Holding Meraepeu+Eunma results in 49 million KRW in comprehensive real estate tax

Significantly increased capital gains tax for multi-homeowners and short-term holders

Measures introduced to prevent choosing gifting over transfer

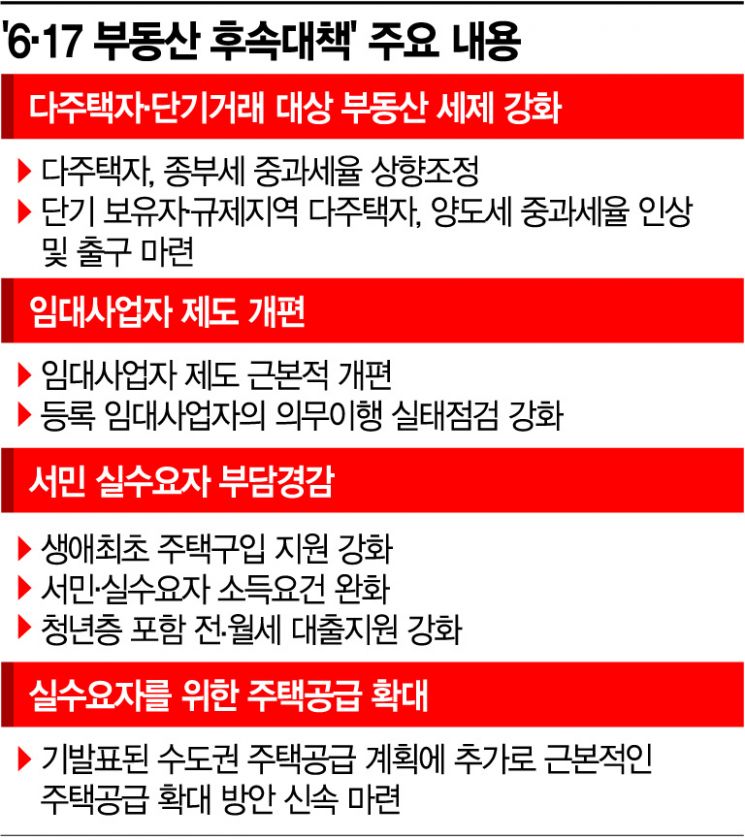

[Asia Economy Reporter Moon Jiwon] As the government plans to significantly increase the property tax burden on multi-homeowners and corporations through the July 10 real estate measures, there is an analysis that the number of properties on the market will increase. Already, a considerable number of multi-homeowners have begun deliberating on the options to minimize their tax burden, including selling, gifting, or holding their properties.

According to the Ministry of Land, Infrastructure and Transport and the Ministry of Economy and Finance on the 12th, the comprehensive real estate tax rates for owners of three or more homes or two homes in regulated areas will rise from the current 0.6?3.2% to 1.2?6.0%. For those owning two houses valued between 2.3 billion and 6.9 billion KRW (tax base 1.2 billion to 5 billion KRW) in regulated areas such as Seoul, the tax rate will double from the existing 1.8% to 3.6%.

According to an analysis by Woo Byungtak, team leader of Shinhan Bank’s Real Estate Investment Advisory Center, the comprehensive real estate tax for a two-homeowner possessing an 84.5㎡ unit in Mapo Raemian Prugio, Ahyeon-dong, Mapo-gu, Seoul, and an 84.4㎡ (6th floor) unit in Eunma Apartment, Daechi-dong, Gangnam-gu, will increase from approximately 18.57 million KRW this year to 49.32 million KRW next year.

Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki stated at the government Seoul office on the 10th after announcing the “Housing Market Stabilization Supplementary Measures,” “For multi-homeowners with properties valued at 3 billion KRW, the comprehensive real estate tax will be about 38 million KRW, and for those with properties worth 5 billion KRW, the tax will exceed 100 million KRW, which is slightly more than double compared to the previous year.”

The burden on corporations owning residential properties will also increase significantly. According to the July 10 measures, from June next year, the 600 million KRW basic deduction for comprehensive real estate tax will no longer apply to corporate-owned homes. Previously, the tax was imposed on the amount exceeding 600 million KRW in property value held by corporations, but going forward, the tax will be applied regardless of the property price. Additionally, the highest comprehensive real estate tax rate of 6% will be applied to corporations owning multiple homes. For those owning two or fewer homes, a 3.0% rate applies.

There is an analysis that tax-saving listings could increase significantly. Park Won-gap, senior real estate specialist at KB Kookmin Bank, explained, “As the holding tax burden increases significantly, especially for high-priced homes and multi-homeowners, the dilemma over whether to dispose of properties will deepen,” adding, "if there are signals that the tax burden is heavy and housing prices are trending downward, there is a possibility that owners will move toward selling."

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, is announcing a comprehensive real estate policy including strengthening the comprehensive real estate holding tax for multi-homeowners at the Government Seoul Office in Jongno-gu, Seoul on the 10th. Photo by Kang Jin-hyung aymsdream@

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, is announcing a comprehensive real estate policy including strengthening the comprehensive real estate holding tax for multi-homeowners at the Government Seoul Office in Jongno-gu, Seoul on the 10th. Photo by Kang Jin-hyung aymsdream@

The government’s significant increase in capital gains tax on housing sales is also expected to have a major impact on the market. The government previously added 10 percentage points for two-homeowners and 20 percentage points for three-homeowners to the basic tax rate (4?42%) when selling homes in regulated areas. Going forward, these surcharges will be increased to 20 percentage points and 30 percentage points, respectively.

In particular, if a property is sold within one year of purchase, the capital gains tax rate will rise from the existing 40% to 70%, and for sales within two years, a 60% rate will be applied instead of the basic rate (6?42%). This effectively imposes a “tax bomb” level increase in tax burden on multi-homeowners and short-term holders seeking capital gains.

Considering concerns that sharply raising capital gains tax might reduce the incentive for multi-homeowners to put their properties on the market, the government has also decided to provide a one-year grace period. Deputy Prime Minister Hong said, “Please interpret this as a sign to sell your homes by June 1 next year, taking capital gains tax into account.”

Since excessively high capital gains tax may lead multi-homeowners to choose gifting over selling, supplementary measures will be introduced soon. Minister of Land, Infrastructure and Transport Kim Hyun-mi appeared on SBS 8 o’clock news on the 10th and said, “We are reviewing measures related to concerns that strengthening real estate taxation might lead to gifting rather than selling.”

The government is reportedly considering raising the acquisition tax rate imposed on gifted real estate. Currently, the acquisition tax rate on gifts is 3.5% (4.0% including the special rural tax and local education tax). Raising the rate is expected to deter multi-homeowners from choosing gifting over selling to reduce their tax burden.

Additionally, there is talk of revising the “carryover taxation” rule, which reduces capital gains tax by calculating it based on the property’s value at the time of gifting rather than the initial acquisition price if the gifted property is sold after “five years.” If this period is extended beyond five years, the incentive to gift may decrease as owners would have to wait longer to benefit from capital gains tax advantages after gifting.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.