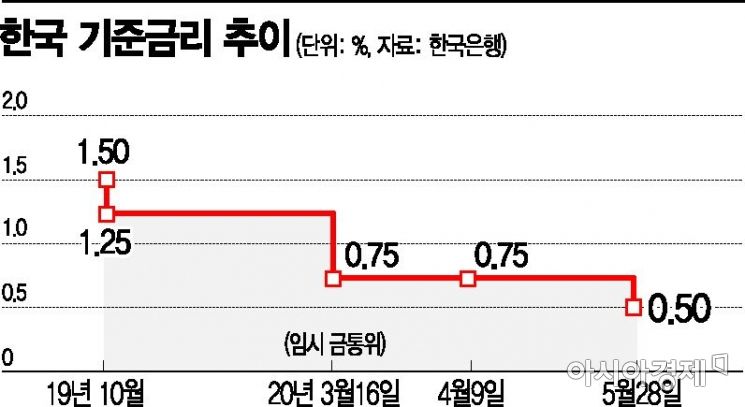

[Asia Economy Reporters Eunbyeol Kim and Sehee Jang] With the Bank of Korea's Monetary Policy Committee meeting to decide the base interest rate just three days away, soaring asset prices are complicating the Bank's calculations. So far, the real economy and employment have not escaped the economic damage caused by the novel coronavirus disease (COVID-19), but asset prices are soaring thanks to low interest rates and abundant liquidity.

Experts believe that the base interest rate is likely to be held steady at the July Monetary Policy Committee meeting. The recent spread of COVID-19 in Korea has not been rapid, and the base interest rate is already at a historic low, making it inappropriate to lower it further at this time. However, as economic recovery from COVID-19 may be slow and there is a possibility of further COVID-19 outbreaks, the Bank of Korea's concerns are expected to grow with each Monetary Policy Committee meeting in the second half of the year.

Low Interest Rates Have Only Raised Stock and Real Estate Prices

According to the Korea Exchange on the 13th, as of 9:56 a.m., the KOSPI index was trading at 2,172.95 points, up 1.06% (22.70 points) from the previous trading day. The KOSPI index had fallen to 1,457.64 (March 19) after the spread of COVID-19 but has almost recovered to pre-COVID-19 levels. The highest point of the KOSPI index this year was 2,267.25 points on January 22.

With untact (contactless) and bio-related stocks rising due to COVID-19, the KOSDAQ index has already surpassed pre-COVID-19 levels and is eyeing the 800 mark. At the same time, the KOSDAQ index was trading at 775.48, up 0.34% (2.67 points).

Real estate prices, a representative asset market in Korea, are also on the rise. According to KB Live On, the apartment sales price index, which was 100.2 on January 20, rose to 103 as of the 6th. This is a 2.8% increase since COVID-19 spread domestically. Jeonse (long-term lease) prices also rose. The Jeonse price index increased 1.31% from 99.4 to 100.7 during the same period.

The factor pointed out as driving the rise in asset prices is 'liquidity.' To stimulate the economy depressed by COVID-19, the government and central bank injected funds into the market, and this rapidly increased money flowed more into investment markets than industrial production and consumption, causing asset prices to rise while wages and prices did not.

According to the Bank of Korea, as of the end of April, the broad money supply (M2) reached 3,018.6 trillion won, surpassing 3,000 trillion won for the first time ever. It increased by 34 trillion won (1.1%) in one month, marking the largest monthly increase on record. M2 includes narrow money (M1) plus savings deposits and represents funds that can be converted into cash at any time. It is commonly used as an indicator of the money supply in the market. M1, which is closer to cash, also entered the 1,000 trillion won range for the first time at 1,012.3 trillion won in the same month.

Some Degree of Liquidity-Driven Market Is Inevitable... "Not the Time to Consider Normalizing Interest Rates"

However, officials from the government and the Bank of Korea say it is not yet time to consider normalizing interest rates (tightening monetary policy). There are still companies and self-employed individuals suffering from poor sales and operating profits, and COVID-19 has not subsided overseas, so export sluggishness is likely to continue. The continued loan demand from people who lost jobs due to COVID-19 is another reason. Since the real economy has not recovered and only asset markets have surged, raising interest rates on this basis is not possible.

A senior official at the Bank of Korea rhetorically asked, "How can we raise interest rates now?" and added, "The recently soaring real estate prices will ultimately have to be controlled through policy." It is difficult to withdraw the liquidity that has been released at this time, and the official pointed out that policies should be used to direct this money to appropriate places.

The government shares a similar view. On the 10th, after announcing the '7.10 Real Estate Measures' at the Government Seoul Office, Deputy Prime Minister and Minister of Strategy and Finance Hong Nam-ki responded to a question about whether it was time to reconsider low interest rates by saying, "It seems to be a concern that excessive liquidity is driving up real estate prices, but the government also believes that fundamental measures should be taken to help market liquidity find more productive investment destinations."

However, experts point out that 'helping market liquidity find productive investment destinations' is not as easy as it sounds. It is difficult to generate new investments amid increased uncertainty, so companies and individuals inevitably pursue profits. Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "The Bank of Korea does not conduct economic policy based on real estate, but since real estate policies have failed and prices in some parts of Seoul have surged, it is indeed difficult to supply additional liquidity." He added, "Although the government has made it difficult for individuals to take out household loans through policy, there is a possibility that funds can flow into real estate through corporations, etc. Since companies with additional funds are not in good condition and have no suitable places to invest, funds may move to real estate in the long term, making it difficult to adjust interest rates."

Foreign IBs and Analysts: "If the US Fed Takes Additional Easing Measures, Further Rate Cuts Possible"

So when might the Bank of Korea, which is likely to hold the base interest rate steady, be able to move? Experts foresee that if the US Federal Reserve (Fed), which currently maintains a zero interest rate, introduces additional accommodative monetary policies, and if COVID-19 spreads again, the Bank of Korea may lower interest rates.

Changseop Oh, a researcher at Hyundai Motor Securities, said, "Because of the effective lower bound, additional easing measures by the US need to be taken preemptively for (the Bank of Korea) to lower the base interest rate further." He added, "It will be difficult for the US to lower rates into negative territory, and even if measures are taken, interest rate changes before the November presidential election will be difficult."

Professor Sung Tae-yoon said, "If the current situation caused by COVID-19 continues, additional rate cuts may come in the second half of the year," adding, "Lowering interest rates could help ease the burden of increased costs on companies through labor policies."

Im Seon Lee, a researcher at Hana Bank's Financial Investment Research Institute, said, "If a second wave of COVID-19 similar to the first large-scale outbreak occurs, talks of additional rate cuts may arise," and predicted, "How COVID-19 spreads in the US and what easing measures the Fed takes will also be variables."

Foreign investment banks such as Citi and JP Morgan expect the Bank of Korea to possibly cut rates further in the third quarter. However, if COVID-19 shows signs of recovery by the end of the year, they believe the Bank of Korea could immediately raise the rates it had lowered.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.