Investment Amount May Be Less Than Initially Reported

Whereabouts of 250 Billion Won Without Disclosed Investment Destination Unclear

Current and Former Executives Entangled with Key Figures of the Current Administration

[Asia Economy Reporter Ji-hwan Park] The future of the Optimus Asset Management scandal, which raises concerns over the suspension of redemptions for private equity funds worth up to 500 billion KRW, is becoming increasingly uncertain. The amount Optimus claimed to have invested may be significantly less than initially reported, and the whereabouts of 250 billion KRW, for which the investment destination has not been disclosed, remain unknown. As circumstances revealing connections between former and current Optimus executives and influential figures in the current administration continue to emerge, attention is turning to whether this will escalate into a power-related gate scandal.

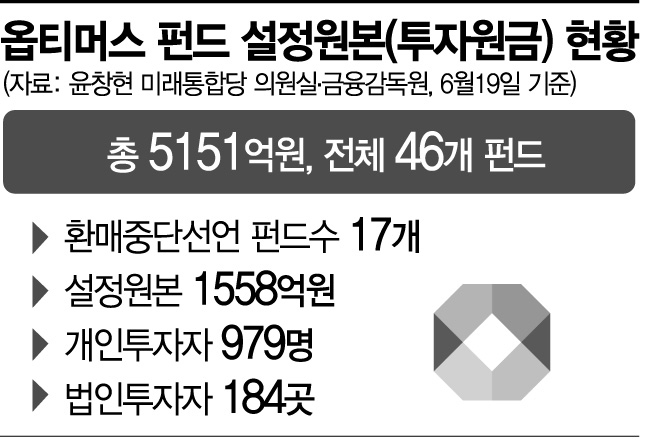

According to data submitted by the Financial Supervisory Service to Representative Chang-hyun Yoon of the United Future Party on the 10th, as of the 19th of last month, Optimus Asset Management had established 46 funds totaling 515.1 billion KRW in principal investment. Among 1,163 investors, 979 were individual investors and 184 were corporate investors.

Initially, Optimus products were introduced as investing more than 95% of the funds in safe public institution revenue bonds. However, the actual investment targets were mostly private company bonds. Among these were a significant number of lending companies. Optimus consistently lied from the start, claiming the products were safe while investing in high-risk areas likely to default.

After the redemption suspension incident broke out and the Financial Supervisory Service began an on-site inspection, Optimus changed its story, stating that out of the 515.1 billion KRW investment, 270 billion KRW was invested in about ten companies including lending firms. For the remaining 250 billion KRW, they failed to disclose any investment destinations.

The problem is that companies Optimus claimed to have invested in, such as Art Paradise, CPNS, and Golden Core, are mostly lending companies or real estate consulting firms with unclear identities. It is necessary to verify whether funds were actually invested, but given Optimus’s history of continuous false explanations, it is highly likely that the actual recoverable asset size is not large. Especially, while money invested in non-performing assets might recover some losses despite significant damage, the 250 billion KRW is so difficult to trace that a total loss is feared.

A Financial Supervisory Service official explained, "The Optimus scandal is fundamentally viewed as fraud rather than investment failure," adding, "There are many indications that even the explanations Optimus has given so far were attempts to conceal fraudulent activities." The official further stated, "Suspicions regarding undisclosed investment funds will be clarified during the ongoing investigation."

Signs are also emerging that the Optimus scandal is intricately connected with political and governmental networks, potentially escalating into a power-related gate scandal. Circumstances revealing ties between former and current Optimus executives and influential figures in the current administration are gradually coming to light.

Yoon, a key figure in the Optimus scandal and a company director, and his wife, lawyer Lee, were listed among legal professionals who supported candidate Moon Jae-in during the 2012 presidential election. Lawyer Lee worked as an administrative officer in the Blue House’s Office of Civil Affairs from October last year until her resignation last month. The presence of heavyweight figures such as former Deputy Prime Minister Heon-jae Lee and former Prosecutor General Dong-wook Chae on the Optimus advisory panel has also attracted attention. The relationship between former Optimus CEO Hyuk-jin Lee and influential figures in the current administration is also noteworthy. Lee was elected as a director of the South-North Economic and Cultural Cooperation Foundation (Gyeongmunhyeop) in March 2006, where he worked alongside figures such as former Presidential Chief of Staff Jong-seok Im and lawmakers Young-gil Song and Sang-ho Woo.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.