COVID-19 Crisis 6 Months 'V' Shape Recovery

Last Month's Average 91.3%... Largest Increase This Year

Outdoor Activities Rise and Medical Services Normalize 'Sigh'

[Asia Economy Reporter Oh Hyung-gil] The loss ratio of automobile insurance, which had stabilized during the COVID-19 pandemic, has recently started to rise again. This is interpreted as an effect of increased outdoor activities due to social distancing in daily life and the normalization of hospital visits that had been suspended during the COVID-19 period.

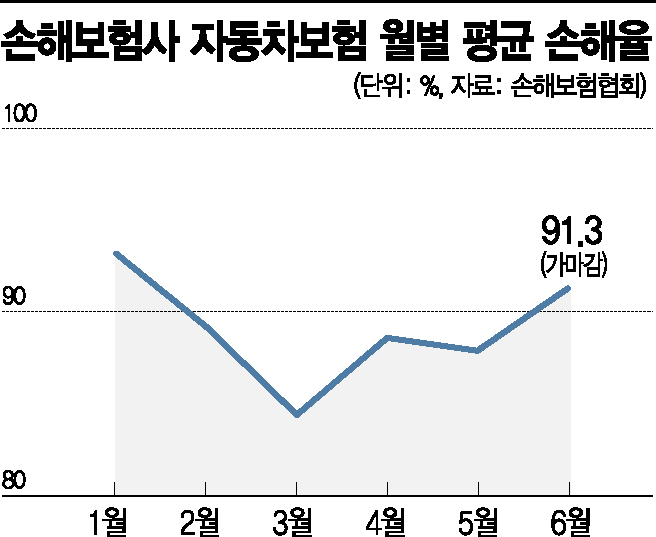

According to the General Insurance Association on the 9th, the average automobile insurance loss ratio of domestic non-life insurers last month was 91.3% (preliminary closing), a sharp increase of 4.6 percentage points compared to the previous month. This is the largest increase this year and the first time in five months that it has risen to the 90% range. It significantly exceeds the 78-80% range that insurers usually manage as an appropriate loss ratio.

The automobile insurance loss ratio, which reached 93.2% in January, dropped to 89.2% in one month due to premium increases. In March, when COVID-19 began to spread in earnest, it fell to 84.4%.

However, as confirmed cases decreased and quarantine guidelines shifted to "social distancing in daily life" in April and May, the loss ratio turned upward to 88.6% and 87.9%, respectively. In particular, some insurers have been deeply concerned as their loss ratios exceeded 100% after the second quarter.

Moreover, it is expected that the rise in automobile insurance loss ratios will accelerate further from this month, when the vacation season fully begins. An insurance company official expressed concern, saying, "Due to the COVID-19 impact this year, overseas travel is virtually blocked, leading to a surge in domestic travel demand using vehicles. As vehicle usage increases, accident rates rise, causing the loss ratio to increase accordingly."

The increasing trend in automobile insurance medical expenses, which is breaking historical records, is also a burden. According to the Health Insurance Review & Assessment Service, automobile insurance medical expenses last year increased by 12.0% compared to the previous year, surpassing 2 trillion won for the first time in history.

In particular, Korean traditional medicine treatment expenses reached 956.9 billion won, a 34.0% increase from the previous year. This contrasts with medical treatment expenses, which decreased from 1.2541 trillion won in 2018 to 1.2496 trillion won last year.

It is believed that some Korean traditional medicine hospitals have promoted themselves as "traffic accident specialized hospitals," aggressively attracting patients with minor injuries such as bruises. The industry expects the trend of increasing Korean traditional medicine treatment expenses to continue this year. This is why calls for detailed review guidelines on Korean traditional medicine treatment expenses, which are a major cause of premium increases, are growing louder.

However, the industry believes it is too early to publicize the issue of premium increases raised by some quarters. An insurance company official said, "The loss ratio is still maintained at a lower level compared to last year," and added, "Since premiums were raised once earlier this year, we are not considering additional increases at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)