Bank of Korea 'Financial Market Trends in June 2020'

[Asia Economy Reporter Eunbyeol Kim] Due to the government's high-intensity real estate regulations causing a sharp rise in housing prices, along with factors such as the SK Biopharm IPO subscription, bank household loans (including policy mortgage loans) increased by more than 8 trillion won last month. As unsecured loans increased, other loans within this category also rose by over 3 trillion won.

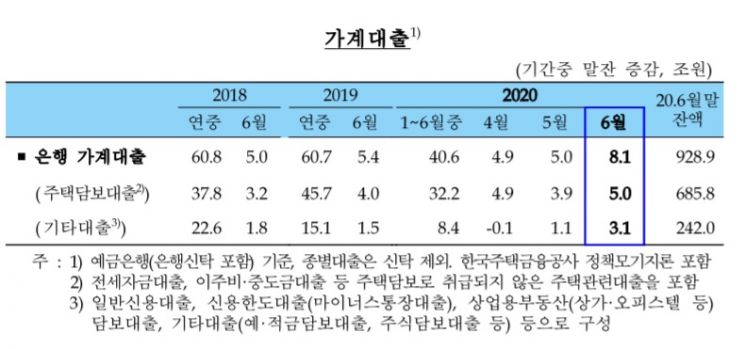

According to the Bank of Korea's 'Financial Market Trends in June 2020' released on the 9th, the balance of bank household loans (including policy mortgage loans) at the end of last month was 928.9 trillion won, an increase of 8.1 trillion won compared to the previous month. This increase is significantly larger than the 5 trillion won in May and 5.4 trillion won in June of last year. When comparing only June, this is the largest increase since the Bank of Korea began compiling statistics in 2004.

Among household loans, mortgage loans increased by 5 trillion won within a month due to continued demand for funds related to housing jeonse (long-term deposit lease) and sales. Although this is less than the increases in February (7.8 trillion won) and March (6.3 trillion won) of this year, it is 1 trillion won more than the increase in June of last year (4 trillion won).

Yoon Okja, head of the Market General Team at the Bank of Korea's Financial Market Department, explained, "According to confirmation with the Financial Supervisory Service, most of the 3.1 trillion won increase in other household loans was due to an increase in unsecured loans. Considering the housing market situation, it appears that temporary factors such as demand for funds not sufficiently covered by mortgage loans and subscription deposits for the SK Biopharm IPO influenced this."

Looking at corporate loans in the banking sector, loans increased by 1.5 trillion won in June, a sharp decline compared to 27.9 trillion won in April and 16 trillion won in May. In particular, loans to large corporations decreased by 3.4 trillion won, marking a decline for the first time in four months since February.

However, loans to small and medium-sized enterprises and individual business owners increased by 4.9 trillion won and 3.7 trillion won respectively in June, maintaining an upward trend. Although these increases are less than half compared to May's 13.3 trillion won and 7.7 trillion won, the June loan increase remains the largest since statistics began in 2004.

Regarding the slowdown in corporate loan growth, Yoon explained, "At the end of the quarter, companies reduce or repay loans for soundness management, and banks dispose of non-performing loans through write-offs. Additionally, recent corporate bond issuance has become easier compared to the early stages of the COVID-19 pandemic, leading to increased fundraising through bond issuance rather than loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.