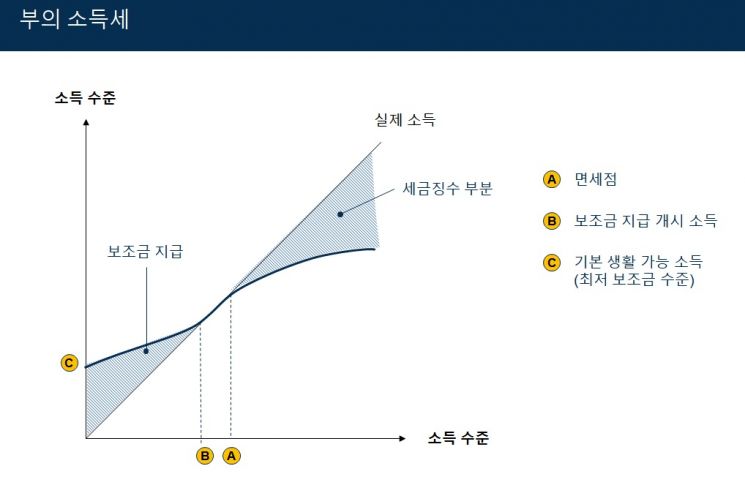

[Asia Economy Reporter Kim Eun-byeol] Byun Yang-ho, an advisor at VI Partners who led the overcoming of the International Monetary Fund (IMF) foreign exchange crisis, proposed the introduction of a 'Negative Income Tax' as a way to revive South Korea's fading economy. He explained that while regulations should be clearly eased to guarantee market freedom, a social safety net should be established through comprehensive taxation of all citizens and the negative income tax. The 'Negative Income Tax,' proposed by American free-market economist Milton Friedman and others, refers to an income tax system where taxes are collected from high-income earners and subsidies are given to low-income earners.

On the 10th, Byun attended a breakfast seminar held at the Anmin Policy Forum in Jung-gu, Seoul, and stated, "The market economy is fair, but its fatal flaw is that capable people always win," adding, "I believe consideration for those who are less capable is also necessary."

He said, "No country in the world has ever introduced this method, but considering our government's administration and IT technology level, I think we have considerable capability," and added, "If this method is introduced, many ineffective systems such as the national pension, unemployment insurance, and ineffective startup subsidies can be greatly reduced." He also mentioned, "I am checking the approximate costs through juniors in the Ministry of Strategy and Finance," and promised to explain in detail if given the opportunity.

He explained, "In the early 20th century, when the economy was growing, people could find jobs if they worked hard, but with the upcoming Fourth Industrial Revolution, there may be people who cannot find jobs no matter how hard they try," and said, "Through the negative income tax, we can send a signal that citizens' livelihoods will be somewhat guaranteed even if they suddenly face difficulties."

However, Byun clearly opposed the basic income system that pays the same amount to all citizens. He emphasized, "Giving the same amount to all citizens is not a way to support the vulnerable," and added, "If there is money, it should be focused on supporting the vulnerable; giving it to everyone makes no sense." He also said, "It is very strange to create a special tax law that collects more taxes specifically for basic income by taxing the wealthy."

Instead, he argued that regulations must be clearly eased. He pointed out, "The economy is like soccer; if a player (government) without skills tries to do too much, it declines," and added, "There has never been a successful case where the rules of the game were changed to suit the disadvantaged." He also recalled, "During the foreign exchange crisis, a broadcaster once asked me to say something about 'regulating to prevent dollar outflow,' but I refused angrily," emphasizing, "If the government blocks dollar outflow, it will discourage overseas investment in Korea even more, and if employment is forced to increase only in regular positions, companies may simply stop hiring."

Byun cited Sweden and Norway as countries that South Korea can model. He said, "It is necessary to set a country that is not lacking in terms of security, environment, publicness, and human rights protection as a model and ease regulations accordingly," and added that the anti-large corporation sentiment should be addressed by blocking management focused on large corporate family interests rather than through other regulations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.