Regulatory Constraints Hampering the Use of Healthcare Data and More

[Asia Economy Reporter Oh Hyung-gil] As 'Insurtech' (a combination of insurance and technology) is changing the framework of the insurance industry, voices calling for deregulation of domestic insurance companies are growing louder.

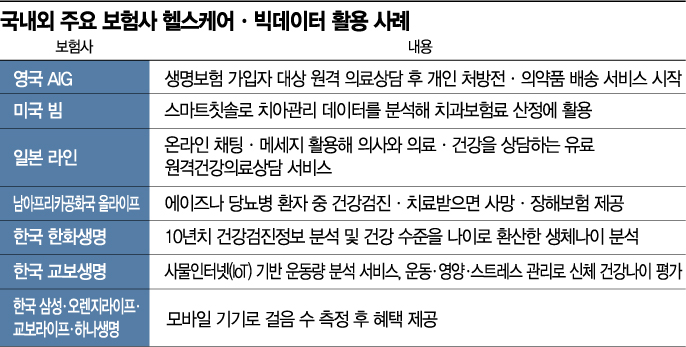

Healthcare using IT technology and big data have emerged as new growth engines in the insurance industry, but unlike overseas insurers, it is not easy to find a breakthrough in the insurtech market in Korea due to stringent regulations. Experts also point out the need to ease related regulations such as the Insurance Business Act and Medical Service Act within the scope that does not disrupt market order, to nurture it as a new blue ocean.

According to the insurance industry on the 10th, since the outbreak of the novel coronavirus infection (COVID-19), 'non-face-to-face' and 'healthcare' have become social keywords, and insurance companies are setting healthcare as a major business model and introducing various services. This coincides with a time when growth engines are desperately needed due to market stagnation, and they plan to expand non-face-to-face healthcare services to secure market dominance.

Hanwha Life analyzes 10 years of health checkup information using the non-face-to-face health management service application (app) 'HELLO'. It analyzes the biological age, which converts the customer's health level into age, and provides benefits such as mobile coupons when health missions are achieved.

Kyobo Life also launched the 'Health Coaching Service' app, which provides one-on-one customized healthcare services. It evaluates physical health age through IoT-based exercise analysis services and management of exercise, nutrition, stress, alcohol moderation, and smoking cessation. Customers can receive health consultations based on the results. Several insurance companies have also introduced and operate healthcare services that offer insurance premium discounts or gift certificates based on the number of steps taken.

However, domestic insurtech services face limitations due to regulations, making it difficult to conduct proper business. The government allowed health management services as ancillary business for insurance companies in July last year.

The problem is that these services are stipulated to be provided only to insurance policyholders. This means that non-insurance subscribers cannot use them. This is relatively different from health management apps like 'Cashwalk' that anyone can use. The industry argues that expanding the scope of permission is necessary to improve the quality of healthcare services.

In the big data sector, which is considered part of the 'Korean New Deal,' insurance companies are also blocked by regulations. Although the amendment of the 'Data 3 Act' has enabled industrial use of data, health and medical data cannot be utilized.

The Health Insurance Review & Assessment Service (HIRA) provided de-identified patient data to insurance companies and the Korea Insurance Development Institute through the Health and Medical Big Data Center, but after being pointed out during the 2017 National Assembly audit that "providing data for non-public interest purposes is problematic," data provision has been completely suspended.

Insurance companies claim that utilizing data can enable the development of new products tailored for patients with pre-existing conditions and the elderly, or economic benefits such as insurance premium discounts through improved rating systems.

An insurance industry official said, "Although discussions on big data utilization are active at the national level, the use of health and medical information by insurance companies remains unresolved," and added, "It is necessary to allow the use of de-identified patient data provided by the National Health Insurance Service or HIRA."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.