Card Companies' Profitability Declines

Benefits Reduced to Cut Costs

[Asia Economy Reporter Ki Ha-young] It has been revealed that nearly 80 types of cards were discontinued in the first half of this year. This is due to card companies facing profitability deterioration from reduced merchant fees and thus cutting costs. There is also criticism that consumer benefits are decreasing as even premium cards offering relatively significant perks have been discontinued.

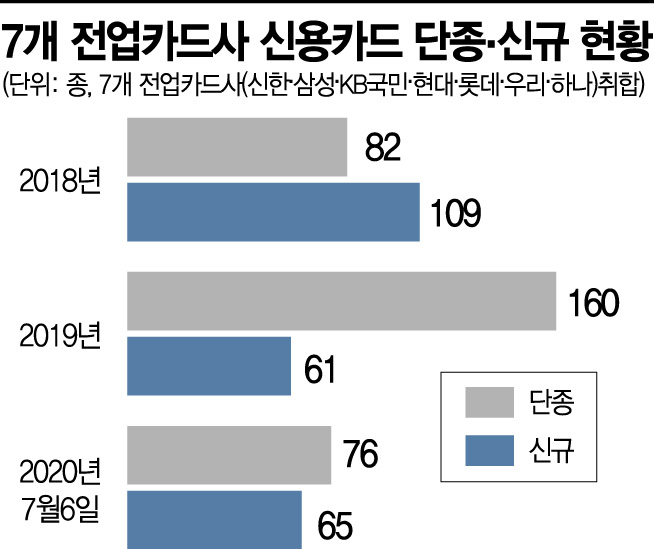

According to the card industry on the 10th, as of July 6, 76 types of credit cards issued by seven full-service card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana) were discontinued in the first half of this year. This is nearly half the number of 160 credit cards discontinued last year.

The number of newly launched credit cards in the first half of this year was 65, 11 fewer than the discontinued cards. However, compared to last year (61 types), the number of new cards already exceeded last year's total in the first half. Last year, discussions on card product profitability guidelines were delayed, resulting in almost no new card launches in the first half.

The number of discontinued credit cards has been increasing since 2017. In 2017, 73 types were discontinued; in 2018, 82 types; and in 2019, 160 types. This trend continues this year as well. Shinhan Card stopped issuing a total of 28 cards from the afternoon of the 6th, including three '2030' cards and nine 'Big Plus' cards. Woori Card will also stop issuing 13 cards from the 31st of this month to the 1st of next month. Discontinued cards include three types of Jeonseok Direct cards (Direct, Discount, SSO3 Check), two types of Free Travel cards, ONLY My Card, and Woori V Railroad Mileage Card. The premium card lineup's 'Grand Blue II' is also among the discontinued cards.

Most of the discontinued products are partnership products that offer discounts or cashback through agreements with specific merchants. Card companies explained that these cards were discontinued due to low usage from being outdated and not reflecting the latest consumer trends.

However, other premium cards were also discontinued in the first half. Representative examples include the 'KB Kookmin Tantan Dero Biz Titanium Card,' which offered solid rewards not only for fuel purchases but also for shopping at the three major discount stores and six major online shopping malls, and Lotte Card's 'I'm YOLO,' which provided a 1.2% payment day discount on all overseas spending regardless of the previous month's performance. Besides credit cards, the 'Naver Pay Shinhan Card Check,' which was considered a premium card by offering 1% Naver Points on payments regardless of performance, also disappeared in the first half.

The trend of discontinuing unprofitable products is expected to continue in the second half of this year. Especially with the introduction of the 'Profitability Analysis System Guideline' from this year, which requires card companies to launch only products that can generate profits over the next five years based on profitability analysis, it has become difficult to release cards with high-cost benefits.

An industry insider said, "Card companies, facing cost reductions due to lower merchant fees, will inevitably discontinue unprofitable products going forward," adding, "New products must also be designed to generate more profit than sales costs according to the profitability analysis system guideline implemented this year, so it is highly likely that cards with reduced benefits will be launched."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.