Directly Providing Evidence to Refute Controversy

"Benefits for Registered Rental Business Operators Are Linked to Those of Previous Governments"

"The Number and Proportion of Multi-Household Families in Seoul Began to Decline in 2018"

"Most Private Housing Winners Last Year Were in Their 30s"

[Asia Economy Reporter Lee Chun-hee] The Ministry of Land, Infrastructure and Transport (MOLIT) has issued a statement in response to criticism that it promised benefits when registering rental business operators but is now reducing those benefits and even considering retroactive application. MOLIT stated that all tax benefits related to registered rentals were linked to existing benefits from previous administrations, and there are no new benefits.

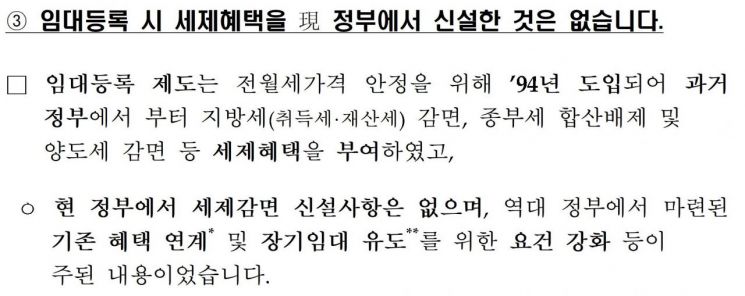

On the 9th, MOLIT said in an explanatory document, "No new tax benefits have been established by the current government upon rental registration."

MOLIT explained, "The rental registration system was introduced in 1994 to stabilize monthly rent prices, and past governments granted tax benefits such as local tax reductions, exclusion from comprehensive real estate tax aggregation, and capital gains tax reductions," adding, "There are no newly established tax reductions under the current administration." The benefits emphasized by the government since the Moon Jae-in administration for registered rental business operators were all measures to "link to existing benefits established by previous governments and strengthen requirements to encourage long-term rentals."

Specifically, the extension of the sunset clause for acquisition tax and property tax reductions was an extension of a system that was set to expire in 2018 to 2021, and the scope and criteria for property tax and rental income tax reductions were only "partially expanded" or "relaxed." Furthermore, the reduction of the scope for excluding multi-homeowners from capital gains tax surcharges and comprehensive real estate tax aggregation was a policy aimed at encouraging long-term rentals by changing the target from maintaining a 5-year rental period to an 8-year rental period and long-term types.

MOLIT also actively refuted claims that multi-homeowners have increased since the current government took office and that the rise in subscription points has made it nearly impossible for people in their 30s to win housing subscriptions.

According to MOLIT data, the number of multi-home households in Seoul and their proportion relative to total owner households showed a decline for the first time since statistics began in 2018. The number of multi-home households in Seoul was 525,000 in 2017 and decreased to 520,000 in 2018. The proportion relative to total owner households also dropped from 28.0% to 27.6%. Although the number of individuals was similar at 389,000 in both 2018 and 2019, the proportion among all owners decreased from 16.0% to 15.8%, according to MOLIT.

On a nationwide basis, while the number of multi-homeowners and multi-home households is still increasing, the growth rate has slowed down?from 7.0% in 2017 to 3.4% in 2018 for multi-homeowners, and from 4.1% to 2.4% for multi-home households during the same period.

MOLIT explained, "The effects of regulations on multi-homeowners, such as the August 2 and September 13 measures, have begun to take full effect," adding, "Through the designation of regulated areas, stricter regulations such as loan bans and imposition of capital gains tax and comprehensive real estate tax are being applied to multi-homeowners."

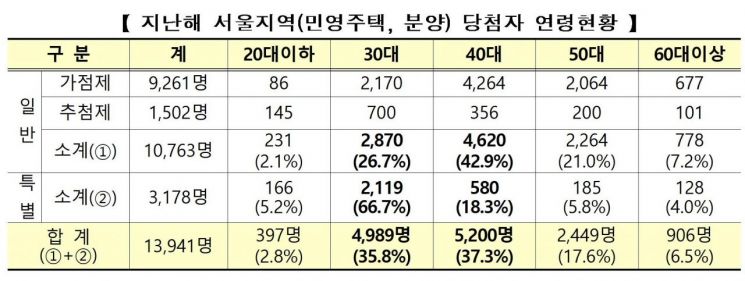

Regarding claims that it has become harder for people in their 30s to win housing subscriptions, MOLIT rebutted by stating that 35.8% of private housing subscription winners in 2019 were in their 30s through special supply and other measures, indicating that there was no age bias.

According to MOLIT data, among private housing subscription winners in Seoul last year, those in their 40s were the largest group with 5,200 people (37.3%), followed by those in their 30s with 4,989 people (35.8%). Those in their 50s accounted for 2,449 people (17.6%), those aged 60 and above were 906 people (6.5%), and those 20 and under were 397 people (2.8%).

MOLIT particularly explained that for houses priced below 900 million KRW, which have high demand from genuine homebuyers without homes, the proportion of winners in their 30s is the highest. Among 8,061 winners of houses priced below 900 million KRW, 3,179 (39.4%) were in their 30s, the highest proportion, followed by 2,805 (34.8%) in their 40s and 1,268 (15.7%) in their 50s.

However, for houses priced above 900 million KRW, the proportion between those in their 30s and 40s was reversed. Among 5,880 winners, those in their 40s were the largest group with 2,395 people (40.7%), followed by those in their 30s with 1,810 people (30.8%). The 50s group also increased somewhat to 1,181 people, accounting for 20.1%.

A MOLIT official explained, "When the price exceeds 900 million KRW, special supplies for newlyweds and others are excluded, so those in their 40s relatively have more opportunities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.