On July 6, Hansangwon, a researcher at Daishin Securities, stated, "- We expect polysilicon (Korea + Malaysia) to return to profitability in the 4th quarter. With the recovery of solar demand in the second half of the year, there is a high possibility of a price rebound along with the temporary resolution of oversupply caused by the year-end demand concentration. However, structurally resolving oversupply is still difficult, so the key to future performance improvement will likely be the increase in semiconductor-grade polysilicon production and profitability improvement," and set OCI's target price at 47,000 KRW.

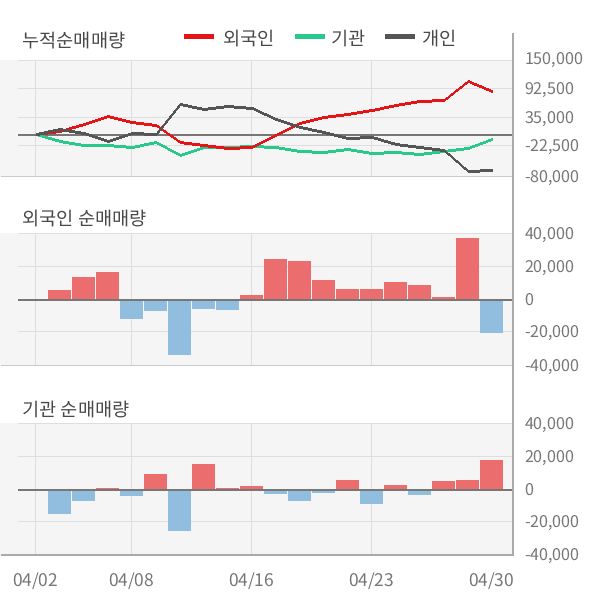

Over the past five days, individual investors have net sold 154,007 shares of OCI, while foreigners and institutions have net bought 43,393 shares and 98,672 shares, respectively.

※ This article was generated in real-time by an automatic article generation algorithm jointly developed by Asia Economy and the financial AI specialist company Thinkpool.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.