[Asia Economy Reporter Su-yeon Woo] Due to the impact of the novel coronavirus infection (COVID-19) pandemic, it is forecasted that the global automobile market will shrink by about 20% compared to last year. The shock caused by COVID-19 is expected to be greater than that during the global financial crisis.

On the 10th, Lee Bo-sung, Director of the Hyundai Motor Group Global Management Research Institute, stated at the Korea Automobile Journalists Association's first half seminar titled "Post-COVID-19 Global Automobile Market Outlook" that the global automobile market this year is expected to decrease by about 20% from last year's 87.56 million units to the low 70 million units range.

Director Lee predicted that after the global automobile market falls to the low 70 million units this year, it will take about 2 to 3 years to recover to the 80 million units level seen last year. He forecasted that the market will not return to normal trajectory until at least 2023.

He said, "The three major global markets?United States, China, and Europe?fell by 20-30% in the first half of this year and have been slowly recovering recently, but the situation in emerging markets is worsening. Although the three major markets will hold up in the second half, due to the sluggishness in emerging markets, a decline of more than 20% is expected throughout this year."

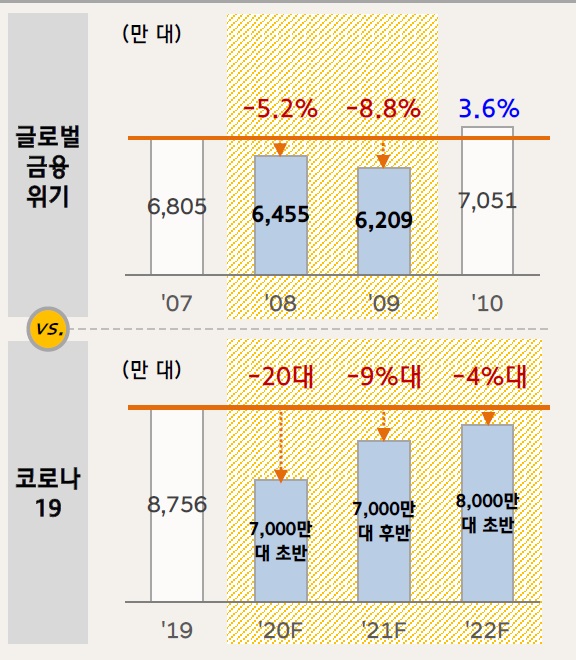

Comparison of the Impact on the Global Automotive Market: Financial Crisis vs. COVID-19 / Data=Hyundai Motor Group Global Management Research Institute

Comparison of the Impact on the Global Automotive Market: Financial Crisis vs. COVID-19 / Data=Hyundai Motor Group Global Management Research Institute

◆ The impact of COVID-19 is greater than the financial crisis= This outlook is darker than during the 2008-2009 global financial crisis. The global automobile market, which reached 68.05 million units just before the financial crisis, decreased by about 6 million units to 64.55 million units (-5%) in 2008 and 62.09 million units (-8%) in 2009. Director Lee said, "The scale and speed of this year's market decline due to COVID-19 are faster than during the financial crisis," adding, "Even if the market recovers somewhat next year, it will only be a technical rebound."

He analyzed four major causes of the shock to the global automobile market caused by COVID-19. First, while past crises were mainly due to a lack of demand, the current situation involves simultaneous shocks in both demand and supply. Also, whereas past crises were concentrated in specific regions such as advanced countries during the global financial crisis or the Great East Japan Earthquake, the current COVID-19 crisis is affecting the entire world.

Moreover, during the financial crisis, demand in advanced countries decreased, but demand in emerging markets acted as a buffer; now, such a buffer zone no longer exists. He explained that the global automobile market was in a growth phase in 2008, but now it is in a paradigm shift period with stagnant market growth, so the impact of the shock is inevitably greater. Director Lee said, "The crisis occurred during a paradigm shift that requires massive investment, worsening the situation," and added, "The sense of crisis is much greater than previous crises in the automobile industry, making normalization difficult even next year and the year after."

◆ The direction of the automobile industry in the 'post-COVID' era= Changes in market trends after COVID-19 can be summarized with keywords such as ▲deglobalization ▲digital technology responsibility ▲normalization of non-face-to-face interactions ▲interest in hygiene and health ▲slowdown in the growth of the sharing economy.

Director Lee predicted that these keywords will have a considerable impact on the automobile industry. First, he pointed out that a change in perception regarding the 'Global Value Chain (GVC),' which has emphasized production efficiency, may begin. In Korea alone, the issue of supply chain stability was highlighted earlier this year due to the Chinese 'wiring harness' incident, raising the need for supply chain diversification.

He said, "Although the Korean government talks about 'reshoring,' it is questionable whether the production system of 4 million Korean cars can be maintained amid the trend of anti-globalization," adding, "I believe the direction of 'near-shoring,' which establishes parts procurement systems close to the final consumption location, is more appropriate than reshoring."

He also forecasted that digitalization of production and sales will accelerate, spreading smart factories and online sales, and that the growth of the sharing economy will slow down as hygiene awareness and the concept of car ownership are reinforced. Instead, subscription-type vehicles or long-term rental cars, which involve occupying a vehicle for a certain period rather than short-term car sharing, may gain popularity.

Director Lee said, "Due to reduced mobility caused by COVID-19, there will inevitably be limits to the expansion of the overall automobile market size," and predicted, "While the growth of the sharing economy slows, online sales will increase, freight transportation will rise, and polarization of income levels will lead to polarization in car classes as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.